E-mini Dow Futures - Trading Below the 21-Day SMA Line

rhboskres

Publish date: Fri, 17 May 2019, 05:34 PM

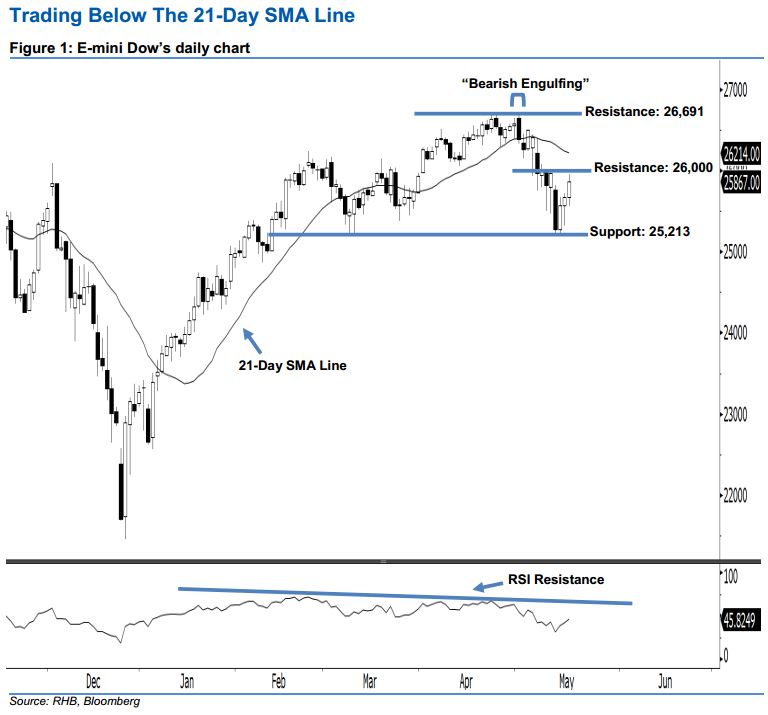

Stay short while setting a stop-loss above the 26,691-pt resistance. The E-mini Dow ended higher to form another white candle last night. It gained 193 pts to close at 25,867 pts, off the session’s high of 25,955 pts and low of 25,554 pts. Still, the appearance of 14-16 May white candles indicate that the market may be experiencing a technical rebound after the losses seen lately. As the index is still holding below the declining 21-day SMA line, this implies that the bearish sentiment stays intact. Overall, we think that the downside swing – ie beginning with 1 May’s “Bearish Engulfing” pattern – may continue.

As seen in the chart, we are eyeing the immediate resistance level at the 26,000-pt round figure, situated near the high of 9 May as well. The next resistance would likely be at 26,691 pts, ie the previous high of 1 May’s “Bearish Engulfing” pattern. On the other hand, the immediate support level is seen at 25,213 pts, which was the previous low of 8 Mar. Meanwhile, the next support is maintained at the 25,000-pt psychological spot.

Hence, we advise traders to stay short, following our recommendation of initiating short below the 26,000-pt level on 10 May. A stop-loss can be set above the 26,691-pt mark in order to minimise the risk per trade.

Source: RHB Securities Research - 17 May 2019

.png)

.png)