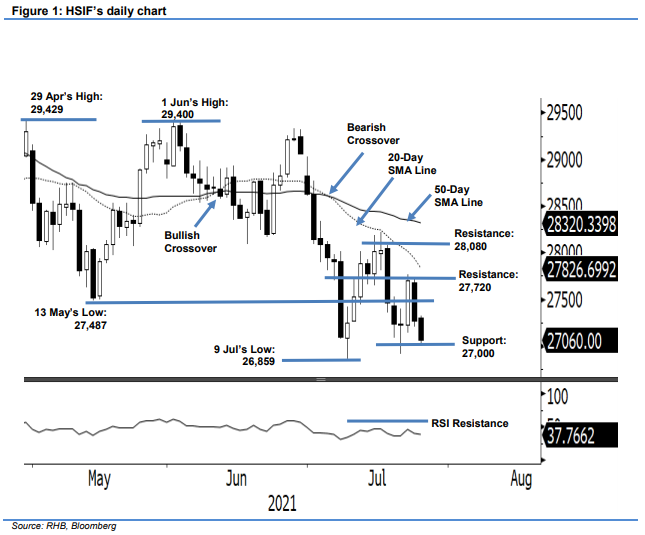

Hang Seng Index Futures - Testing the 27,000-Pt Support Level

rhboskres

Publish date: Mon, 26 Jul 2021, 09:27 AM

Maintain short positions. The HSIF experienced another strong-selling round on Friday, plunging 433 pts to settle the day session at 27,272 pts – moving further away from the 20-day SMA line too. After it opened the session at 27,720 pts, the index straight away progressed lower and reached the 27,200-pt day low before its close. Sentiment remained wary over the evening session, where the HSIF dropped 212 pts and last traded at 27,060 pts – marginally staying above the 27,000-pt support level. To recap our previous note, a false break at the 28,000-pt psychological level will confirm our thesis that the index is now trapped in a downtrend phase – hence, we expect it to form “lower highs and lower lows” in the coming sessions. The 27,000-pt immediate support level will be crucial – breaching it will see sentiment worsen and open the door for a deep correction. We stick with our negative trading bias for now.

Traders should stick with the short positions initiated at 27,469 pts, or the closing level of 19 Jul. To manage the risks, the initial stop-loss threshold is set at 28,080 pts.

The immediate support is expected at 27,000 pts, followed by the 26,600-pt whole number. On the upside, the immediate resistance level is revised to 27,720 pts – 23 Jul’s high – and followed by 28,080 pts, ie 19 Jul’s high.

Source: RHB Securities Research - 26 Jul 2021

.png)