Hang Seng Index Futures: Attempting to Reclaim the 24,000-Pt Level

rhboskres

Publish date: Fri, 04 Feb 2022, 09:57 AM

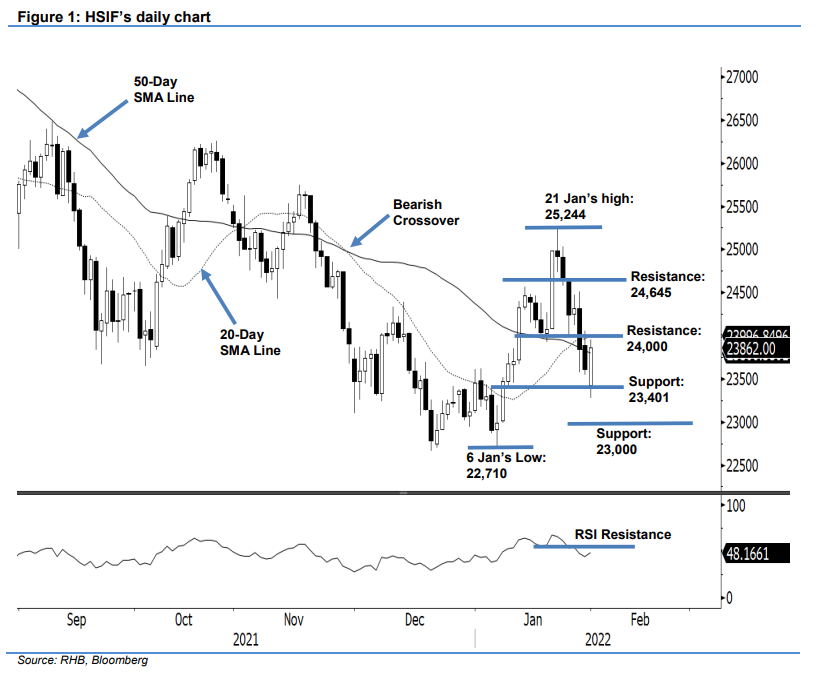

Maintain short positions. The HSIF staged a strong rebound on the eve of the holiday, rising 477 pts to settle the day session at 23,862 pts. The index opened Monday’s session at 23,585 pts. After establishing the day’s low at 23,426 pts, it progressed to touch the 23,958-pt intraday high before closing at 23,862 pts – printing a long bullish candlestick. The latest price action showed that the bears have refrained from selling, as Monday’s session was shortened to half-day, and there was no evening session. The renewed positive momentum also lifted the index above the 50-day SMA line. If it manages to sustain above the medium-term moving average line, the index may continue to climb, and cross above the 20-day SMA line. Until then, we expect selling pressure to pick up again near the 24,000-pt level. For now, we maintain our negative trading bias until the HSIF crosses above the stop-loss level.

Traders are advised to maintain the short positions initiated at 23,840 pts or the closing of 27 Jan day’s session. For trading-risk management, the initial stop-loss is fixed at 24,645 pts.

The immediate support is set at 23,401 pts (10 Jan’s low), followed by the 23,000-pt round number. On the upside, the immediate resistance is seen at the 24,000-pt psychological mark, followed by 24,645 pts (the high of 25 Jan).

Source: RHB Securities Research - 4 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024

.png)