MQ Trader - Technical Indicators (Part 1) [UNISEM]

MQTrader Jesse

Publish date: Mon, 03 Sep 2018, 05:51 PM

Introduction

Technical analysis is basically performed by using various technical indicators to predict future price movement from historical trading data. Some people think technical indicators are mainly used by active traders to analyse short-term price movements. However, long-term investors do refer to technical indicators to search for entry and exit points most of the time. Thus, technical analysis is very useful for both short-term and long-term investors.

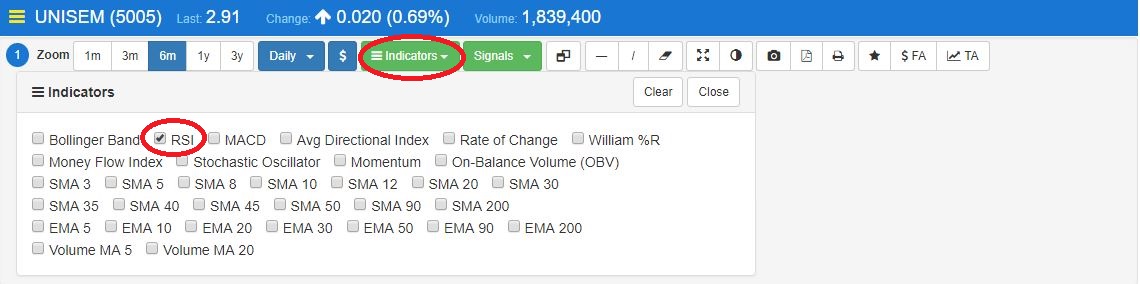

There are thousands of technical indicators available but it is not possible for us to use all of them to make our investment decision. Hence, several technical indicators that can work well on the stocks in Malaysia market have been selected and incorporated in MQ Trader stock analysis system.

In this blog post, we will be discussing on how we utilise technical indicators in MQ Technical Analysis. To have a better understanding on this topic, you can read MQ Trader –Technical Analysis [UNISEM].

What is Technical Indicator?

Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. By analyzing historical data, technical analysts use indicators to predict future price movements. There are 9 technical tests introduced in MQ Trader system to confirm and enhance the accuracy of trading signals of each technical test. In this article, we will cover 2 of the technical tests.

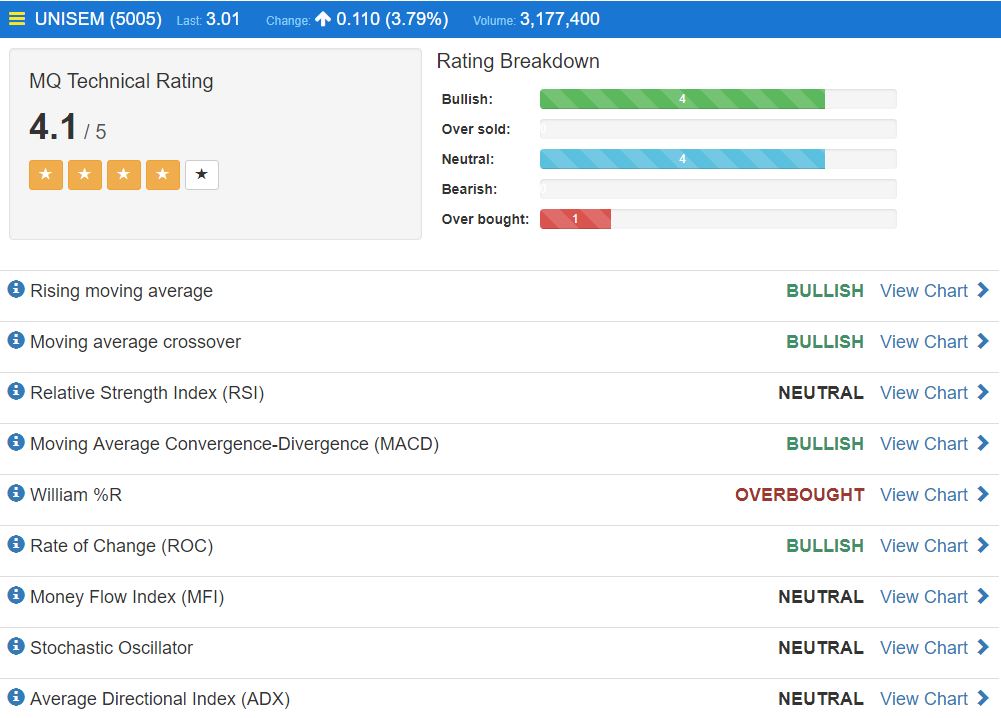

Source: MQ Trader Stock Analysis System

There are 9 technical indicators introduced in MQ Trader system to confirm and enhance the accuracy of trading signals with each other. In this article, we will cover 2 of the technical indicators.

