Trading With A View

Tradeview - 2016 Value Stock No. 5 (Perusahaan Sadur Timah Malaysia (PERSTIMA) Berhad)

tradeview

Publish date: Tue, 19 Jan 2016, 05:21 PM

Dear fellow readers,

I have shared 4 value companies namely : 1.Magni 2.UPA 3.Apollo 4. FFHB

Once again, these writings are just my humble highlights (not recommendation), feel free to have some intellectual discourse on this. To join my telegram channel : https://telegram.me/tradeview101

____________________________________________________________________

Value Stock No. 4: Perusahaan Sadur Timah Malaysia (PERSTIMA) Berhad

With volatility in the market, I would suggest a more defensive pick and Perstima fits the bill. At current price, it is only trading at 10-11x trailing P/E while offering yields in excess of 6%. Given the above average dividend return, I think share price will be well supported. Further, Perstima has a strong balance sheet with a net cash position (RM0.96/share vs. current price of RM5.54). Considering this, the stock is priced at a mere 8-9x trailing P/E (ex-net cash).

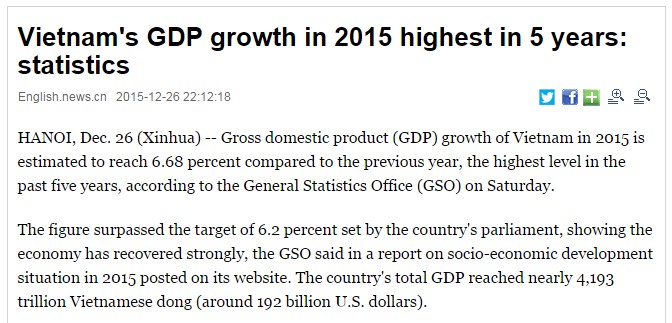

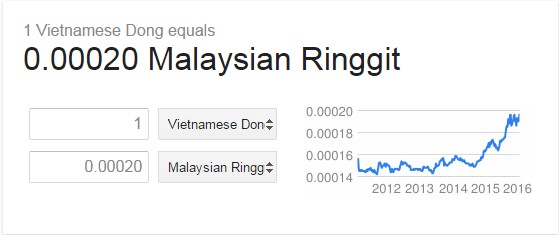

What really excites me it is business prospects. Perstima has a monopolistic position in Malaysia with around 50-60% market share, granting it pricing power and the ability to maintain profit margins. For growth, it has exposure in Vietnam where the economy is still growing robustly. Further, Vietnamese Dong has strengthened against Ringgit over the past one year and this bodes well for Perstima. Another plus point is that its tinplates are used for the packaging of food, beverage and sanity cans, which are generally resilient in nature (non-discretionary consumer products).

What really excites me it is business prospects. Perstima has a monopolistic position in Malaysia with around 50-60% market share, granting it pricing power and the ability to maintain profit margins. For growth, it has exposure in Vietnam where the economy is still growing robustly. Further, Vietnamese Dong has strengthened against Ringgit over the past one year and this bodes well for Perstima. Another plus point is that its tinplates are used for the packaging of food, beverage and sanity cans, which are generally resilient in nature (non-discretionary consumer products).

