Hang Seng Index Futures - Stick to Long Positions

rhboskres

Publish date: Tue, 26 Feb 2019, 10:47 AM

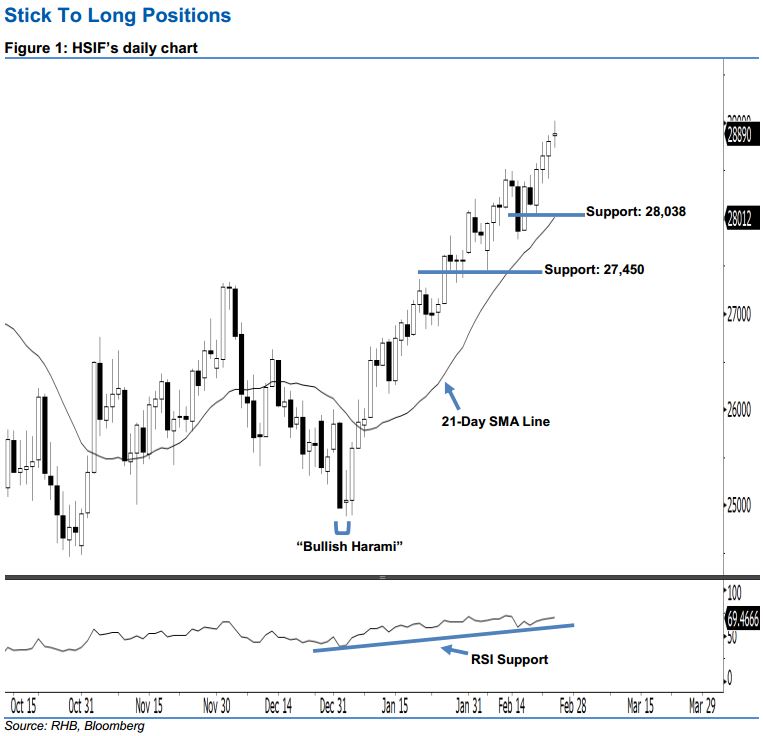

Stay long. After posting three white candles in a row, the HSIF ended higher to form a “Doji” candle yesterday. It closed at 28,890 pts, off its high of 29,018 pts and low of 28,740 pts. However, from a technical perspective, we expect the rebound that started from 3 Jan’s “Bullish Harami” pattern to likely persist. This is because the HSIF has marked a higher close vis-à-vis the previous session and stayed above the rising 21-day SMA line, implying that the market sentiment is bullish. Overall, we maintain our bullish view on the HSIF’s outlook.

Stay long. After posting three white candles in a row, the HSIF ended higher to form a “Doji” candle yesterday. It closed at 28,890 pts, off its high of 29,018 pts and low of 28,740 pts. However, from a technical perspective, we expect the rebound that started from 3 Jan’s “Bullish Harami” pattern to likely persist. This is because the HSIF has marked a higher close vis-à-vis the previous session and stayed above the rising 21-day SMA line, implying that the market sentiment is bullish. Overall, we maintain our bullish view on the HSIF’s outlook.

Judging from the current outlook, the immediate support level is seen at 28,038 pts, determined from the low of 20 Feb. The next support is seen at 27,450 pts, ie the previous low of 8 Feb. Towards the upside, we are eyeing the immediate resistance level at 29,113 pts, obtained from the high of 26 Jul 2018. If a breakout arises, the next resistance is maintained at the 30,000-pt psychological spot.

Thus, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 26,000-pt level on 10 Jan. A trailing-stop is preferably set below the 28,038-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 26 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024