1. Rising Moving Average

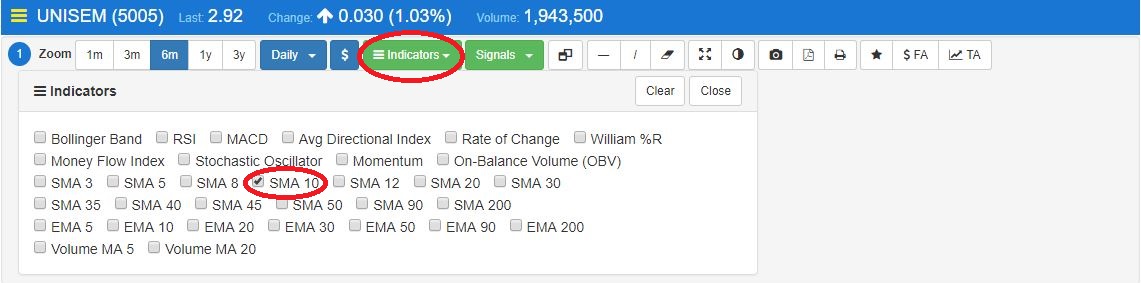

Source: MQ Trader Stock Analysis System

The rising moving average is one of the simplest technical indicator used in trading. The trend is bullish when the 10 day Moving Average is rising in the past 3 days; bearish when it is falling in the past 3 days, and neutral otherwise.

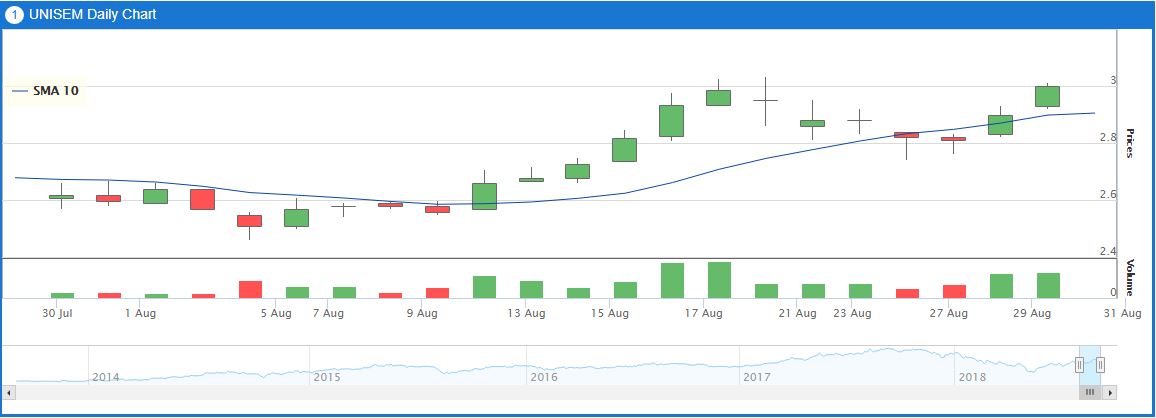

Figure 1: SMA 10 trend of UNISEM

According to Figure 1, UNISEM’s trend is bullish at the moment, as its 10 day Moving Average is rising in the past 3 days. To view the technical chart in MQ Trader Stock Analysis System, please visit Rising Moving Average Technical Chart.

2. Relative Strength Index (RSI)

We have defined RSI in our previous blog post regarding to MQ Technical Screener, so you can read MQ Trader – variables of Technical Screener for more information.

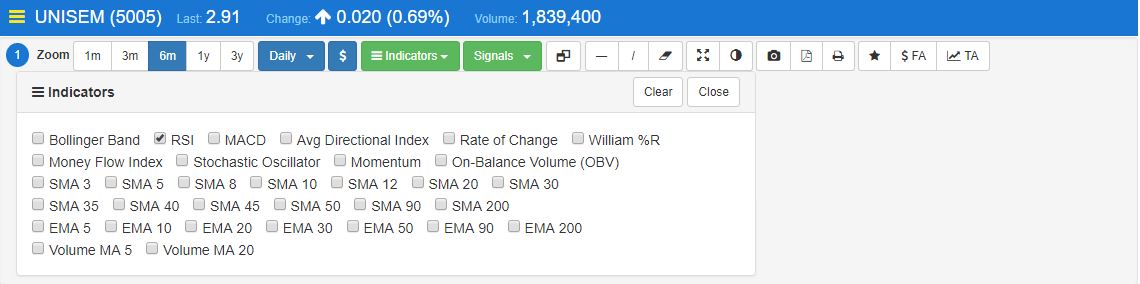

Source: MQ Trader Stock Analysis System

RSI is a momentum indicator that compares the magnitude of recent gains to recent losses in a range between 0 - 100 to determine overbought and oversold conditions of a stock. A stock is deemed to be overbought once the RSI approaches the 70 level, meaning that it may be getting overvalued and is a good candidate for a pullback. Likewise, if the RSI approaches 30, it is an indication that the stock may be getting oversold and therefore likely to become undervalued.

Figure 2: RSI of UNISEM

Figure 2 shows that the value of RSI is currently 55 at the moment which is within the range between 30 and 70. This, its current trend is categorized as neutral trend, as it falls into the range which is neither in the bullish (>70) nor bearish (<30) trend. To see more details, you can proceed to Moving Average Crossover Technical Chart to have a clearer image of the chart.

We will explain the rest of the technical tests in the next blog post – MQ Trader – Technical Tests (part 2) [UNISEM]. To understand more about technical indicators, please visit MQ Trader – Variable of Technical Screener.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-13

UNISEM2024-11-13

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEMMore articles on MQTrader Education Series

Created by MQTrader Jesse | Apr 13, 2023

Created by MQTrader Jesse | Aug 06, 2021

Created by MQTrader Jesse | Nov 01, 2019