AIRASIA – A TRAVEL TECHNOLOGY COMPANY WITH COMING SPECIAL DIVIDEND REWARD and new A321neo aircraft in 2019 (Davidtslim)

davidtslim

Publish date: Wed, 14 Nov 2018, 10:47 PM

Highlights:

- At the time of writing, both WTI and Brent oil have fallen more than 20% from their four-year highs last month, putting them in bear market territory. The latest catalyst for crude's plunge was OPEC's monthly report that said production from the cartel and Russia had continued to climb in October, more than offsetting losses from Iran’s supply.

- 84 Aircraft (AAC) disposal has been almost completed (RM4 Billion proceeds have been received so far), Airasia will become a NET CASH airline company (from 0.76x net gearing now) as the cash proceed of AAC sale will be more than RM4.1 billion (Tony reiterated special dividend in 4Q18). The selling of aircraft is expected to be completed by end of Nov 2018.

- One of the most efficient management teams and super competitive cost structure of Airasia make them still profitable even at the Jet fuel price of USD90 per barrels (where many other airlines are operating at loss).

- Airasia still expanding their capacity even in high fuel price period with aggressive pricing which they keep increase their market shares in Malaysia, Thailand, Philippines and India.

- With 29% YoY increase in fuel costs, Airasia’ net operating profit (net finance costs) fell only 18% YoY in 2Q18, with a net operating profit margin of 12.4%. This margin clearly outperforming most of the Asian airline sector’s results.

- 25% of Expedia stake disposal has been completed. The proceeds from this disposal is USD60 mil with initial cost of investment of 10mil. There will be an one-off disposal gain in 3Q18 result of about RM210 mil.

- AirAsia has ordered with 100 A321neo aircraft. The A321neo (seating up to 240 vs 200 A320 model) will help Airasia to meet ongoing strong demand in congested airports in Asean as well as further reduce their cost per Available Seat Kilometer (ASK).

- Digitalization progress well which show the company’s ambition to transform from an airline into a global technology company. The digitization employed technologies (Big data, AI and IoT) which can improve in area of ticket sales targeting, speedier check-in (using face), reduce flight delay (AI to predict weather)

- Airasia exhibits growth element from its growing revenue and earnings growth prospects in long term (especially when oil price come down in future). It can generate good profit from its airline business (even at high fuel price period) and big potential from its digital venture.

- Management stated their plan to reward shareholders with special dividend in every two years on top of 20% dividend policy on their operation profit.

- Key risk lies in surge in jet fuel oil price and USD appreciation which may affect its operation cost.

New Airbus A321neo in 2019 help to reduce cost per KM (all existing Airasia aircraft is A320)

Many existing airports are running at full capacity where they are quite congested (like Penang, Kota Kinabalu, India airports). To grow it carried passengers with the same airport size or capacity, Airasia need to employ a larger aircraft like A321neo. Seating up to 240 passengers in a single class layout, the A321neo will enable the airline to increase capacity while benefitting from the lowest operating costs in the single aisle category.

A321neo can help Airasia to move 240 passengers (vs A320 of 200 passengers) per flight without sacrificing the carrier’s quick 25-minute turnaround time. This aircraft will also help to reduce cost per available seat KM (CASK) for AirAsia and enable them to continue grow in the larger Asean markets which suffering from limited airport capacity today.

Let us see one of the airlines which has received A321neo claim that this model is more efficient in term of cost per seat.

AirAsia has ordered with Airbus for the purchase of 100 A321neo aircraft. The A321neo will help Airasia to meet ongoing strong demand as well as further reduce their cost per Available Seat Kilometer. Airasia is set to receive their first batch of A321 neo in 2nd quarter 2019 and they will be more competitive at that time.

