COMEX Gold - Looking Good

rhboskres

Publish date: Tue, 29 Jan 2019, 10:54 AM

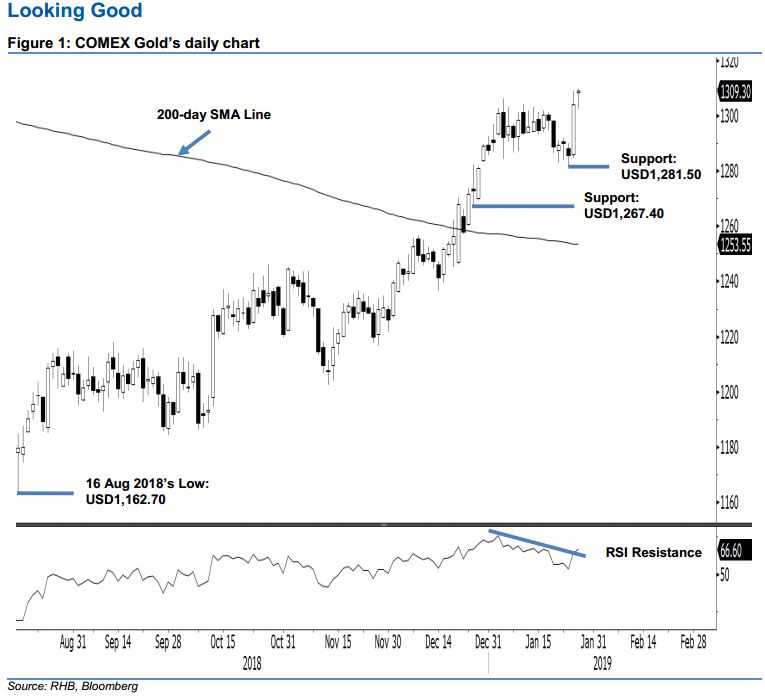

Maintain long positions as the bias is strong for the upward move to be extended. The precious metal managed to end the latest session in positive territory, after it experienced swings between the negative and positive area intraday. The low and high were posted at USD1,302.70 and USD1,309.80, this was before it ended USD5.10 better at USD1,309.30. Overall, we believe the commodity is in process of extending its upward move – as it was deemed to have completed its 3-week sideways consolidation phase in the prior session. The Daily RSI, which is showing an initial breakout from the resistance line (as labelled in the chart), suggests momentum is picking up as well. On this technical background, we keep to our positive trading bias.

As the bulls are still showing signs of dominating the price trend, we continue to advise traders stay in long positions. We initiated this at the USD1,216 mark, which was 14 Nov 2018’s closing level. For risk-management purposes, a stop-loss can now be placed below the USD1,281.50 threshold.

Immediate support is expected at USD1,281.50, which was the low of 24 Jan, while the second support is set at USD1,267.40, which was the low of 21 Dec 2018. Conversely, the overhead resistance of USD1,332.40, ie the high of 11 May 2018, is the immediate resistance. This is followed by USD1,370.50, or the high of 25 Jan 2018.

Source: RHB Securities Research - 29 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024