E-Mini Dow: Re-Attempting to Return Above the 200-Day SMA Line

rhboskres

Publish date: Thu, 17 Feb 2022, 04:26 PM

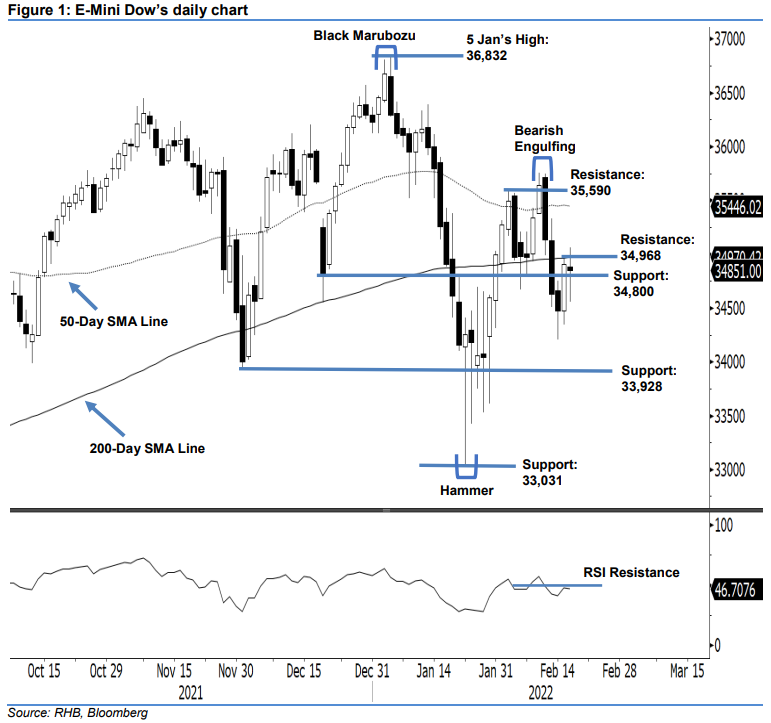

Remain in short positions. The E-Mini Dow attempted to move higher yesterday but failed to sustain, which then saw it falling. It closed 53 pts weaker at 34,851 pts. The index began the session at 34,886 pts and oscillated sideways before jumping upwards early during the European trading session where it hit the day’s high of 35,060 pts. Strong selling pressure then came in to drag the E-Mini Dow towards touching the intraday low of 34,558 pts. Buying momentum then re-appeared to uplift the index towards the close – slightly below the opening. The “doji” neutral candlestick hitting the 200-day SMA line for two consecutive sessions suggests the buying pressure is still building up for an uptrend reversal amid the recent rebound. Nevertheless, it is still premature to assume an uptrend reversal will take place in the medium term until the E-Mini Dow cross above the 200-day SMA line. Therefore, we retain our bearish view until the index breaches above the 200-day average line.

We suggest traders maintain the short positions initiated at the closing level of 11 Feb, ie 34,627 pts. For risk-management purposes, the stop-loss threshold is pegged at 34,968 pts.

The first support is revised to 34,800 pts and followed by 33,928 pts or the low of 1 Dec 2021. Conversely, the resistance levels are revised to 34,968 pts – 15 Feb’s high – and 35,590 pts, which was 2 Feb’s high.

Source: RHB Securities Research - 17 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024

.png)