Trading With A View

(Tradeview Commentaries) - Looking Ahead to A Volatile October Election Month

tradeview

Publish date: Wed, 30 Sep 2020, 10:54 PM

__________________________________________________________

Today's Q3 window dressing ended with a whimper. It appears that there is not much push upwards and plenty of profit taking especially in the glove sectors. It is my view the closing is directionless and may be a signal for the October market direction - either sideways or downward bias. I would like to be wrong. From the macro perspective there is an overwhelming pressure to stay sidelines or hold cash, but from a valuation or bottom picking view point, the market currently gives many opportunities.

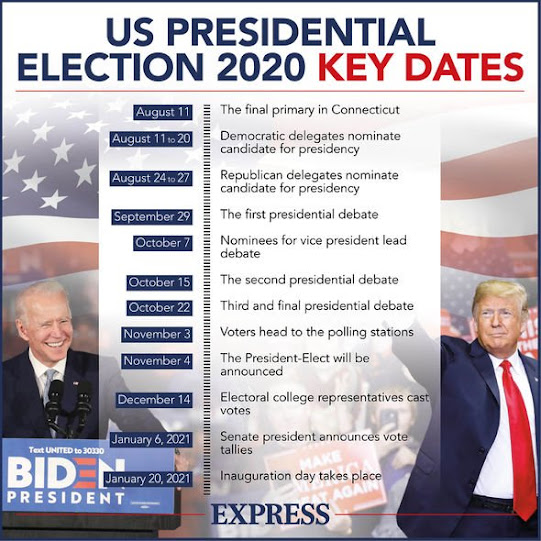

Of course many would like to wait and see the outcome of US election, impact from end of moratorium, Covid-19 vaccine approval prior election, and Covid-19 situation. In Malaysia itself the cases are on the rise. I believe most who were bullish about vaccines are now questioning the timeline and potential efficacy. This would mean Glove sector has longevity in terms of the investment horizon. At Tradeview, we are still very confident with the Glove stocks especially after tonight's news confirmation indicated to us the earlier sell off of the glove sectors was likely due to a particular Local Funds need for income recognition to declare dividend for their unit holders.

In terms of price movement, I think this recent retracement is healthy if it can stay above these levels to form a support for higher price rise. Do remember, those who can sit tight are usually the one most rewarded.

As we enter US final campaign period, the volatility heightened as expected. Domestically, the political risk subsided following Sabah election.

How should we move forward?

Maintain healthy cash position and don't be too concerned with gyrations. If you are holding a fundamental value stocks with good earnings prospect, all is well. But if you are still holding penny stocks based solely on rumours and news with unproven earnings visibility, it may be a good time to be afraid.

_______________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : https://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

More articles on Trading With A View

NST Business x Tradeview No.3 - Adam Yeap, Owner of 212 Hospitality and co-founder of Wonderbrew

Created by tradeview | Oct 18, 2021

NST Business x Tradeview No.2 - Muzahid Shah, CEO of SteerQuest Sdn. Bhd.

Created by tradeview | Sep 28, 2021

News Straits Times Business x Tradeview - Sharing Stories of Retail Investors & the Stock Market

Created by tradeview | Sep 15, 2021

Tradeview (2021) - Peterlabs Holdings Berhad Long Term Value Stock (Update)

Created by tradeview | Jun 01, 2021

Tradeview Commentaries - The Glove Surge, A Mirage or A Path To Oasis?

Created by tradeview | Apr 08, 2021

(Tradeview 2021) - Are Research Analysts' Reports Worth Their Salt?

Created by tradeview | Mar 17, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments