E-mini Dow Futures: Moving Higher

rhboskres

Publish date: Thu, 31 Jan 2019, 04:23 PM

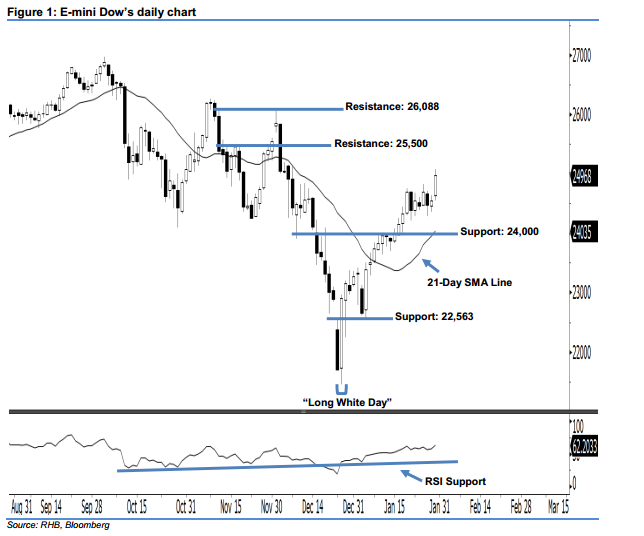

Stay long, with a new trailing-stop set below the 24,000-pt level. Last night, the E-mini Dow formed another white candle – surging 415 pts to close at 24,968 pts, off the session’s high of 25,068 pts and low of 24,540 pts. Based on the current technical landscape, yesterday’s white candle has taken out the previously-indicated 24,844-pt resistance – and also sent the E-mini Dow to its highest point in more than 1.5 months. This indicates that the buying momentum has extended. Overall, we believe the rebound that started off 26 Dec 2018’s “Long White Day” candle may continue.

Currently, we are eyeing the immediate support level at the 24,000-pt round figure, also set near 10 Jan’s high and 17 Jan’s low. The next support would likely be at 22,563 pts, determined from the low of 4 Jan. On the other hand, we now anticipate the immediate resistance level at 25,500 pts, situated near the midpoint of 4 Dec 2018’s long black candle. Meanwhile, the next resistance is seen at 26,088 pts, ie the previous high of 3 Dec 2018.

Recall that on 27 Dec 2018, we initially recommended traders initiate long positions above the 22,400-pt level. We continue to advise them to stay long for now, while setting a new trailing-stop below the 24,000-pt threshold. This is in order to lock in a larger part of the profits.

Source: RHB Securities Research - 31 Jan 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024