E-mini Dow Futures - the Buying Momentum Resumes

rhboskres

Publish date: Mon, 28 Jan 2019, 11:25 AM

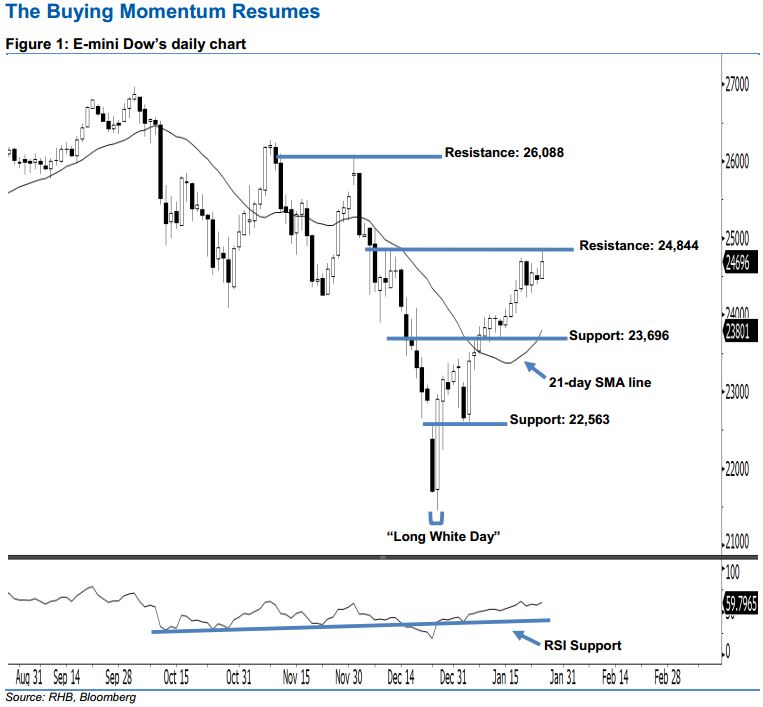

Bullish sentiment remains intact, stay long. The buying momentum in the E-mini Dow has continued as expected, as a white candle was formed last Friday. It gained 238 pts to close at 24,696 pts after oscillating between a high of 24,830 pts and low of 24,458 pts. Technically speaking, we believe the upside move is likely to continue, as the index has recouped the previous week’s losses and marked a higher close above the rising 21- day SMA line. Overall, we expect the market to rise further if the immediate 24,844-pt resistance mentioned previously is taken out decisively in the coming sessions.

As seen in the chart, we are eyeing the immediate support at 23,696 pts, ie the low of 14 Jan. If a breakdown arises, look to 22,563 pts – obtained from the low of 4 Jan – as the next support. To the upside, the immediate resistance is maintained at 24,844 pts, which was the high of 12 Dec 2018. If a breakout arises, the next resistance will likely be at 26,088 pts – this is situated at the previous high of 3 Dec 2018.

Therefore, we advise traders to stay long, following our recommendation to initiate long above the 22,400-pt level on 27 Dec 2018. In the meantime, a trailing-stop can be set below the 23,696-pt threshold to lock in part of the gains.

Source: RHB Securities Research - 28 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024