FKLI - Approaching Immediate Resistance

rhboskres

Publish date: Wed, 23 Jan 2019, 05:06 PM

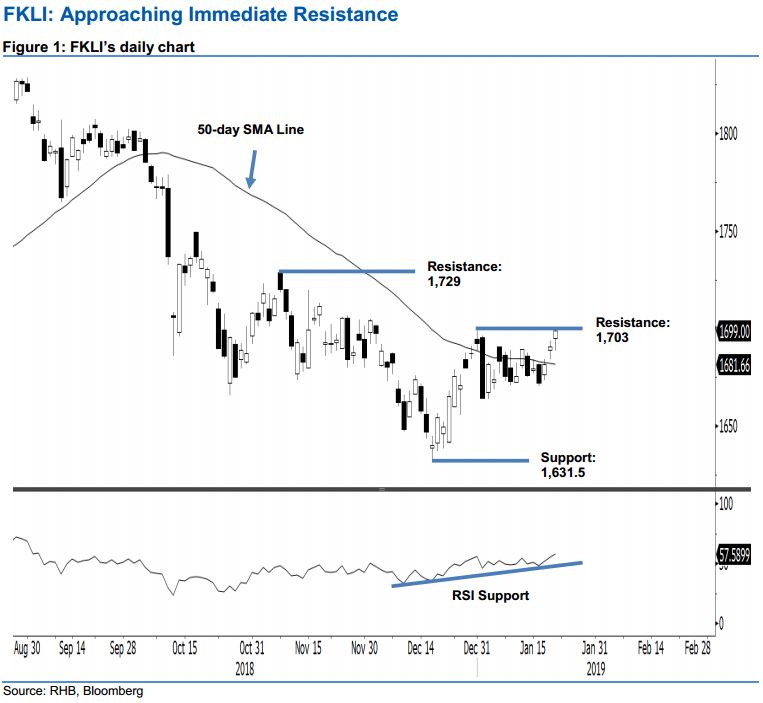

Maintain short positions pending a confirmation of change in bias. The FKLI gained 8.5 pts to close at 1,699 pts yesterday, with the low and high at 1,688.5 pts and 1,699.5 pts. The positive session pushed the index closer to testing the immediate resistance of 1,703 pts. Until this resistance mark is overcome decisively, the bearish bias that set in from the 1 Jan’s black candle should remain in place, and the index could still weaken in the coming sessions. Additionally, a breakout from this resistance mark would also mean that the FKLI has managed to cross the 50-day SMA line decisively. Until this happens, we maintain a negative trading bias.

Until there is a firm confirmation that the index is ready to resume its rebound, traders should remain in short positions. We initiated these at 1,664.5 pts, the closing level of 2 Jan. To manage risks, a stop-loss can be placed above 1,703 pts.

Immediate support is maintained at 1,631.5 pts, the low of 18 Dec. This is to be followed by the 1,600-pt mark. On the other hand, the immediate resistance is set at 1,703 pts, the high of 31 Dec 2018. This is followed by 1,729 pts, the high of 8 Nov.

Source: RHB Securities Research - 23 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024