Hang Seng Index Futures - Final Attempt to Cross the 28,000-Pt Psychological Level

rhboskres

Publish date: Thu, 15 Jul 2021, 09:49 AM

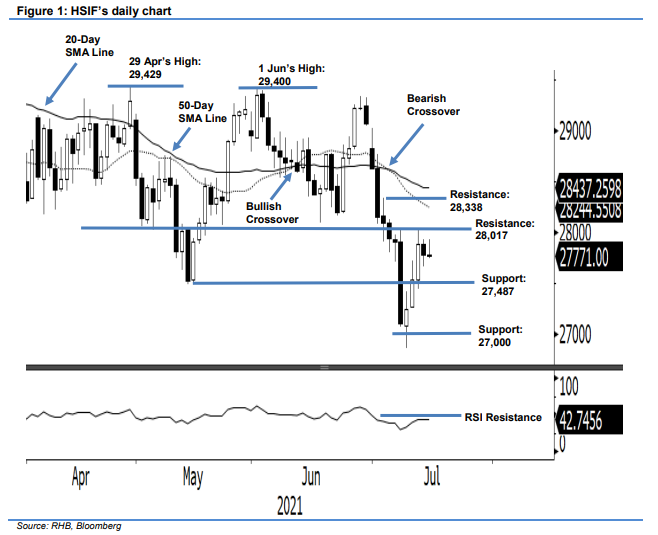

Maintain short positions. The HSIF took a wait-and-see approach just before the 28,000-pt mark, retracing 104 pts yesterday to close at 27,776 pts. The index initally opened flat at 27,807 pts and tested the 27,890-pt day high. However, it dipped to the 27,662-pt day low in the afternoon before settling the day session at 27,776 pts. It did not change much during the evening session and closed at 27,771 pts. The bulls are consolidating before making a final attempt to breach the 28,000-pt psychological mark. If the HSIF manages to cross the level convincingly – ie above the 28,017-pt resistance – then perhaps the momentum will push towards the 20-day SMA line. However, looking at a longer timeframe, the 50-day SMA line is still trending lower, which we think poses as a selling pressure on the index for the medium term. We keep to our negative trading bias until the HSIF surpasses 28,000 pts.

Traders should hold on to the short positions initiated at 28,630 pts, or the closing level of 30 Jun’s day session. To control trading risks, the trailing-stop mark is set at the 28,000-pt psychological level.

The immediate support remains at 27,487 pts, or 13 May’s low, and then the 27,000-pt whole number. Conversely, the resistance levels are pegged at 28,017 pts – 8 Jul’s high – and 28,338 pts.

Source: RHB Securities Research - 15 Jul 2021

.png)