Heveaboard vs Homeritz

ScrewDriver

Publish date: Thu, 26 Jun 2014, 12:07 PM

First of all this article is created by me to share some of my findings when it comes to comparing and contrasting between Heveaboard and Homeritz, since both company belong to same industry. (Hopefully I'm right)

And to be exact, this is a template for what aspects I am comparing when doing FA.

Therefore I hope everyone can share their view on it, and give some suggestion to improve my FA skills. Thanks =D

I'm starting to practice investment based on fundamentals for my portfolio and I welcome any constructive criticism and comments for me to learn with a faster pace.

And this article itself does not suggest any buy or sell call on aforementioned companies. The author is not liable for any losses or profit (no need to spend me lol) that shall arise from any decision made by readers after reading this article.

The raw data for calculating the ratios and some of the ratios below are obtained directly from bursamarketplace, and I'm using formulas suggested by investopedia.

Financial Health

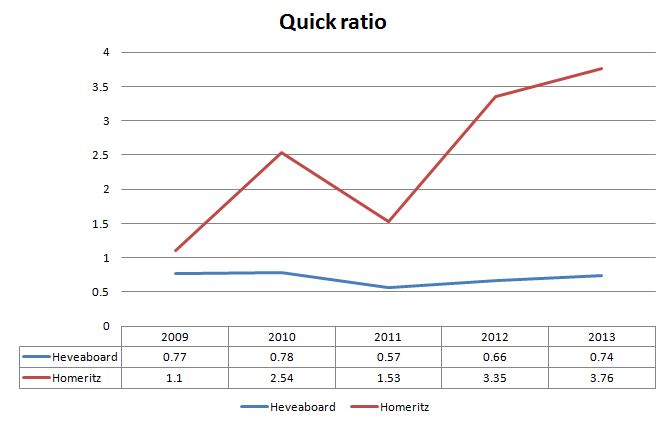

Looks like Homeriz have the higher ability to service it's short term debt.

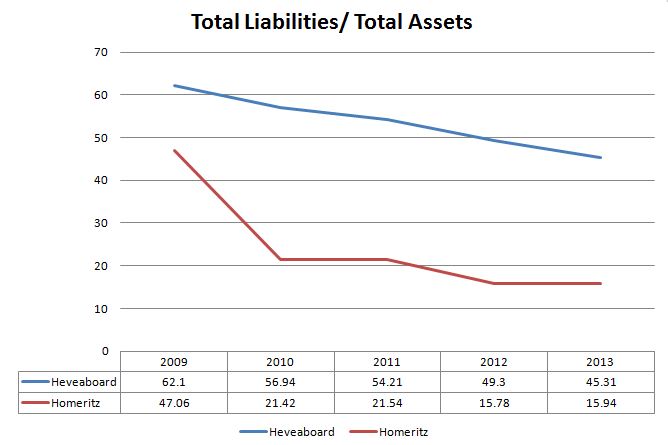

Both companies have their gearing lower down over time. In spite of that, homeritz is having a lower gearing than hevea.

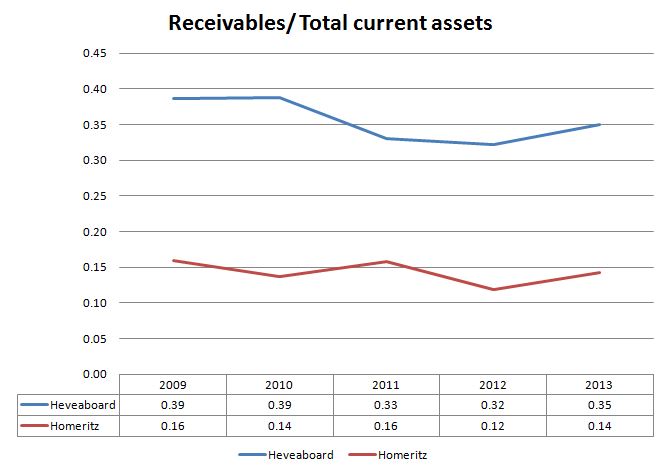

Looking at the graph, we can know that hevea is having greater portion of current assets contributed by receivables, but there shouldn't be much problem for both companies since the figures for the ratio are relatively stable, i.e didn't change much for both of them.

