E-mini Dow Futures - Slight Pullback

rhboskres

Publish date: Wed, 27 Feb 2019, 05:28 PM

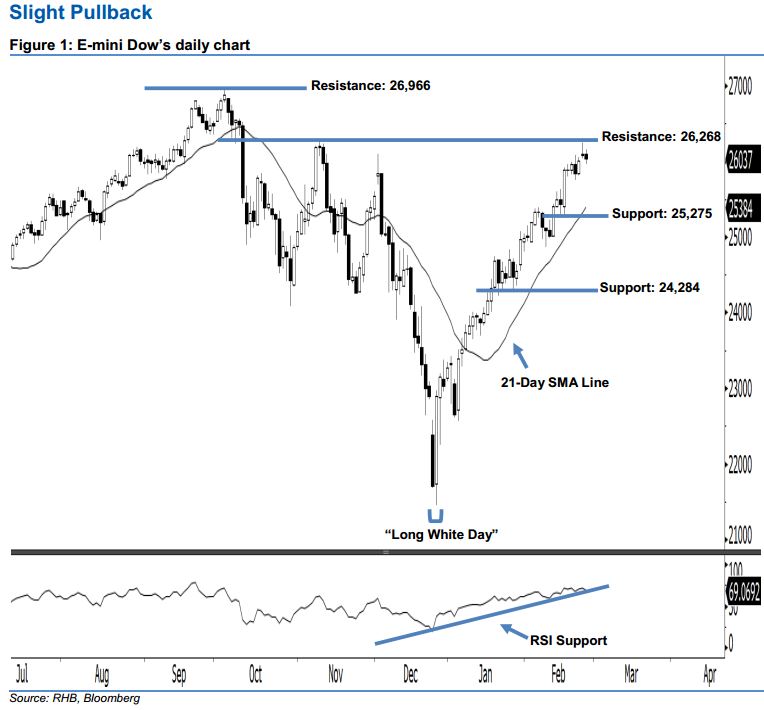

Bullish trend remains intact; stay long. The E-mini Dow ended lower to form a negative candle last night. It dropped 62 pts to close at 26,037 pts, off its high of 26,150 pts and low of 25,954 pts. Still, based on the current outlook, we note that the index is still trading above the rising 21-day SMA line, which signals that the bullish sentiment remains unchanged. Technically, the bulls may continue to control the market as long as the E-mini Dow fails to erase the gains from 15 Feb’s long white candle. Overall, we think the market’s rebound, which began from 26 Dec 2018’s “Long White Day” candle, may persist.

As seen in the chart, the immediate support level is seen at 25,275 pts, ie the low of 15 Feb’s long white candle. Meanwhile, the next support is situated at 24,284 pts, determined near the lows of 23 and 28 Jan. Towards the upside, we anticipate the immediate resistance level at 26,268 pts, ie the high of 8 Nov 2018. The next resistance is seen at the 26,966-pt record high.

Thus, we advise traders to stay long, following our recommendation of initiating long above the 22,400-pt level on 27 Dec 2018. A trailing-stop can be set below the 25,275-pt threshold in order to secure part of the gains.

Source: RHB Securities Research - 27 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024