FAQ - AmEquities

TOPICS

What is FIS?

This FIS account is a special service that allows you to trade 12 different markets in a single account - allowing you to access 12 foreign markets without having any foreign bank account and residential proof in that country.

How do I activate my FIS account?

Step 1:

Search for the 2 FIS activation emails in

your inbox, titled as below:

- First Password - AmeSecurities Foreign

Investing Services (FIS) Online Trading

- Second Password - AmEquities Foreign

Investing Services (FIS) Online Trading

Step 2:

Get your Activation ID and first password

by opening the document attached in the “First Password” email by using the

combination below:

The last 4 digits of your NRIC or passport

no. (e.g. 641110-10-1028)

The first 3 letters of your name as per

NRIC or passport in capital letter. (e.g. MOHAMAD ABU BIN ALI)

From the above sample, the password

combination to open the attachment is: 1028MOH

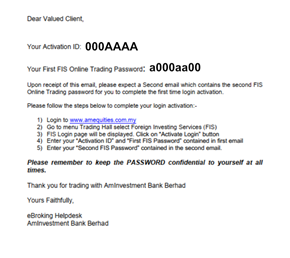

The attachment should look like the image below:

From the above example, your Activation ID

is 000AAAA, First password is a000aa00

Step 3:

Get your second password by opening the

document attached in the “Second Password” email by using the combination

below:

1. The first 3 characters of your AmEquities

login ID e.g. holiday123 (in CAPITAL Letter)

2. The last 3 digits of your AmInvestment CDS

number e.g. 086-001-034567889

From the above sample, the password combination to open the attachment is: HOL889

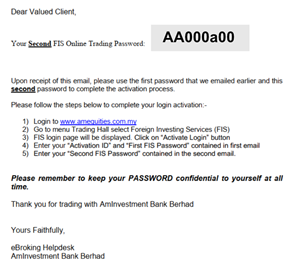

The attachment should look like the image below:

From the above example, your Second

password is AA000a00

Step 4:

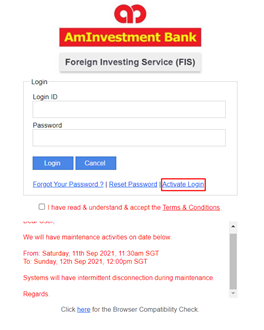

Activate your account by going to this

link: https://www2.cqtraderonline.com/AmInvestment

Click on Activate Login

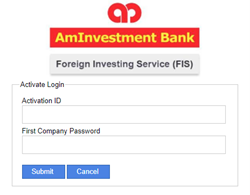

Then, fill in your Activation ID and First

Password > click submit

**From our example, the activation ID is 000AAAA,

First password is a000aa00

Next, fill in your Second Password >

click Submit

**From our example, the Second password is AA000a00

When will I receive the FIS activation email?

I have not received my FIS activation email. When will I receive it?

Normally, FIS activation email will be sent within 1 week after your trading account is opened. You may want to check your junk/spam mailbox as well.

Where can I log in to view my FIS account?

You can use this link to access your FIS

account directly: https://www2.cqtraderonline.com/AmInvestment

Can I access my FIS account using AmEquities Mobile App?

Currently, you will need to access your FIS account using a computer browser.

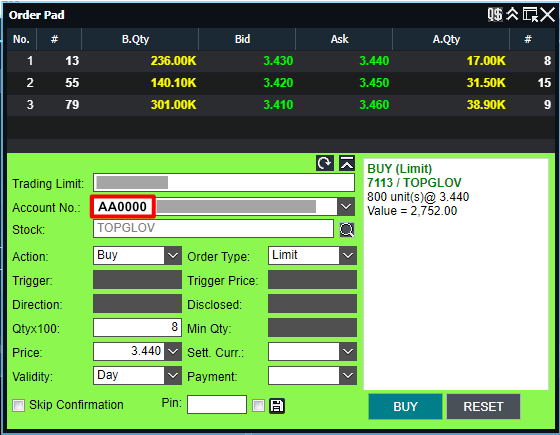

How can I trade in my FIS account?

For trading in the US and Singapore, you

can trade directly through your FIS account online.

For trading in other countries (e.g. HK, UK, Japan, etc), you can send your request to the dedicated MQ Support group we have for you on Whatsapp using the information below:

Country:

Types: [Buy/Sell]

Counter: [name & code]

Quantity:

Price: [in the currency traded]

Is the trading data in the FIS platform live?

Currently, the price in the FIS platform is

live with a 15 mins delay for counters in Singapore and the U.S.

You can subscribe to live quotes for Singapore exchange with a subscription fee of SGD3 per month. Please send us your subscription request to the dedicated MQ Support group we have for you on Whatsapp.

