WTI Crude Futures: Still a Rebound Play

rhboskres

Publish date: Thu, 28 Feb 2019, 05:41 PM

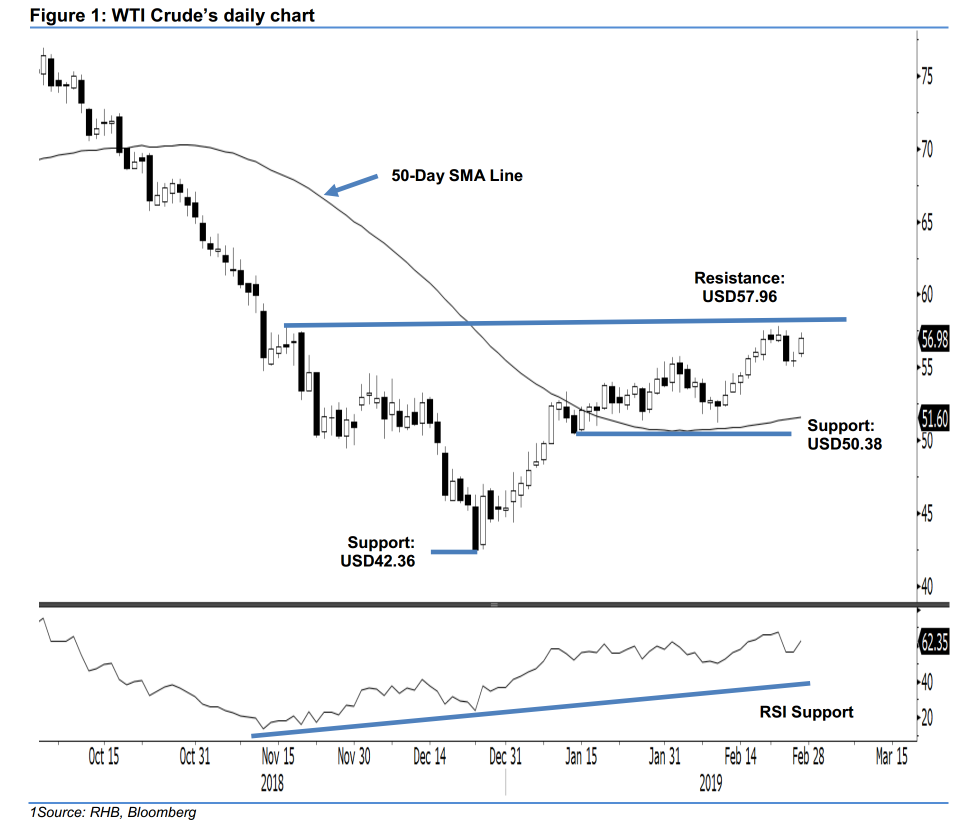

Maintain long positions as rebound is still showing signs of developing. The WTI Crude formed a white candle to end the latest session USD1.48 higher at USD56.98. Intraday tone was encouraging, as it generally scaled higher for the entire session, the low and high were posted at USD55.72 and USD57.39. Overall, the commodity’s rebound continues to show signs of developing. For now, we continue to see this as a technical rebound for the commodity’s sharp decline that took place in between early Oct 2018 and end of Dec 2018. Until we see that signs of this rebound have reached an end, we keep to our long bias.

As the rebound continues to show signs of extending, we continue to recommend traders maintain long positions. These were initiated at USD49.78, or the closing of 8 Jan. For risk management purposes, a stop-loss can be placed at the breakeven level.

Immediate support is expected to emerge at USD50.38, which was the low of 14 Jan. The second support is at USD42.36, or the low of 24 Dec 2018. On the other hand, immediate resistance is expected at USD57.96, which was the high of 16 Nov 2018. This is followed by USD60, a round figure.

Source: RHB Securities Research - 28 Feb 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024