Rakuten Trade Research Reports

Technical View - Dayang Enterprise Holdings Bhd

rakutentrade

Publish date: Wed, 21 Feb 2024, 12:15 PM

Dayang Enterprise Holdings Bhd (DAYANG, 5141)

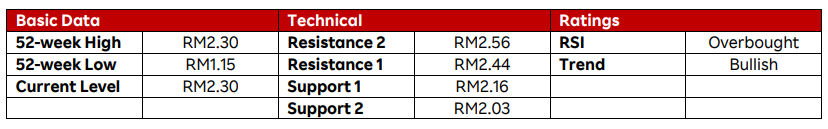

- DAYANG may extend its upward trajectory after breaking out from its 3-week ascending trianglepattern, surpassing the immediate resistance of RM2.16 with a long white candle yesterday. In view of the stock hitting a new 52 week high coupled with 4 white candles in a row, a positive outlook is expected. In addition, yesterday’s white bullish candle was supported by higher trading volume which suggests a return in buying interests.

- We expect the rising momentum is set to steer the stock higher and test the next level of resistance of RM2.44 (R1) and RM2.56 (R2) in the near term.

- On the downside, stop-loss is set at RM2.02, below 8 Feb’s low.

- Fundamentally, we like DAYANG due to its solid earnings growth driven by (i) recent announcementsof new contract wins and renewals (ii) anticipated increase in vessel utilisation and charter rates benefiting DAYANG's external marine charter operations, particularly via its stake in Perdana Petroleum, and (iii) higher offshore activities planned by Petronas. As such, we believe DAYANG’s earnings outlook to remain buoyant.

Source: Rakuten Research - 21 Feb 2024

To sign up for an account: http://bit.ly/40BNqKI

[Youtube Tutorial] Account Opening & Enable Foreign Equity: http://bit.ly/3I5Jzxo

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Rakuten Trade Research Reports

Discussions

Be the first to like this. Showing 0 of 0 comments