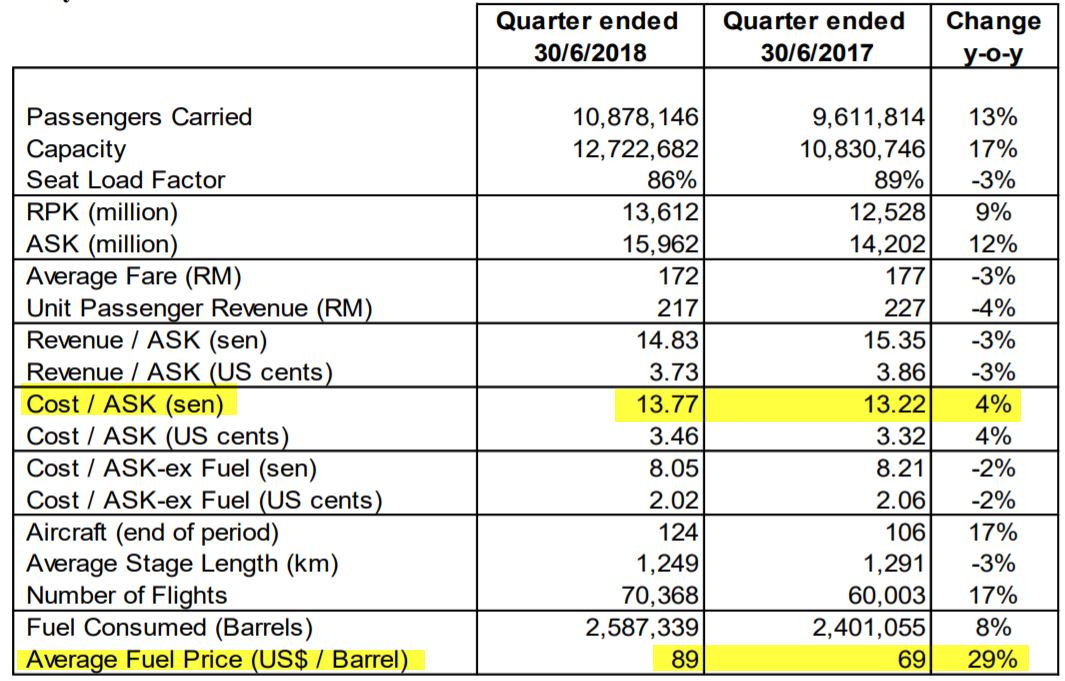

How High Jet Fuel Price Affects on Airasia’s cost?

Almost all airlines operation cost is highly correlated to jet fuel price. No doubt Airasia’s cost is also correlated to jet fuel price but Airasia has shown in previous two quarters that it able to minimize the effect of fuel cost by increasing their aircraft’s utilization hours and carried capacity. To know the key indicator of an airline operation cost, we need to look at its Cost per ASK (Available Seat Kilometers). Let us go through the cost per ASK for Airasia when it experienced high jet fuel cost in 2Q2018 as below:

Source: 2Q18 report

We can notice from the table above Cost / ASK (sen) increased by 4% to 13.77 sen as compared to 13.22 sen YoY when Average Fuel Price (US / barrel) has increased from 69 to 89 (increased 29%)

Airasia manage to maintain low level of Cost / ASK in 2Q18 is due to the following reasons:

- Higher capacity (more new aircrafts à higher available seat and fuel saving of A320) lead to higher passengers carried which can bring down the unit cost or cost / ASK.

- Higher aircraft utilization (13 hours per day) and route rationalization.

- Cut other related cost to reduce the cost / ASK ex-fuel.

In addition, their net gearing has improved to 0.76x (net debt of 6.2 billion) from previously 0.9x (1Q18). Net cash inflow in the quarter amounted to RM58.4 million due to repayment of loans for aircraft of RM2.04 billion.

Let see the Auguest 2018 statistic of KLIA2 passengers as published by Airport Berhad Malaysia (Theedge news) as below:

Source: http://www.theedgemarkets.com/article/mahb-sets-dedicated-clearance-facility-klia2-airline-crew

Remember, Airasia still achieved relative good profit under Jet fuel price of USD89 in 2Q18 while MAS reduced 189 weekly flights and Malindo reduced 385 flights and terminates 3 domestic route.

Source: Refer to page no 3 of the Airasia 2Q2018 result presentation slides.

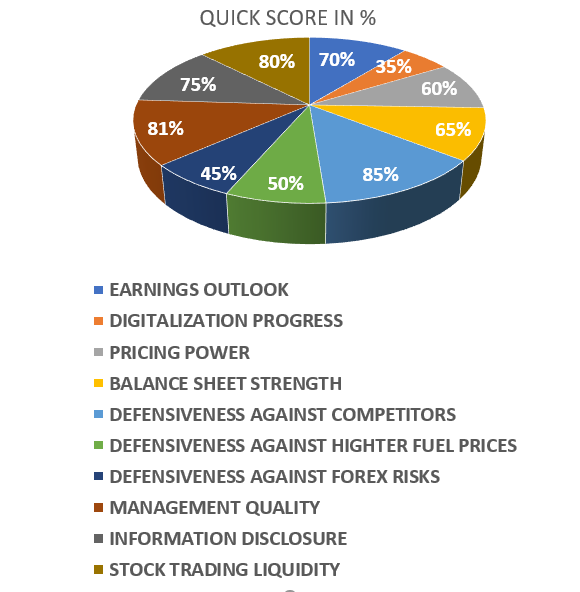

Below is a quick score chart in percentage for overall Airasia quality which comprise Of Earnings Outlook, Digitalization Progress, Pricing Power, Balance Sheet Strength, Defensiveness Against Highter Fuel Prices, Defensiveness Against Forex Risks, Management Quality, Information Disclosure and Stock Trading Liquidity

Below is a market share chart of Airasia of 2Q18 vs 2Q17.

