Hang Seng Index Futures: Attempting to Cross the Immediate Resistance

rhboskres

Publish date: Tue, 08 Feb 2022, 04:57 PM

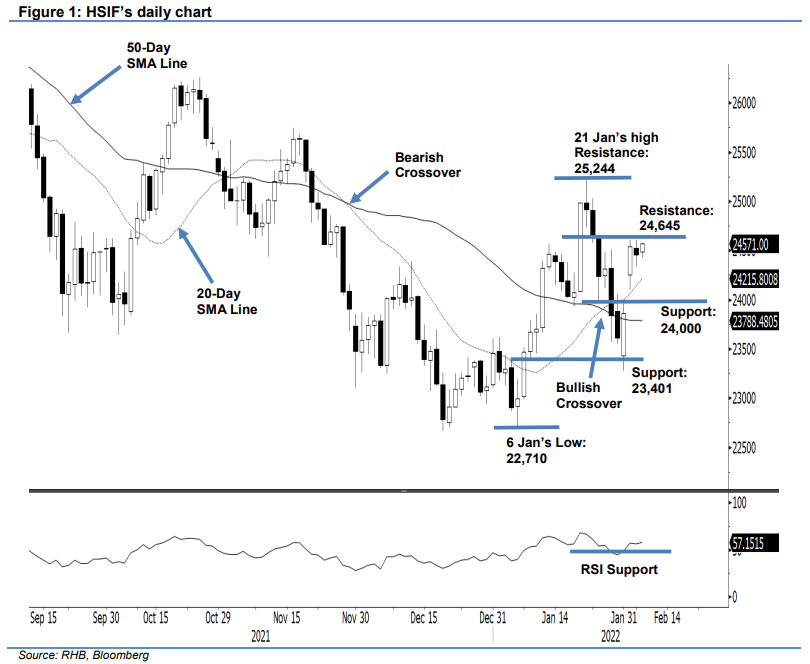

Maintain short positions. The HSIF was hesitant to cross the immediate resistance yesterday, retracing 87 pts to settle the day session at 24,456 pts. It opened at 24,503 pts. At one point, it slipped to the 24,335-pt day low, and then rebounded to the 24,583-pt day high to settle at 24,456 pts. During the evening session, it rose 115 pts and last traded at 24,571 pts. The price action showed that the recent bullish momentum is still in play. If the index manages to cross above the 24,645-pt resistance level, it may climb towards the higher resistance at 25,244 pts. As mentioned in our previous note, we think selling pressure will persist at the immediate resistance. Despite the index marching higher on renewed momentum, we will stick to our negative trading bias until it breaks past the stop-loss level.

Traders are advised to keep the short positions initiated at 23,840 pts or the closing level of 27 Jan day’s session. To mitigate trading risks, the initial stop-loss is fixed at 24,645 pts.

The immediate support is marked at the 24,000-pt round figure, followed by 23,401 pts, or the low of 10 Jan. Meanwhile, the immediate resistance stays at 24,645 pts – 25 Jan’s high – followed by the higher hurdle at 25,244 pts, which is the YTD high.

Source: RHB Securities Research - 8 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024

.png)