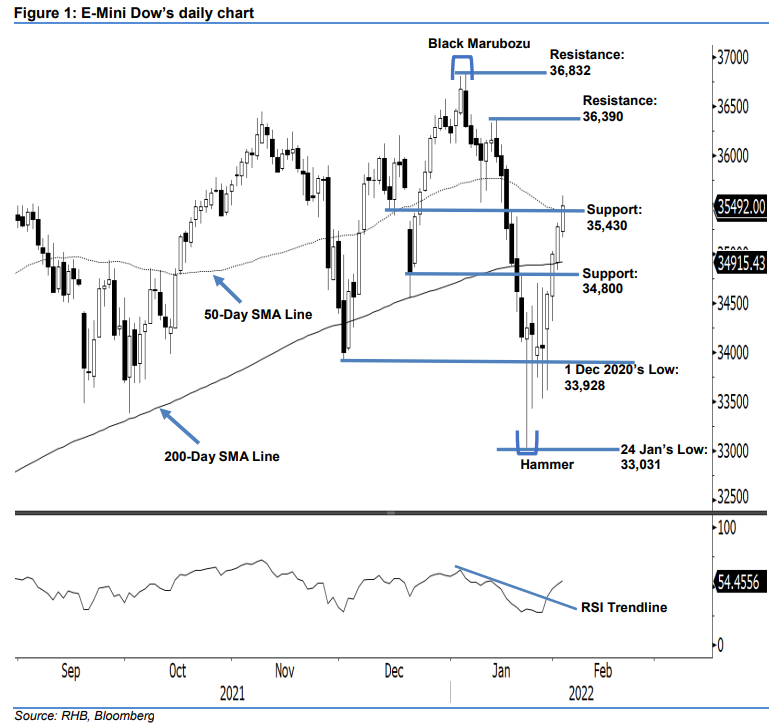

E-Mini Dow: Propelling Above the 50-Day SMA Line

rhboskres

Publish date: Thu, 03 Feb 2022, 06:09 PM

Trailing-stop mark triggered; initiate long positions. The E-Mini Dow has propelled itself strongly for four consecutive sessions as of yesterday, adding a strong 218 pts to settle at 35,492 pts, ie slightly above the 50-day average line. It opened positive at 35,232 pts and then whipsawed in a sideways direction to touch the 35,167-pt day low during the early US trading session. It then rebounded strongly northwards to hit the day’s high at 35,590 pts before retracing mildly towards the close. The session’s long white body candlestick – printed for four consecutive sessions – depicts a strong bullish momentum in the medium term. Nevertheless, mild profit-taking could be expected between the 50- and 200-day average lines before the E-Mini Dow propels northwards. Since the trailing stop of 34,800 pts was triggered, we shift to a positive trading bias.

We closed out our short positions – initiated at the closing level of 7 Jan or 36,107 pts – after the trailing-stop at 34,800 pts was triggered. Conversely, we initiate long positions at the closing level of 31 Jan. For risk-management purposes, the stop-loss threshold is introduced at 34,800 pts.

The immediate support sets at 35,430 pts – 19 Jan’s high – while the lower support is marked at 34,800 pts. The immediate resistance is pegged at 36,390 pts – 13 Jan’s high – and followed by 36,832 pts, ie 5 Jan’s high.

Source: RHB Securities Research - 3 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024

.png)