WTI Crude Futures - Bias for Further Rebound Intact

rhboskres

Publish date: Wed, 27 Feb 2019, 05:30 PM

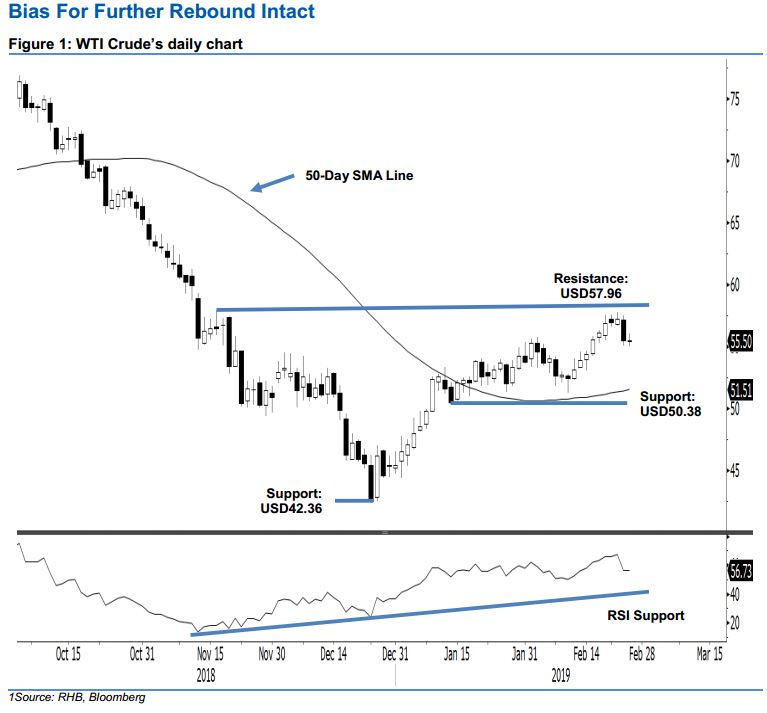

Maintain long positions. The WTI Crude formed a “Doji” formation in the latest session – indicating it was an indecisive session. Ending at USD55.50, the low and high were posted at USD55.02 and USD56.08. The latest performance suggests there was no negative follow-up from the prior session’s black candle. Broadly, the technical rebound that started from the low of USD42.36 on 24 Dec 2018 is still considered valid. Further supporting this bias is the fact that it has recently completed its sideways consolidation near the 50-day SMA line area. Maintain long bias.

As there are no clear signs to indicate the said technical rebound – to correct the sharp down leg that took place between early Oct 2018 and end Dec 2018 – has reached an end, we continue to recommend traders maintain long positions. These were initiated at USD49.78, or the closing of 8 Jan. For risk management purposes, a stoploss can be placed at the breakeven level.

Immediate support is set at USD50.38, which was the low of 14 Jan. The following support may emerge at USD42.36, or the low of 24 Dec 2018. Moving up, overhead resistance is expected at USD57.96, which was the high of 16 Nov 2018. This is followed by USD60, a round figure.

Source: RHB Securities Research - 27 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024