The Making of the Next ULTRA HIGH ROI Technology Company – Part 1

beeniebags

Publish date: Wed, 02 Mar 2022, 12:58 AM

The recent tech selloff had indeed, shaved premium of many tech companies who had already priced in onto their growth for the next couple of years.

However, this does not mean the tech selloff had ended, and investors must proceed with care when selecting prospective company to invest in.

And I would like to just share with you this company that I had identified 2 weeks ago.

Speaking of G3 GLOBAL BERHAD, many investors would associate the company alongside with the famous-infamous entrepreneur/investor – Puan Chan Cheong or better known as CC Puan.

There are endless stories associated with the said individual, but that will not be our case of study here.

G3, the Internet of Things (IoT) provider had once piqued investors hope when GREEN PACKET BERHAD and CC Puan emerges as the major shareholder of the company back in 2018.

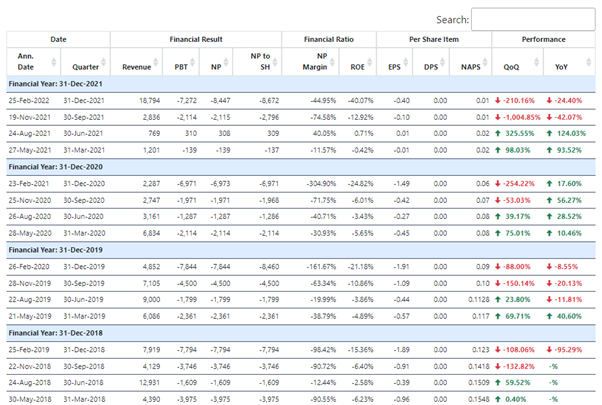

However, the numbers don’t really justify the so-called “turnaround plan” upon the emergence of the said personnel onto the company.

But what’s done is done.

In our part 1 discussion of G3 GLOBAL, I wanted to highlight that in December 2021, a huge chunk of the shares was disposed by the said personnel, and this had resulted in a temporary hike in share price for the company.

Seeing how GREEN PACKET share price performed, I think investors knows best the departure of the said personnel is for the best of the company.

And at the same period of time, an emergence of new major shareholder – Dato’ Sri Aminul Islam Bin Abdul Nor had a strong debut with up to 25% of stakes in G3.

For your information, Dato’ Sri Aminul Islam Bin Abdul Nor is the founder and chairman for BESTINET SDN BHD, an information technology company with solutions which include FWCMS, bio-medical system, MIGRAMS, BESTID, TAHSS and so forth. I will leave the details of the solutions mentioned above for our part 2 article.

What’s more important is, BESTINET had generated USD23 – 24 million in revenue for the latest financial year publicly available, which is in turn equivalent to RM97 million in revenue.

Based on our ground checking, BESTINET had a similar, or close to the same business model with the soon-to-be RTO’d S5 HOLDINGS, and in 2017, BESTINET had an astounding profit after tax margin of 60%.

Now, if you really give it a serious thought, the company, G3 had gone down significantly, and this had lowered your entry costs and risk level.

The exit of GREEN PACKET and CC Puan indeed gave G3 a fresh start, especially when they had completed most, if not all kitchen sinking exercise in their 2 latest financial quarters.

Assuming if, BESTINET were to inject 20% of the revenue and profit into G3, which by accounting standard only profit will be recognized, the PAT of G3 shall be circa. RM11.64 million based on latest available revenue data, and excluding any potential growth and following the 60% PAT margin back in 2017.

We can also do a backwards calculation at this should result in 0.5378 EPS and this should result in a PER of less than 15 times.

So far, we have no clear peer comparison as the valuation work for S5 had not been completed, and players such as DATASONIC GROUP BERHAD and IRIS CORPORATION BERHAD are generally loss making in nature. But by taking CENSOF HOLDINGS BERHAD and RAMSSOL GROUP BERHAD’s approximately 20 times PER, shouldn’t G3 worth much more than the current price level, given that the potential earnings of BESTINET is so high?

What about the loss-to-profit turnaround premium by the market?

In our part 2 article, we shall explain in deeper depth on the true value of G3, added value of BESTINET HEALTH, as well as the other biggest underlying problem with G3.

Stay tuned.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Not Venture Capitalist

Created by beeniebags | Mar 08, 2022

Discussions

Everyone having different perspective, if you think is SKL, you can skip

2022-03-02 13:59

Can see it thru your comment . Anyhow the past is behind, learn to let go.

2022-03-03 10:25

ccpuan track record is too bad. pls check his past performance. stay away people

2022-03-03 19:12

The exit of GREEN PACKET and CC Puan indeed gave G3 a fresh start, especially when they had completed most, if not all kitchen sinking exercise in their 2 latest financial quarters.

2022-03-04 12:48

these kind of holland stock can say as empty shell company. their business are all "ideas / potential business venture" in the end will stop half way change new project. all money injected = hilang, sapu by operator. then will ask for more money for new project through PP / RI. if you scared of missing out you invest but dont expect any returns anytime soon

2022-03-04 14:43

price movement base of pure speculation aka GORENG / PUMP&DUMP you lucky you ride the wave, you no lucky you lose kao kao.

2022-03-04 14:45

waiting for part 2, just for fun, ha ha, anyway, hoot9e996, good comment.

2022-03-07 16:05

GPACKET ?? Digital Banks announcement anytime... watch closely..

----------------------

macamyesman

The exit of GREEN PACKET and CC Puan indeed gave G3 a fresh start, especially when they had completed most, if not all kitchen sinking exercise in their 2 latest financial quarters.

3 days ago

2022-03-08 09:37

.png)

techinvestormy

Interesting sharing

2022-03-02 10:53