MQ Trader – Technical Indicators (Part 3) [UNISEM]

MQTrader Jesse

Publish date: Wed, 05 Sep 2018, 05:13 PM

Introduction

In this blog post, we will be explaining on 2 of the technical indicators including Rate of Change (ROC) and Money Flow Index (MFI) which are used in MQ Technical Analysis. This topic is the continuation of the previous blog post, please read MQ Trader – Technical Indicators (Part 2) [UNISEM] for better understanding.

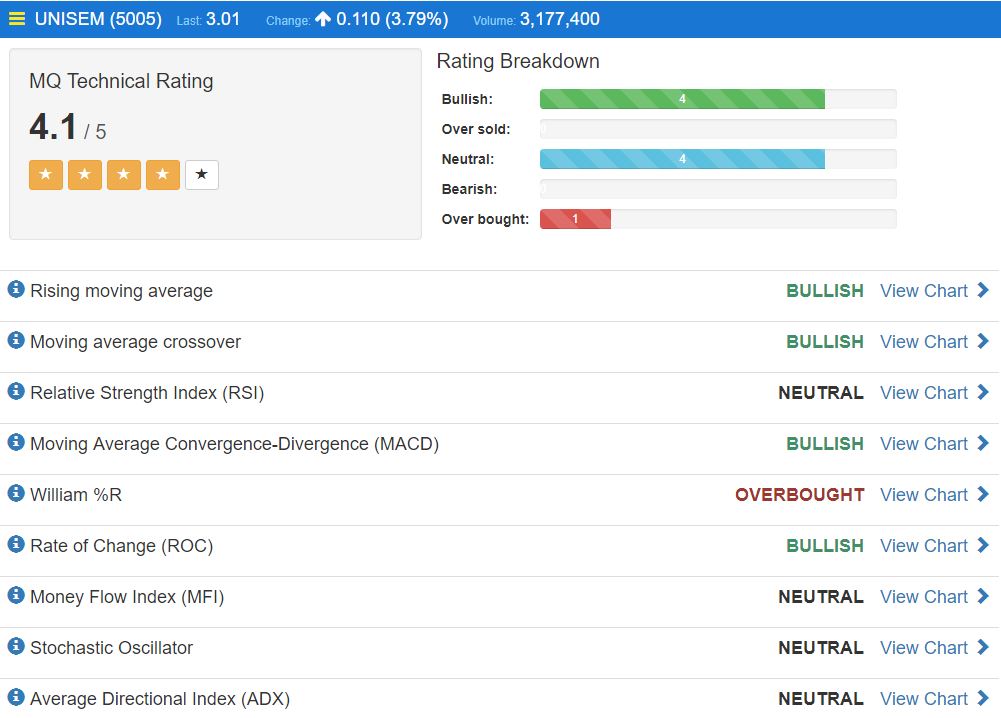

MQ Technical Indicators

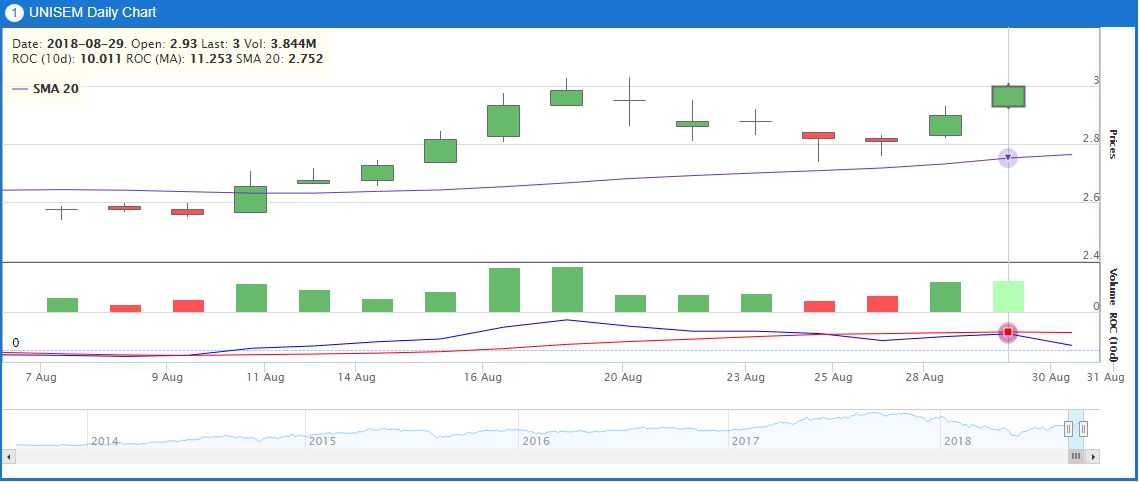

- Rate of Change (ROC)

The Rate-of-Change (ROC) indicator, which is also referred to as simply Momentum, is a pure momentum oscillator that measures the percent change in price from one period to the next. The ROC calculation compares the current price with the price "n" periods ago. The plot forms an oscillator that fluctuates above and below the zero line as the Rate-of-Change moves from positive to negative.

