FCPO - Bullish Momentum Accelerates

rhboskres

Publish date: Mon, 26 Jul 2021, 09:40 AM

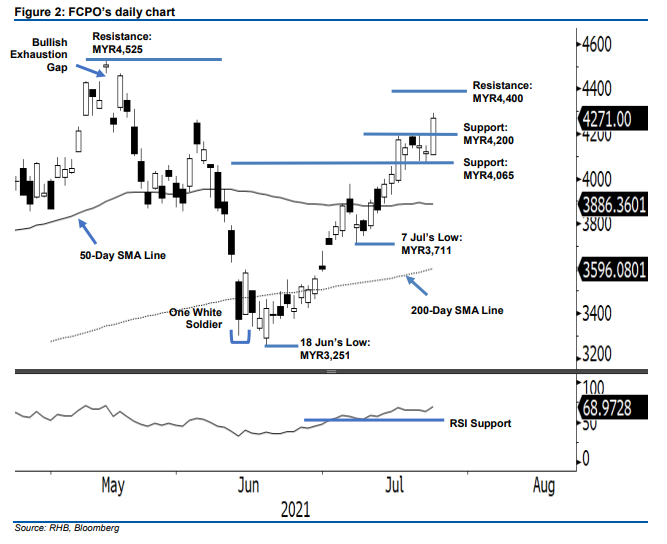

Maintain long positions. After recently moving sideways, the FCPO bounced off and breached its immediate resistance as it was boosted by MYR150.00 to close at MYR4,271 last Friday. The commodity started the session at MYR4,107 and immediately moved northwards, where the buying momentum persisted throughout the session, which hit the intraday high of MYR4,294 just before settling at MYR4,271. Last Friday’s long white candle, which shows a strong buying momentum with a “higher high” bullish pattern, clearly indicates the bulls are back in the driver’s seat. Supported by the RSI indicator that is trending stronger near the 70% level, we expect the positive momentum to continue towards the next resitance before the RSI reaches overbought territory above the 70% level for profit-taking activities to happen. Nevertheless, if it fails to maintain above the immediate resistance-turned-support level, we expect mild profit-taking to occur towards the next support mark. Until that happens, we stick to our bullish trading bias.

We recommend traders stay in long positions, which were initiated at the close of 13 Jul, or MYR3,977. To manage risks, the trailing-stop threshold is placed at MYR4,039.

The immediate support level is revised to the MYR4,200 round number, followed by MYR4,065 – 8 Jun’s high. Towards the upside, the resistance levels are pegged at the MYR4,400 round figure and MYR4,525, ie 12 May’s high.

Source: RHB Securities Research - 26 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024