WTI Crude Futures - Sideways Consolidation Phase Still Developing

rhboskres

Publish date: Wed, 13 Feb 2019, 04:39 PM

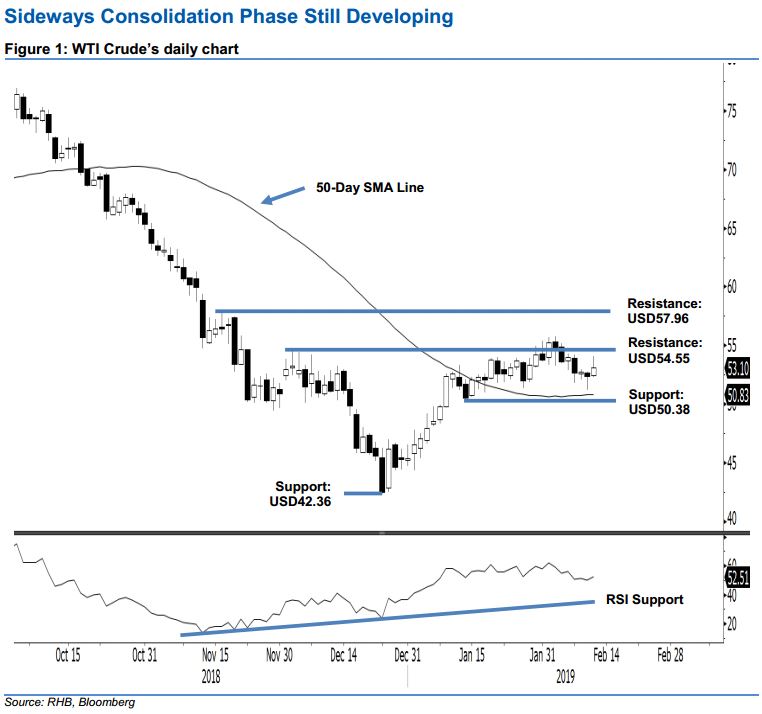

Piggy back on rebound extension; maintain long positions. The WTI Crude ended in positive territory in the latest trading, closing USD0.69 higher at USD53.10. Intraday low and high were at USD52.29 and USD54.05. The positive session was a follow-up from the prior session’s “Hammer” formation – which appeared near the 50- day SMA line. Still, until there are further positive price actions in the coming sessions, from the price pattern perspective, the commodity is still trading in a multi-week sideways consolidation phase. This consolidation phase is deemed healthy to correct the commodity’s prior multi-week upward move. Hence, we maintain our positive trading tone.

With the price actions over the recent weeks pointing towards a healthy sideways consolidation, before the next rebound leg is expected to develop – we continue to recommend traders keep long positions. These were initiated at USD49.78, or the closing level of 8 Jan. For risk-management purposes, a stop-loss can be placed at the breakeven level.

Towards the downside, immediate support is set at USD50.38, which was the low of 14 Jan. This is followed by USD42.36, or the low of 24 Dec 2018. Moving up, the immediate resistance is set at USD54.55, ie the high of 4 Dec 2018. This is followed by USD57.96, which was the high of 16 Nov 2018.

Source: RHB Securities Research - 13 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024