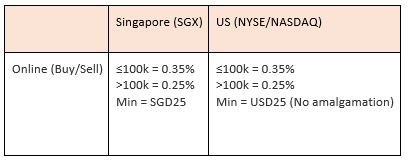

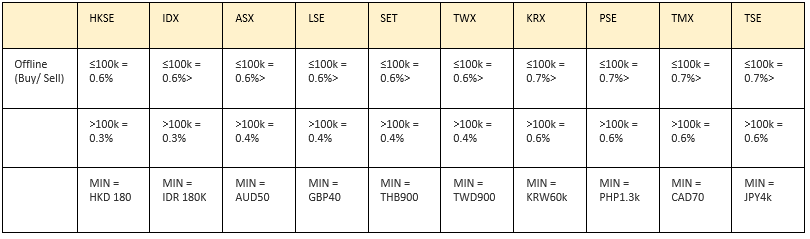

What are the charges for trading in foreign counters?

Below are the charges for different

exchanges.

Online Trading (Singapore & US)

Offline Trading

**Note

1. Min Brokerage is in traded currency or

settlement currency (due to currency restriction) and shall be converted to RM

equivalent based on the applicable FX rates.

2. Brokerage rates and regulatory charges

are subject to change.

Are there other charges for trading in foreign counters?

You can check charges for specific foreign

exchange that you are interested in trading by sending your inquiries to the

dedicated MQ Support group we have for you on Whatsapp.

What happens when I sell my foreign counter?

You can choose to retain your sales

proceeds in the currency you sold.

You can send your preference to MQ Trader support team members in the dedicated MQ Support group we have for you on Whatsapp.

What is the difference if I choose to retain or not to retain in the currency I sold?

Below are differences explained:

If you choose to retain the currency you sold, your sales proceeds will be retained in the currency you sold.

For example, if you sold your shares in the

U.S. exchange with a total value of USD 10,000.00, the funds will be kept as

USD 10,000.00.

**Disclaimer: the above example did not include brokerage and other transaction charges.

If you choose NOT to retain the currency you sold, your sales proceeds will be converted to MYR when the funds are credited into your account.

For example, if you sold your shares in the

U.S. exchange with a total value of USD 10,000.00, the funds will be converted

to the default SGD currency (around SGD 7,400.00, using a rate of USD 1.00 =

SGD 1.350), then to MYR (around RM 2,350.00, using a rate of SGD 1.00 = MYR 3.137).

**Disclaimer: the above example did not include brokerage and other transaction charges.

**Note: the currency that you can choose to

retain includes:

SGD, HKD, USD, IDR, AUD, GBP, CAD, and JPY.

You can find AmEquities exchange rates through this link: https://www.ambank.com.my/eng/rates-fees-charges

Can the currency retained from sales proceeds be used to buy counters of other currency?

When sales proceeds are retained in a

currency, it can only be used to purchase the stock of the same exchange.

For example, if you have retained your sales proceeds in USD, you can only use the funds to purchase stocks in the U.S. exchange. If you have retained sales proceeds in HKD, you can only use the funds to purchase in the HK exchange.

If you would like to use the sales proceeds to purchase in the stock exchange other than your retained currency, you can perform funds withdrawal from your foreign currency account to your Malaysia trust account. After the funds have been transferred to your Malaysia account, you can then purchase stocks from any foreign exchange as usual.

How can I withdraw cash retained in foreign currency?

You can send your withdrawal request to MQ

Trader support team members in the dedicated MQ Support group we have for you

on Whatsapp. Please note that there will be a small number of processing fees

to withdraw from your foreign currency account.

You may check with the dedicated MQ Support group we have for you on Whatsapp on the charges of the specific currency you want to withdraw.

What is trading limit allocation?

You can split your deposit into 2 allocations,

or full allocations to either Bursa / Foreign market.

For example, you can choose to allocate 70%

for Local (Bursa market), 30% for Foreign market, or allocate 100% for Local

(Bursa) and vice versa.

The trading limit allocation works for both deposit and money in your trust. Should you wish to set special instructions for your deposit individually, you can always send us your request in the dedicated MQ Support group we have for you on Whatsapp, and we will update the ops team to allocate your trading limit as per your request.

How can I activate my account?

Where can I find my client code?

There is no response when I click on the login button on the activation page.