Bullish: when it has a positive Rate-of-Change and the stock price is above the 20-day SMA.

Bearish: when it has a negative Rate-of-Change and the stock price is below the 20-day SMA.

Source: MQ Trader Stock Analysis System

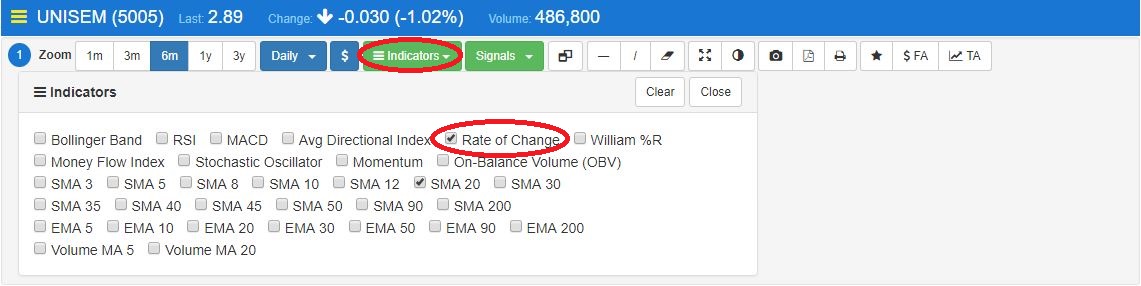

Figure 1: ROC in UNISEM’s daily technical chart

Based on Figure 1, it is still experiencing bullish trend, as its ROC is above SMA 20. Besides, ROC is increasing steadily showing that the share price is increasing over the time.

To view the technical chart in MQ Trader Stock Analysis System, please visit ROC Technical Chart.

- Money Flow Index (MFI)

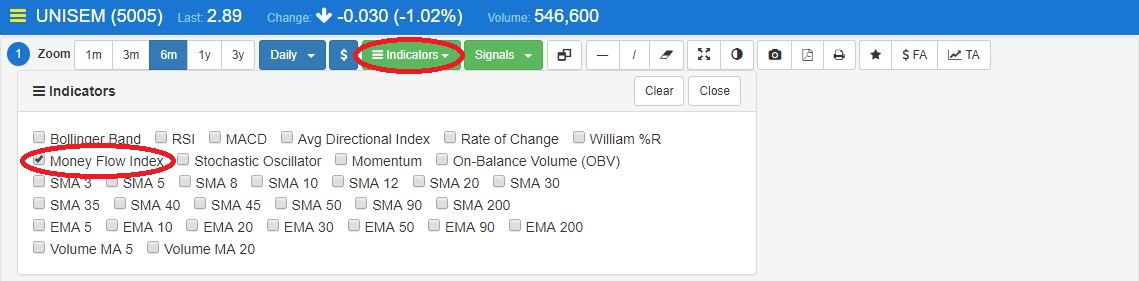

Money Flow Index (MFI) is a technical oscillator that is able to identify overbought or oversold conditions of a stock. It is also known as volume-weighted RSI which enhances the function of RSI (just price) by incorporating both price and volume data. 14 days of period is commonly used as default by traders to determine the MFI in the technical analysis.

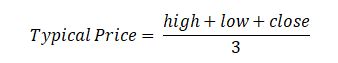

Calculation of MFI

Step 1: Calculate typical price for each day to obtain the average of high price, low price and the closing price.

Step 2: Calculate the positive and negative money flow

![]()

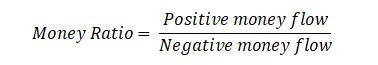

Step 3: Calculate the money ratio

Money flow is divided into positive and negative money flow:

- Positive money flow: The sum of the money flow of all the days where the typical price is higher than the previous day's typical price.

- Negative money flow: The sum of the money flow of all the days where the typical price is lower than the previous day's typical price.

- If typical price is unchanged, that day will be discarded.

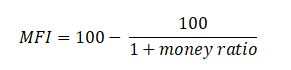

Step 4: Calculate the money flow index

The Money Flow Index (MFI) is an oscillator that moves between 0 and 100. It uses both price and volume to measure buying and selling pressure. Typically, MFI above 80 is considered overbought and MFI below 20 is considered oversold. Strong trends can present a problem for these classic overbought and oversold levels. MFI can become overbought (>80) and prices can simply continue higher when the uptrend is strong. Conversely, MFI can become oversold (<20) and prices can simply continue lower when the downtrend is strong.

Source: MQ Trader Stock Analysis System

Figure 2: MFI in UNISEM’s daily technical chart

Figure 2 shows the MFI with the value of 76.319 which is approaching 80. Hence, UNISEM’s share is still considered as neutral which is neither overbought nor oversold at the moment.

To view the technical chart in MQ Trader, please visit MFI Technical Chart.

We will continue the last part of this topic in our next blog post – MQ Trader – Technical Indicators (Part 4) [UNISEM].

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-13

UNISEM2024-11-13

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEMMore articles on MQTrader Education Series

Created by MQTrader Jesse | Apr 13, 2023

Created by MQTrader Jesse | Aug 06, 2021

Created by MQTrader Jesse | Nov 01, 2019