COMEX Gold - Still Expecting Further Corrections

rhboskres

Publish date: Tue, 26 Mar 2019, 12:30 PM

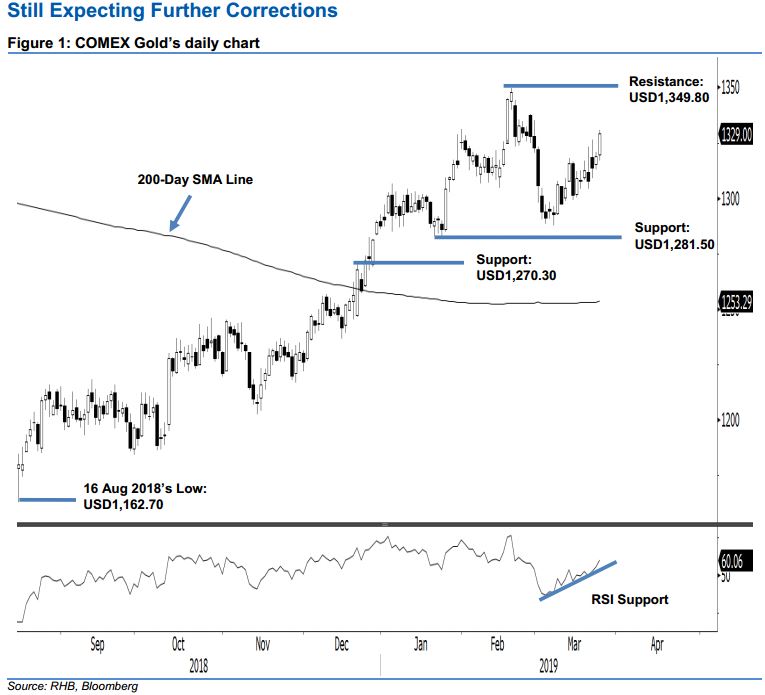

Maintain short positions. The COMEX Gold ended the latest trading on the positive side – adding USD10.30 to close at USD1,329. During the intraday, it reached a low and high of USD1,317 and USD1,330.80. While the commodity has been able to pose a relatively sharp rebound from its recent low, said rebound has been corrective in nature, instead of indicating a total price reversal. This implies that we still believe the COMEX Gold’s correction phase – which started from the recent high of USD1,349.80 – remains in place and is likely to resume once said corrective rebound reaches an end. We maintain our negative trading bias.

Given the expectation that the commodity is still in the process of completing its multi-week correction phase, we continue to recommend traders stay in short positions. These positions were initiated at the USD1,322.70 level, which was the closing level of 1 Mar. For risk-management purposes, a stop-loss can be placed above the USD1,349.80 level.

The immediate support is set at USD1,281.50, which was the low of 24 Jan 2018. The second support is envisaged at USD1,270.30, or the high of 20 Dec 2018. Conversely, the immediate resistance is set at USD1,349.80, ie the high of 20 Feb. This is followed by USD1,370.50, which was the high of 25 Jan 2018.

Source: RHB Securities Research - 26 Mar 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024