FCPO - Taking a Pause

rhboskres

Publish date: Mon, 28 Jan 2019, 11:28 AM

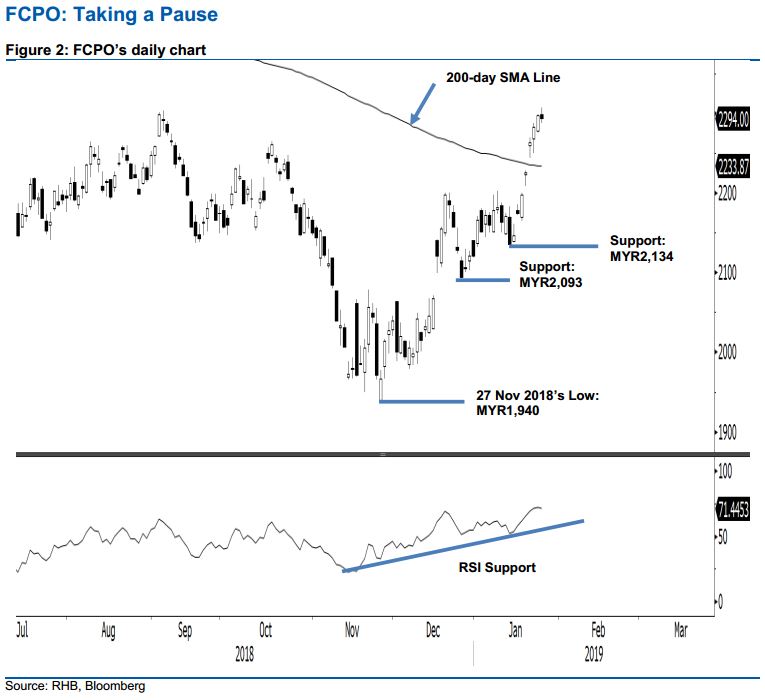

Maintain long positions. The FCPO failed to sustain its earlier session’s positive tone which, at one point, saw it testing the immediate resistance of MYR2,303. Last Friday, the commodity hit a high of MYR2,307 before dropping to close at MYR2,294, indicating a decline of MYR3. The weak session may suggest the commodity is probably taking a pause, after the recent relatively sharp rally that sent its daily RSI slightly into a overbought reading in the sessions. Until there are further negative price actions that indicate a deeper consolidation phase is developing, we keep to our positive trading bias.

As the overall upward bias is still firmly in place, traders are advised to stay in long positions. We initiated these at MYR2,226, the closing level of 18 Jan. For risk management purposes, a trailing-stop can now be placed below MYR2,288, the low of the latest session.

Towards the downside, the immediate support is set at MYR2,134, the low of 14 Jan. The second support is at MYR2,093, the low of 26 Dec 2018. On the other hand, the immediate resistance is maintained at MYR2,303, the high of 5 Sep 2018. This is followed by MYR2,348, the high of 29 Jun 2018.

Source: RHB Securities Research - 28 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024