FCPO - Bearish Momentum Picks Up Speed

rhboskres

Publish date: Tue, 03 Aug 2021, 09:47 AM

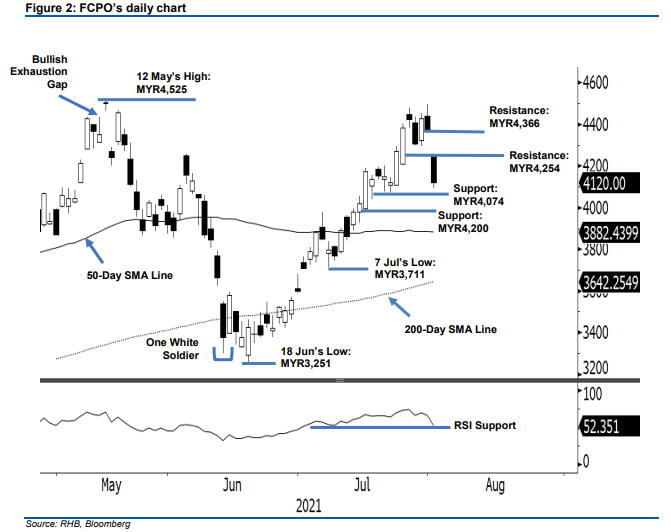

Maintain short positions. Bearish pressure on the FCPO ramped up yesterday, and the commodity shed MYR249.00 to close at MYR4,120. Initially, it gapped down at the start of Monday’s session, opening weaker at MYR4,247. Underpinned by negative sentiment, the bears pulled the commodity downwards and the latter breached the MYR4,200 level to print the day’s low of MYR4,093 day, just before trading closed. As mentioned in previous notes, the commodity is prone to profit-taking activities and upside movement will be limited. The latest price action showed that bearish momentum is accelerating, and the FCPO may test the support levels of MYR4,074 and MYR4,000. Before we can see a bullish candlestick formation, expect the bearish momentum to follow through. As such, we maintain a negative trading bias.

We recommend that traders maintain short positions, initiated at MYR4,308 or the closing level of 28 Jul. To mitigate trading risks, the stop-loss is set at MYR4,380.

The nearest support level has been revised lower to MYR4,074, the low of 22 Jul, followed by the MYR4,000 psychological level. Towards the upside, the immediate resistance level has been revised to MYR4,254, the high of 2 Aug, and followed by MYR4,366 or the low of 30 Jul.

Source: RHB Securities Research - 3 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024