WTI Crude - Hitting the Trailling-Stop

rhboskres

Publish date: Mon, 16 Nov 2020, 11:56 AM

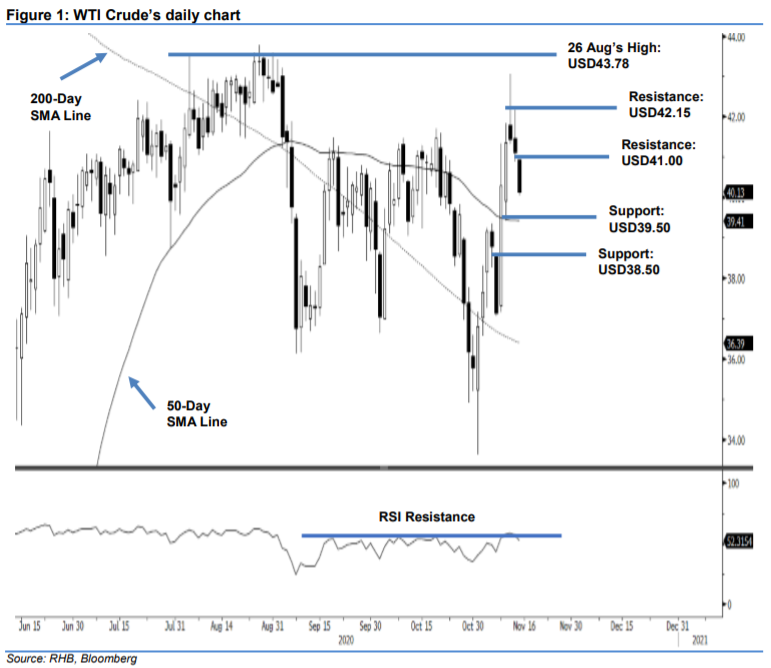

Maintain short positons. The WTI Crude generally moved lower during Friday’s session, indicating that the selling pressure was persistent. It ended the session USD0.99 weaker at USD40.13, crossing below the previous USD40.50 immediate support level. We believe this signals that the black gold is in the process of developing a deeper correction phase, which came after its recent sharp upward move reached a high of USD43.06 on 11 Nov. On a bigger picture, we remain convinced that the lengthy multi-month correction phase, which started from end August, is still incomplete. Towards the downside, the minimum retracement target is pegged at the 200-day SMA line. Consequently, we switch our trading bias to negative from positive.

Our previous long positions – initiated at USD40.29, or the closing level of 9 Nov – were closed out at USD40.50 during Friday’s session. Concurrently, we initiate short positions. To manage risks, a stop-loss can now be placed above the USD43.78 threshold.

The support level is revised to USD39.50, which was near the 200-day SMA line, and is followed by the USD38.50 mark. Conversely, resistance levels are pegged at USD41.00 and USD42.15.

Source: RHB Securities Research - 16 Nov 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024