Rakuten Trade Research Reports

Technical View - MK Land Holdings Bhd

rakutentrade

Publish date: Fri, 12 Apr 2024, 10:52 AM

MK Land Holdings Bhd

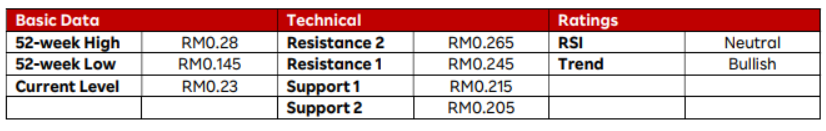

- MKLAND formed a double bottom pattern recently thereafter broke above the neckline at RM0.225 with a long white marubozu candlestick on Tuesday, signalling a strong potential for a trend reversal. The higher trading volume also sent the share price to close above the 50-day EMA. In view of the 20-day EMA and 50-day EMA are converging thus confirming a bullish crossover soon, this has enhanced the near-term positive momentum.

- We expect the positive momentum to steer the stock higher and test the next resistance level of RM0.245 (R1), followed by RM0.265 (R2) in near term.

- On the downside, stop-loss is set at RM0.20.

Source: Rakuten Research - 12 Apr 2024

To sign up for an account : http://bit.ly/40BNqKI

[Youtube Tutorial] Account Opening & Enable Foreign Equity:http://bit.ly/3I5Jzxo

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Rakuten Trade Research Reports

CBH Engineering Holdings Berhad - Shaping the Homes of Big Data

Created by rakutentrade | Jan 16, 2025

Discussions

Be the first to like this. Showing 0 of 0 comments