RHB Investment Research Reports

Trading Stocks - KKB Engineering

rhbinvest

Publish date: Tue, 30 Apr 2024, 11:04 AM

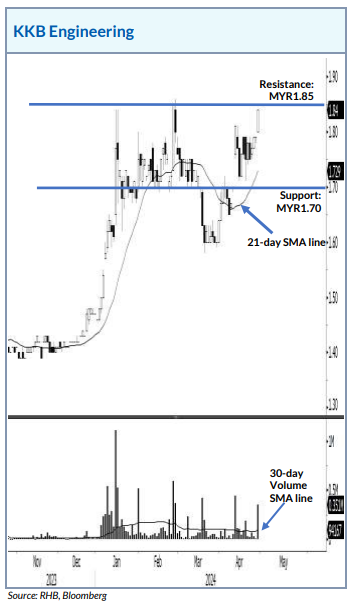

KKB Engineering may be headed for a technical breakout after climbing strongly and moving towards the immediate resistance of MYR1.85 on a spike in trading volume. If a breakout above that level happens, the bullish momentum may propel the stock towards MYR2, followed by the next resistance point of MYR2.10. However, breaching below the MYR1.70 support would reverse the momentum, as it would be trading below the 21-day SMA line.

Source: RHB Securities Research - 30 Apr 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on RHB Investment Research Reports

MAG Holdings - Sabah’s Shrimp Fuels Malaysia’s Aquaculture Giant

Created by rhbinvest | Feb 03, 2025

Discussions

Be the first to like this. Showing 0 of 0 comments