Source: Airasia 2Q2018 result presentation slides

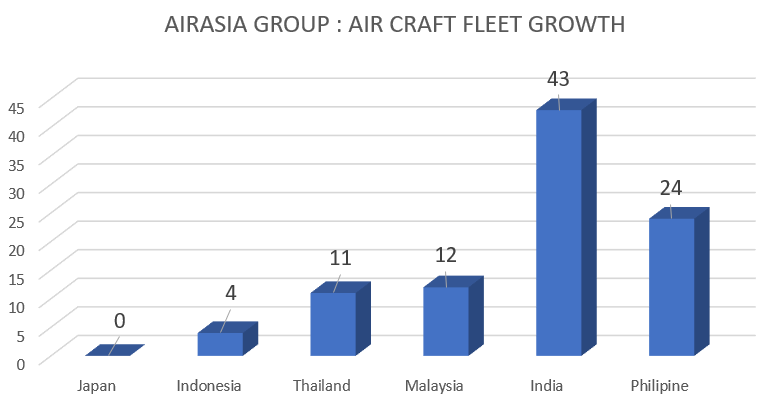

Below is a aircraft fleet growth chart of Airasia for its Asean market in 2Q18.

Risk

- Further depreciation of the MYR against the USD. A stronger USD will pressure Airasia’s profitability as a significant portion of its operating and financing costs are in USD.

- Surge in jet fuel price which may cause unit cost to ASK to rise on jet fuel (currently about USD90-92).

Short Summary which includes recent development:

Negative factors:

1. Weaker than expected coming Q3 result to be released by end of Nov, due to high jet fuel price in Q3 and weak regional currencies (RM, Rupiah, Peso etc)

2. Higher leasing cost due to sales of 84 aircraft

3. RM20 and RM40 departure tax from June 2019

4. USDRM strengthen to 4.19

Positive Factors:

1. Special dividend of 70-80 sen to be paid in Dec 2018 or Jan 2019

2. One-off gain of its Expedia booking site at USD50M (RM210M) which concluded in Aug 2019 which to be reflected in coming Nov result

3. Much lower depreciation cost in P&L due to sales of 84 aircraft

4. Jet Fuel price dropping to USD86-87+ (from earlier USD94-96)which lead to lower operation cost

5. Strong load factor in Q4 of 85% and above for their forward ticket booking

If you interested on my analysis report, please contact me at davidlimtsi3@gmail.com

You can get my latest update on share analysis at Telegram Channel ==> https://t.me/davidshare

Disclaimer:

This writing is based on my own assumptions and estimations. It is strictly for sharing purpose, not a buy or sell call of the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Davidtslim sharing

Created by davidtslim | Oct 03, 2020

Created by davidtslim | Aug 28, 2020

Created by davidtslim | Aug 06, 2020

Created by davidtslim | Aug 04, 2020

Created by davidtslim | May 15, 2019

Discussions

NEO is said to save 15% fuel. I wonder its because of the bigger load or there is another 15% saving on fuel?

Personally I think BIGpay will definitely fail (lack of imagination). Ground handling is brilliant.

By the way, ROKKI free for passengers, that is a great idea.

2018-11-14 23:15

If there ever was an award for Intellectual Yet Idiots (IYI), you may very well take first place.

2018-11-14 23:23

Posted by qqq3 > Nov 14, 2018 11:33 AM | Report Abuse X

buy airasia, layhong, supermax.....

2018-11-15 00:01

My benchmark is index. But over the long term, i expect to beat the FD rate very handily ;)

You got lose less than FBEMAS index anot? Or lose more than MIDS index? Haha

====

Posted by Alex™ > Nov 14, 2018 11:36 PM | Report Abuse

got beat 4.4% FD or not?

2018-11-15 00:14

https://says.com/my/news/half-of-malaysians-are-still-earning-below-rm2-000-a-month

is this true? soooooo many malaysians got money travel, means got money, means the article not true?

2018-11-15 09:29

Bruce88, about 2 years ago, Tony Fernandez + 1 inject RM1 billion (the PP) into Airasia. Market believes the deal is, after sales of AAC, Airasia gives a special dividend and so Tony Fernandez + 1 can repay the bank loan.

How true? 99.9% true.

2018-11-15 21:45

Congratulations!!!!

Oil is bearish near term. Now US got 12 million bpd of shale. OPEC and Russia will go to price war again, very soon. You will see USD50 / barrel very soon, then USD40, USD30 and probably USD20 eventually.

Don't see me normally LELEFEFE, I am still an economist. Keke!

Despite that, market is really weak and getting weaker. Don't expect airfare and load factors to be high in the coming quarters.

Elon Musk said Ford won't survive the next financial crisis. Well, SIA, Cathay may survive, but they got to shrink to survive.

2018-11-15 22:01

hi David, great analysis there! Would like to reach out to you for some collaborations; I am James from smallcapasia.com here.

Can you email me @ smallcapasia@gmail.com? Thanks!

2018-11-16 18:35

Flintstones

This guy might be worth a rm5k subscription fee

2018-11-14 22:53