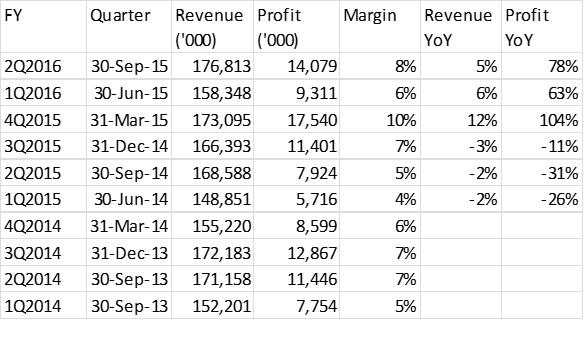

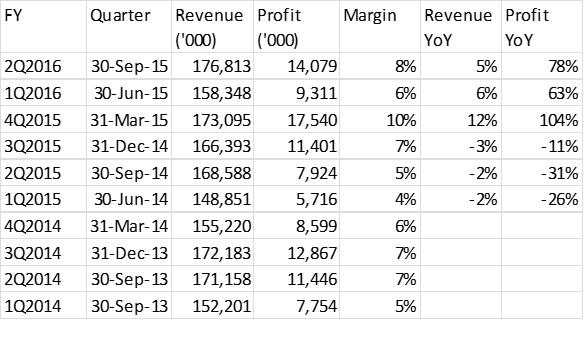

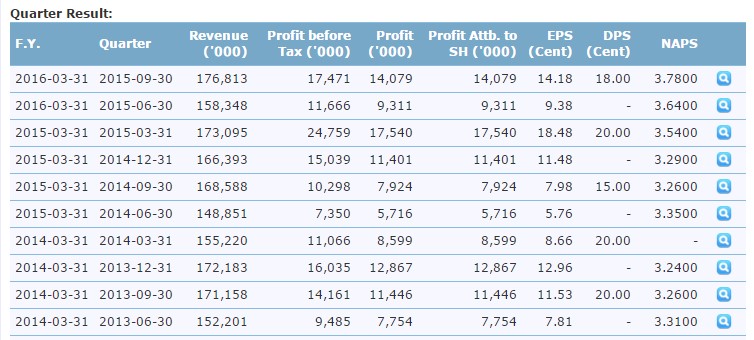

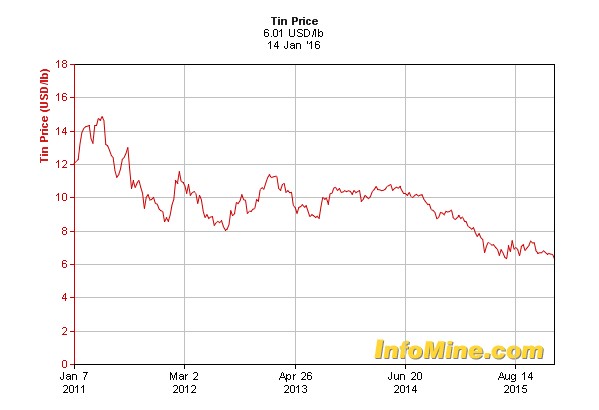

Delving deeper into the financials, for the past 3 consecutive quarters, I observed that revenue and profit accelerated despite low tin prices. This was thanks to volume increase and forex tailwind. In turn, margins were lifted as well. I believe Perstima will continue to perform well in the upcoming quarters. To further back up my investment thesis, Perstima has raised its interim dividend to 18sen from 15sen recently, implying optimistic business prospects.

At RM9.00 (60% upside), Perstima would reflect 16-17x trailing P/E and 14-15x on an ex-net cash P/E basis. On the other hand, dividend yield is still attractive at 4% at RM9.00 (assuming 38sen DPS - already paid out 18sen and typically the 2nd interim dividend is 20sen). I don’t think this back-of-the-envelope valuation is steep since this is a growth stock. Further, as EPS grow, the P/E would narrow while dividend payout would increase and hence, provide higher yields. FYI, Perstima’s payout ratio is between 60-70% (so much more room to dish out dividends) and yet the yield is superior compared to many listed companies on Bursa. However, as Perstima traditionally have been undervalued despite its monopolistic position, conservative individulas can provide a 15% discount for a conservative FV of RM 7.65.

To join my telegram channel : https://telegram.me/tradeview101

Email me at : tradeview101@gmail.com

Food for thought:

Sacrifice is risking everything without guarantee.

May good fortune come your way!

Disclaimer: This is not a recommendation to trade. It is merely the expression of the author's personal opinion and shall not be held responsible for potential gains or losses executed by readers.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Trading With A View

NST Business x Tradeview No.3 - Adam Yeap, Owner of 212 Hospitality and co-founder of Wonderbrew

Created by tradeview | Oct 18, 2021

NST Business x Tradeview No.2 - Muzahid Shah, CEO of SteerQuest Sdn. Bhd.

Created by tradeview | Sep 28, 2021

News Straits Times Business x Tradeview - Sharing Stories of Retail Investors & the Stock Market

Created by tradeview | Sep 15, 2021

Tradeview (2021) - Peterlabs Holdings Berhad Long Term Value Stock (Update)

Created by tradeview | Jun 01, 2021

Tradeview Commentaries - The Glove Surge, A Mirage or A Path To Oasis?

Created by tradeview | Apr 08, 2021

(Tradeview 2021) - Are Research Analysts' Reports Worth Their Salt?

Created by tradeview | Mar 17, 2021

Discussions

2 people like this. Showing 5 of 5 comments

wow already moving upwards quietly even thought weak market! I havent collect yet

2016-01-20 10:43

DLGF

indeed, putting aside the export's play with Vietnam, very convincing figures seeing the net cash ... will load up tomorrow perhaps.

2016-01-19 21:01