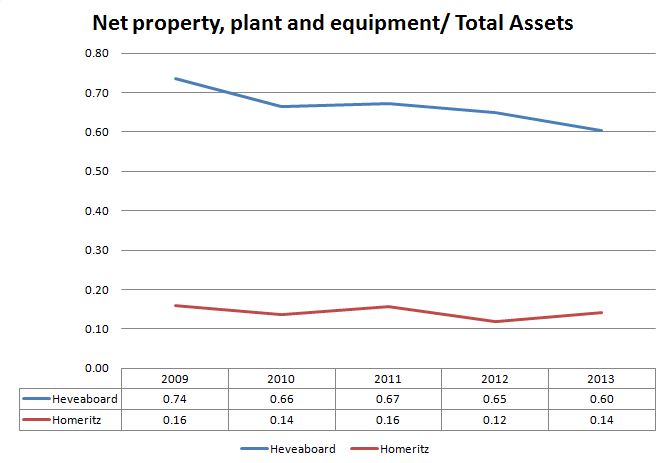

This one I duno what to comment. lol. Heveaboard is having much of its assets allocated on illiquid assets.

Efficiency

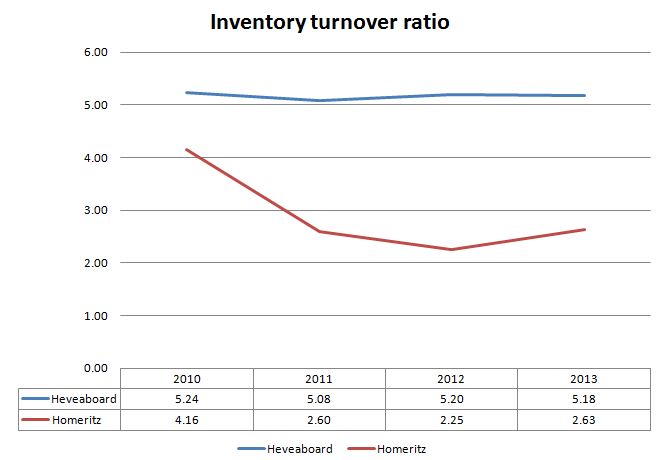

Hevea has a stable inventory turnover while homeriz's inventory turnover rate is not that consistent.

However I have no idea what type of figure would be consider as optimum, too high or too low?

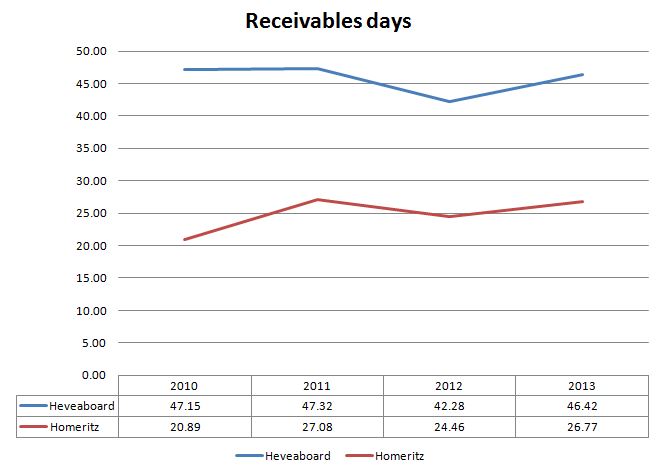

Despite of having higher inventory turnover rate, hevea is taking longer time to collect debts from the debtors.

Profitability

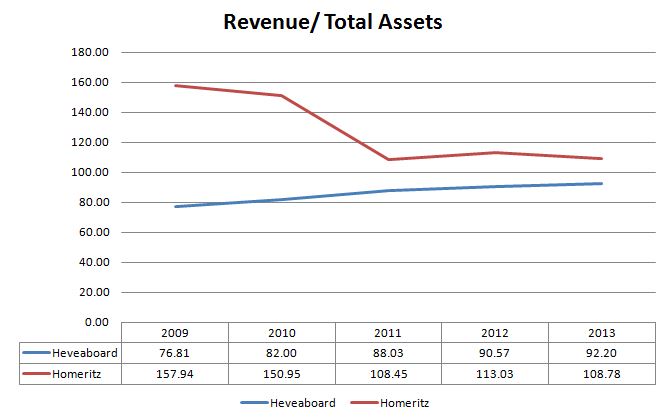

Apparently Homeritz is capable of generating more sales out of every single cents of assets it owns.

