Smart Robie

Despite the news

smartrobie

Publish date: Tue, 10 Mar 2020, 02:02 PM

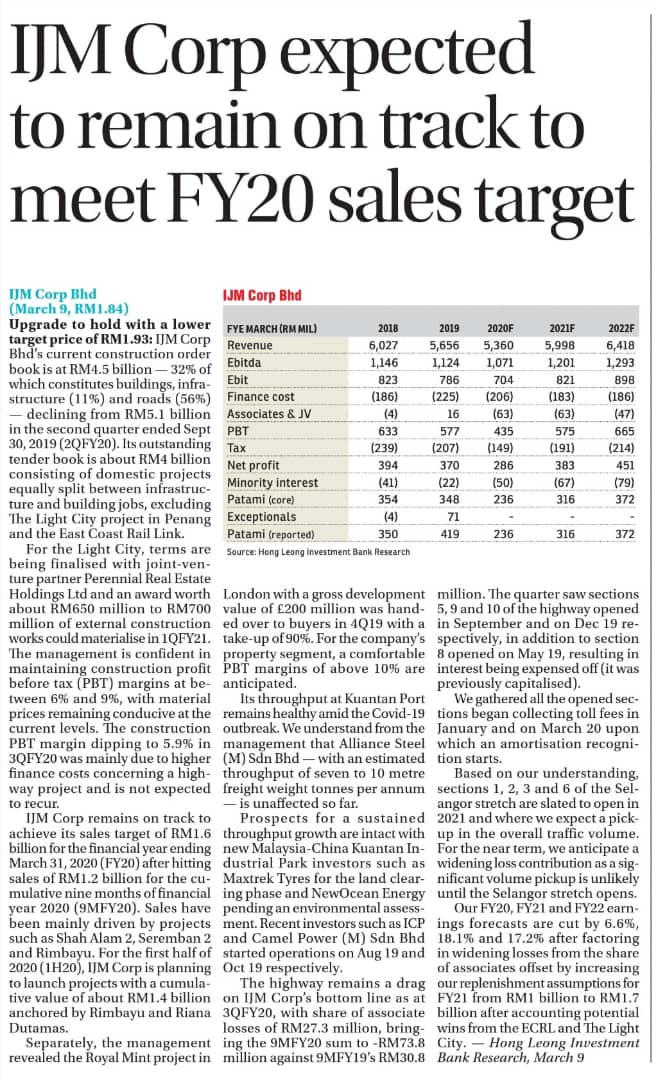

Despite the news "Back on track....for IJM". IJM is still priced as overpriced with 2/8* Robie rating.

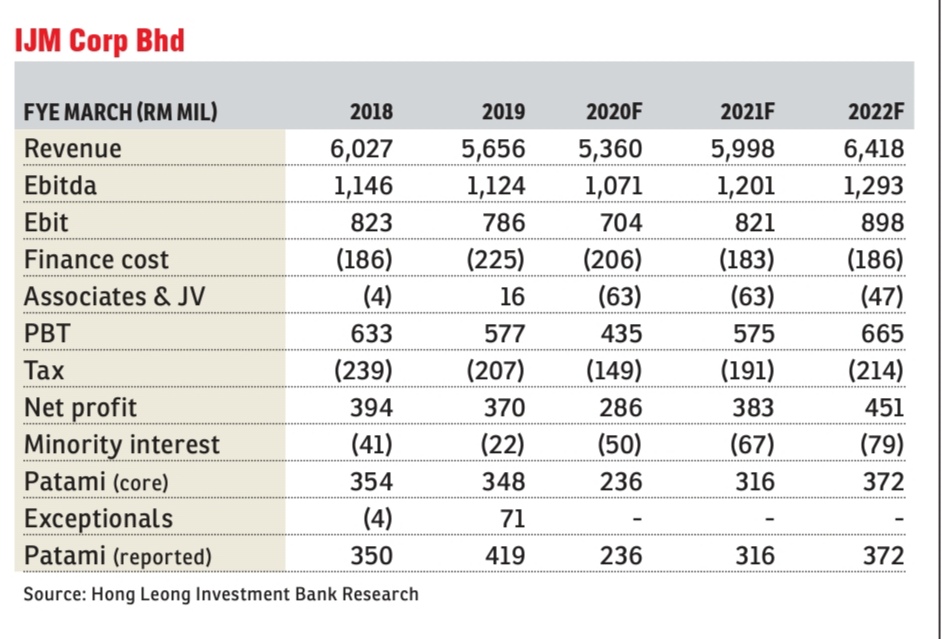

Fundamental for IJM[s] (3336). [Macq]

FA Ratings : 2/8*

PE = 15.94

ROE = 4.37 %

DIY = 2.17 % **

Mkt Cap: 6,696.3M (RM) in Large Cap, Construction, Main Market.

Note: [s] = Syariah, ** = Good.

@ Trading at Overpriced (relative).

Intrinsic Valuation Desk

Intrinsic Value @ 10% disc rate = RM 0.50, IV @ 3.6% = RM 3.89, IV @ 7.5% = RM 0.90, IV @ 12% = RM 0.35,

Share is *OverValued *, Safety Margin @ 10% disc rate = -73 % (Sell !).

(Recommend Safety Margin > +40% or higher for undervalued share if negative safety margin, overvalued share.)

Watch tutorial http://bit.ly/2mpnLGx

For FA Ratings (Best=8*), recommend to invest at 3* & above.

SMART Robie, Stock Market Assistant ChatBot

1. Register your Free Access to Robie: https://tradevsa.com/robie/signup

2. Also Watch Install-Robie video

https://youtu.be/c432d75vwZ4

https://youtu.be/c432d75vwZ4

3. Get Telegram Messaging App to talk to Robie. Get from Google Play store or Apple PlayStore.

4. Whatsapp +6010-266-9761 if you need further assistant.

5. Visit fb.com/SmartRobie or tradevsa.com

More articles on Smart Robie

Waseong, a trade for oil and gas play now as crude oil prices recovering...

Created by smartrobie | May 19, 2020

Covid-19 related venture for Scicom will push it's prices higher

Created by smartrobie | May 19, 2020

Pullback opportunity now for MI Innovation now. Plan carefully, use Robie Trading Plan

Created by smartrobie | May 19, 2020

Duopharma still remained to be lowly rated by Robie at 1/8* ...

Created by smartrobie | May 19, 2020

Gpacket, like it or avoid it, it's in the limelight for post MCO despite negative profit.

Created by smartrobie | May 18, 2020

Discussions

Be the first to like this. Showing 0 of 0 comments