AYS price trend reversal is confirmed - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 16 Dec 2021, 10:39 AM

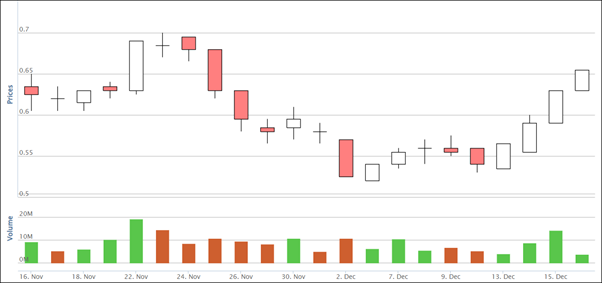

AYS price chart below shows that it has been going up every day in the last 9 trading days which indicates that its price trend reversal is confirmed. That also means that it is quite safe to buy an up-trending stock.

What is a stock price chart?

It is a record of the daily price movement. If there are more buyers than sellers its price will go up. On the contrary, if there are more sellers than buyers its price will drop. In the case of AYS, there were more buyers than sellers on each of the 9 trading days. That means it is quite safe to buy AYS.

Share placement

On 15 October, the AYS company placed out 38 million AYS shares which is equivalent to 10% of the total issued shares at 76 sen each to institutional or big buyer when the open market price was 88 sen. The big buyer must know the company operation and its profit growth potential before he decided to buy so many AYS shares. No investor would buy 38 million AYS shares unless he knew the quality of people managing the company.

My target price for AYS

Its 2nd quarter ending Sept EPS was 6.51 sen and its 1st quarter ending June EPS was 8.5 sen, totalling 15 sen for 1st half year. All these profits were achieved during the Covid 19 pandemic MCO lockdown. Currently there is no more MCO lockdown and AYS should be able to make better profit in its 2nd half year than its 1st half year.

Assuming its 2nd half year performance is the same as its 1st half year, its annual profit EPS will be 30 sen per share.

Based on PE 3, AYS should be 90 sen.

Based on PE 4, AYS should be Rm 1.20.

Based on PE 5, AYS should be Rm 1.50.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

Dear Mr Koon Yew Yin,

It is a push up to sell before/on the coming quarter results. Hope you are able to escape then

Sincerely,

EMSVSI

2021-12-16 21:19

Uncle said stock market gonna crash before. Why invest now uncle. Run run first.

2021-12-17 15:55

What do you know about chart? You talked what you wanted to talk only, nothing to do with chart.

2021-12-18 18:11

Biden's $1.75 trillion stimulus bill has no hope of passing this year, plus Omicron sweeps Europe and the US

U.S. Democratic Senator Manchin does not support Biden's nearly $2 trillion Rebuild the Good Act, the bill will be forced to delay

2021-12-21 08:06

abang_misai

Cantek Koon. AYS sudah ada jalan sikit

2021-12-16 21:09