Based on the chart above, the markup for Homeritz's product is higher than that of Hevea, and homeritz has higher margin as well. Maybe homeritz got the better economic moat compared to hevea.

However, the gap between gross profit margin and margin is greater for homeritz, indicating that greater portion of gross profit of homeritz is used on the expenses.

As we can see, the graph suggests that ROE (return on equity) and ROCE (return on capital employed or return on invested capital) of homeritz is better than hevea.

However, the ROE and ROIC of homeritz are relatively unstable between 09 and 13, in fact it had decreased between 09 and 11.

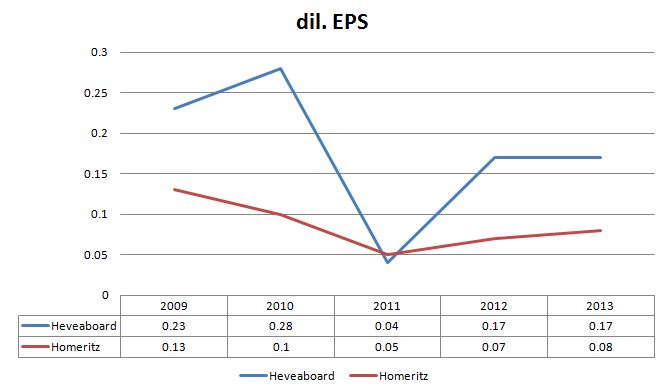

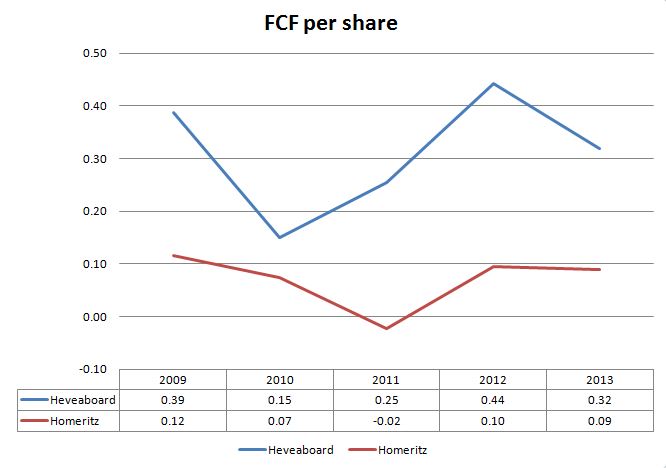

From the FCF per share and dil. EPS, Hevea is generatting more money than homeritz, hence, if their valuation are the same, Hevea should trade at higher price.

Summing up, on the surface, hevea is generating more income to their shareholders, hence it should trade at higher price. However homeritz is more capable in printing money for every cents they have compared to hevea.

Beside that, its doing better financially.

Hence homeritz deserve better valuation compared to hevea.

Wait, what about the fair price for both company?

I'm hoping that someone who are very good at fundamental investing can teach me on how to derive a fair value for both company. As I mentioned above, I'm still a newbie, so I hope that someone is willing to teach me on it.

Thank you very very much in advance for helping me out to learn any models or methods to calculate a fair value for both of them.

Please feel free to leave your valuable comments and correct me if there's anything wrong.

Hope to learn from each other =D

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Hi GenghisHoe, I just comments based on screwdriver's calculation. I was suprised by the 60% ROE.

2014-06-26 17:26

"HOMERITZ ROE and ROCE is 60% and 51% respectively and this is a very high number. Do check why it drop to 42.85 and 31.98 on year 2010 and further drop to 21.85 and 16.46 on year 2013. Do a DuPont analysis to check out where the number come from. And, check out who is the culprit."

Good point! Previously, its ROE was so high as it was highly geared.

screwdriver, first of all you gotta define what kinda businesses that both companies run. Hevea is involved in wood-related furniture products but Homeritz is primarily engaged in upholstered furniture products and mainly in the export market. They're actually different business models, although they're in the same industry/sector. So better don't compare it like this.

