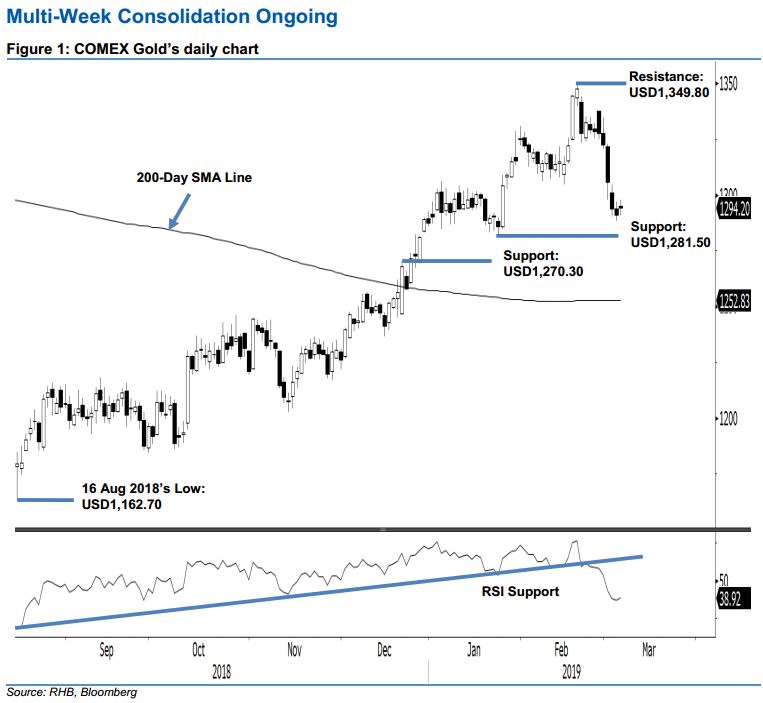

COMEX Gold - Multi-Week Consolidation Ongoing

rhboskres

Publish date: Thu, 07 Mar 2019, 05:14 PM

Maintain short positions, as the decline is taking a pause. The yellow metal added USD3 to end at USD1,294.20 yesterday, after ranging between USD1,290.90 and USD1,298.10. This positive session can be seen as a sign that the COMEX Gold is taking a minor pause after the sharp declines in recent sessions. Looking at the broader technical picture, we still believe the commodity’s correction phase is still ongoing and may still have a few weeks more to develop. This correction is to rectify the previous multi-month upward move. We maintain the short bias. As the latest positive session did not produce any price reversal or deeper rebound signals, we continue to recommend traders stay in short positions. These positions were initiated at USD1,322.70, which was the closing level of 1 Mar. For risk-management purposes, a stop-loss can be placed above the USD1,349.80 level. The immediate support is maintained at USD1,281.50, which was the low of 24 Jan 2018. We eye the following support at USD1,270.30, or the high of 20 Dec 2018. Conversely, the immediate resistance is set at USD1,349.80, ie the high of 20 Feb. This is followed by USD1,370.50, which was the high of 25 Jan 2018.

Source: RHB Securities Research - 7 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024