Is Solar District Cooling Group Berhad (SDCG) a Worthwhile IPO?

thesolarguy

Publish date: Sun, 01 Sep 2024, 05:40 PM

The year 2024 has proven to be full of surprises in the capital markets, with events ranging from the unexpected surge of the Yen disrupting Yen Carry Trade deals to the anticipation surrounding the upcoming U.S. elections and rate cut.

In such a volatile environment, investors are presented with a variety of IPOs on Bursa Malaysia, leaving many unsure where to place their bets.

One IPO that has caught our attention is that of Solar District Cooling Group Berhad (SDCG). With its unique business model and growth prospects, SDCG is certainly a company that investors should consider.

Understanding SDCG’s Core Business

SDCG operates in two primary business areas: Building Management System (BMS) and Solar Thermal Systems (STS), along with other energy-saving services.

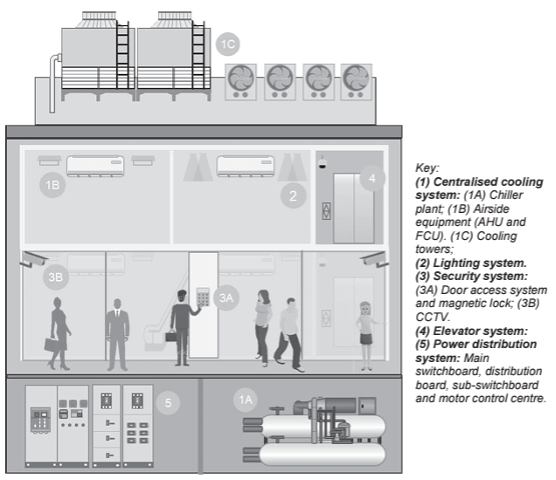

In the realm of BMS, think of an office building with various components like centralised cooling systems, lighting, security, elevators, and power distribution systems.

Each piece of equipment is different, with its own operational language. SDCG’s expertise lies in “retrofitting” these systems to enable them to communicate seamlessly, thereby automating building functions such as shutting down lights and Air Handling Units (AHU) when they are not in use. This process not only optimises energy consumption but also simplifies data collection.

SDCG’s business is divided into two segments: project-based systems integration (installation) and the more consistent revenue stream from contractual maintenance of installed BMS. While the concept might seem straightforward, the complexity of integrating various systems for automation and energy efficiency cannot be understated.

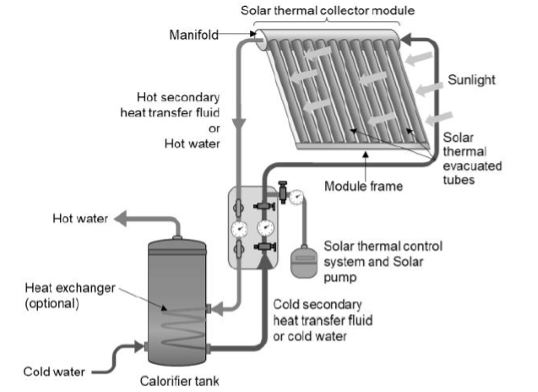

The STS division of SDCG focuses on installing hybrid solar thermal hot water systems, integrating them with existing boilers, retrofitting fluorescent lighting with LEDs, and providing ongoing maintenance services. These initiatives further SDCG’s commitment to sustainability and energy efficiency.

Key Projects and Financial Performance

SDCG has secured several energy performance service contracts with public hospitals under the Ministry of Health (MOH). For every litre of Liquified Petroleum Gas (LPG) saved, SDCG receives a portion of the savings, making these contracts both sustainable and recurring revenue streams.

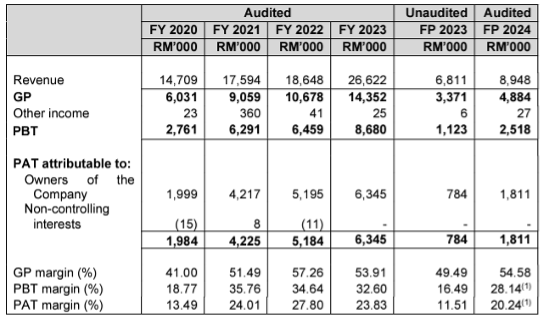

In FY2023, SDCG reported a revenue of RM26.6 million, with RM19.7 million derived from non-recurring projects and RM6.9 million from recurring sources. This robust financial performance reflects the company’s ability to secure more orders while steadily building its recurring revenue base.

Notably, SDCG achieved a Profit After Tax (PAT) margin of 23.83% in FY2023, and 20.24% in the five-month period of FY2024. This strong profitability is indicative of SDCG’s successful business model and its potential for continued growth.

Strategic Expansion and IPO Prospects

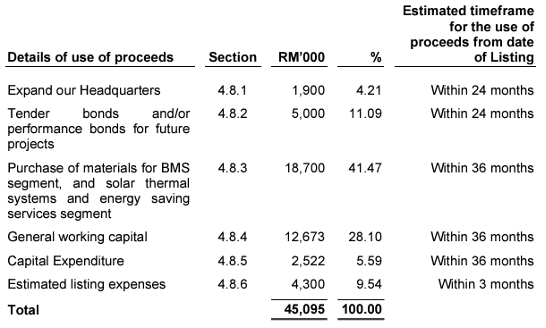

SDCG has historically been conservative, particularly in bidding for contracts that require collateral. However, with the IPO proceeds, the company plans to expand its business aggressively. A significant portion of the funds will be allocated to business expansion and working capital, with no “Offer for Sale,” indicating that the owners are not cashing out but are instead reinvesting in the company’s future growth.

One notable use of the IPO proceeds will be for tender bonds, enabling SDCG to bid more aggressively on projects, which could translate into stronger growth moving forward.

Investors interested in SDCG should note that the IPO is open until 6th September 2024, with shares priced at 38.0 sen, based on a PE valuation of 25.38 times.

Conclusion

While some investors may compare SDCG to KJTS Group Berhad, which is a potential client of SDCG, the nature of SDCG’s business is more closely aligned with SMRT Holdings Berhad, which specialises in retrofitting for Tenaga Nasional Berhad (TNB), whereas SDCG focuses on MOH’s hospitals.

Given its strong financial performance, strategic expansion plans, and the sustainable nature of its business model, SDCG’s IPO is certainly worth considering for investors looking to tap into the growing energy efficiency sector.

.png)