As for the manufacturing business, you've to keep an eye on the cash conversion cycle (DIO + DSO - DPO), CAPEX, staff costs, gearing and margins.

Give me your email, I send you a book to learn financial ratios. You must make sure that you gotta finish reading up it and directly apply.

Note: NOSH = Number of shareholding, in case that you do not understand Intelligent Investor's word.

2014-06-26 17:41

Intelligent Investor, I interpreted your message wrongly. Yup 2009's ROE one was damn high due to the component of the leverage (from DuPont analysis).

It's good to use DuPont ROE to find the culprit as you mentioned.

For your information, basically 1st year of listing those ratios are weird if you notice on it.

Anyway, I see you share a lot of your hardwork through i3 if possible, we can exchange knowledge and information to stick with the principles of being a fundamentalist.

2014-06-26 18:12

The ROE I obtained it directly from bursamarketplace, I think they are using average equity in their calculation.

Thanks for highlighting their differences in businesses and the drop of ROE.

Intelligent, in your view, are P/E and P/FCF the most suitable metrics to compare their prices?

Since if one is having better valuation and it has better growth prospect, people may consider to pay more, hence giving them a higher P/E and P/FCF.

This is what had puzzled me all this while.

GenghisHoe, thanks for showing me cash conversion cycle, and other aspects for comparison, does the book u recommends include them? My email is screwdriver168@gmail.com, thank you very very much.

2014-06-26 18:12

Every ratio's formula, you need to keep in mind and do not try to go shortcut because that if you're unable to master the ratios properly then you will interpret wrongly as the ratios could be manipulated easily. If you directly plug from those websites provided, then how can you 'feel' the overall company's operations?

I've emailed to you, please check it out.

2014-06-26 18:26

Hi screwdriver,

If you want to perform valuation from the future, give DCF a try - http://intelligentinvestor8.blogspot.com/2014/06/discounted-cash-flow-dcf-analysis-excel.html

2014-06-26 18:39

GenghisHoe, would you mind to send me the book to my email as well?

My email is seng0111@gmail.com, appreciate it. Thanks =)

2014-06-26 19:01

Hi GenghisHoe, would you mind send to me too?

Email: sharestock888@gmail.com

2014-07-02 02:43

Hi GengHisHoe, would you mind to send to me as well?

Email: deslim91@hotmail.com

Thanks!!

2014-07-03 23:19

Hi GenghisHoe, would you mind send to me too?

Email: chengleong88@hotmail.com

2014-09-11 20:37

hi GengHisHoe, i'm appreciate if you could offer me the chance to learn the skills by sending me the book as well. Thank you.

email: cjiejack@gmail.com

2014-09-27 17:46

hi GengHisHoe, i'm appreciate if you could sending me the book as well. Thank you.

email: csteor@gmail.com

2014-10-01 10:33

Hi GenghisHoe, appreciate if you can send me (yklip@hotmail.com) the book regarding financial ratios. Thanks!

2014-10-13 21:34

Hi GenghisHoe, appreciate if you can send me, jobliew@gmail.com the book regarding financial ratios. Thanks!

2014-10-28 12:19

Hi GenghisHoe, appreciate if you can send me, clloh85@gmail.com the book regarding financial ratios. Thanks!

2014-12-26 22:58

H Versus H Furniture?

Just Buy Both Lah!

H Stands for high or higher

So Higher Versus Higher?

2014-12-26 23:04

Intelligent Investor

HOMERITZ ROE and ROCE is 60% and 51% respectively and this is a very high number. Do check why it drop to 42.85 and 31.98 on year 2010 and further drop to 21.85 and 16.46 on year 2013. Do a DuPont analysis to check out where the number come from. And, check out who is the culprit.

For EPS and FCF per share, I think there is no point to compare both of them as they have different NOSH. I prefer to compare Net Profit or FCF as a whole, or alternately we can compare P/E or P/FCF to check which company is a cheaper buy. In my view, I prefer the EV\EBIT instead.

You can refer to my writeup on http://intelligentinvestor8.blogspot.com/2014/06/financial-statement-analysts-template.html

2014-06-26 15:36