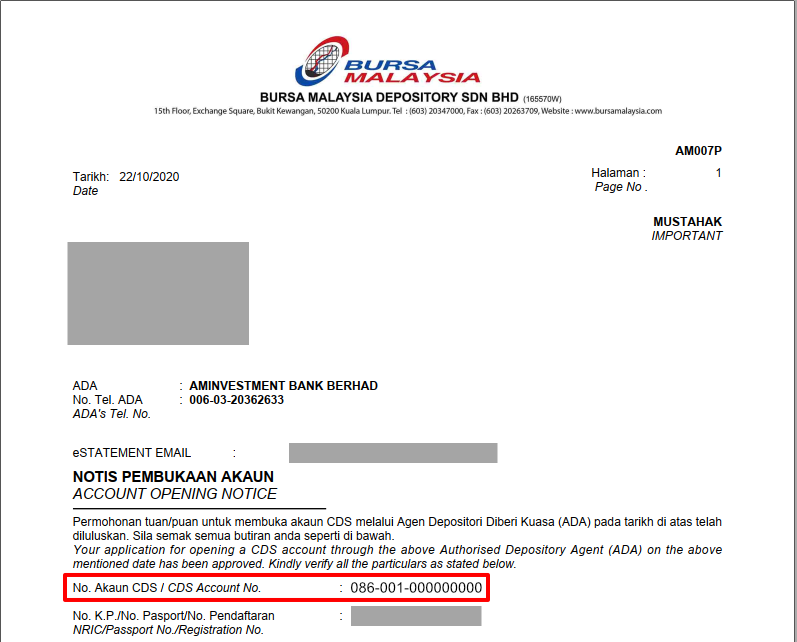

Where can I find my CDS number?

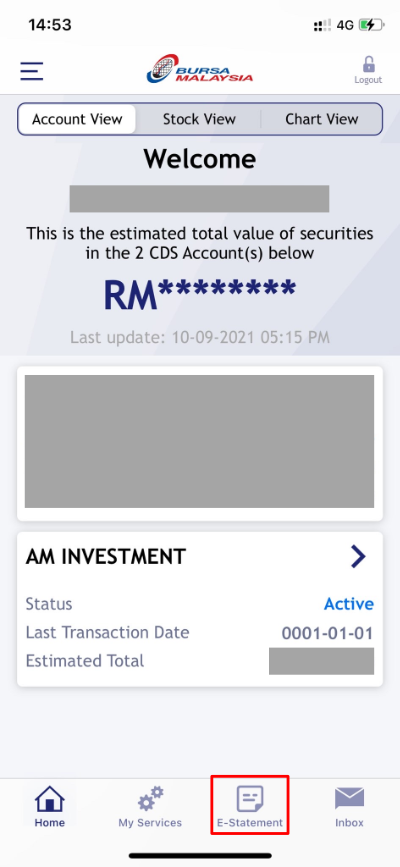

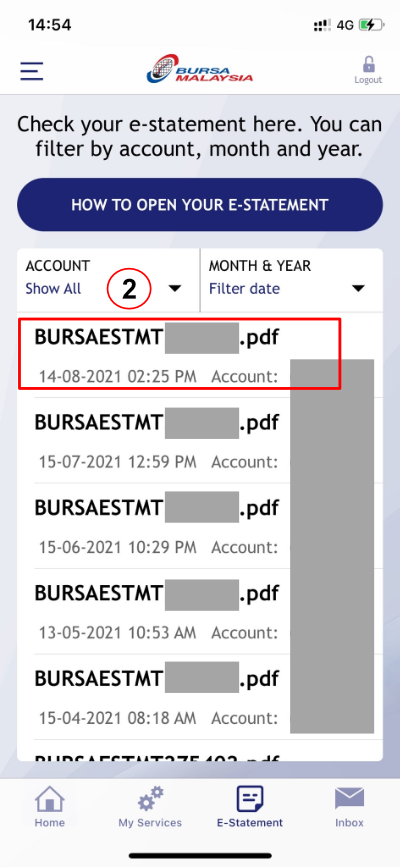

How to get my CDS statement?

,

,  ,

,

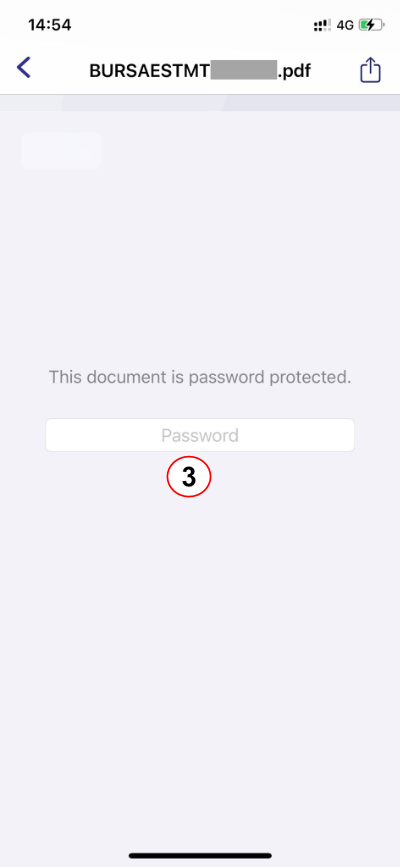

How can I open my CDS statement from Bursa?

How will I get my dividend?

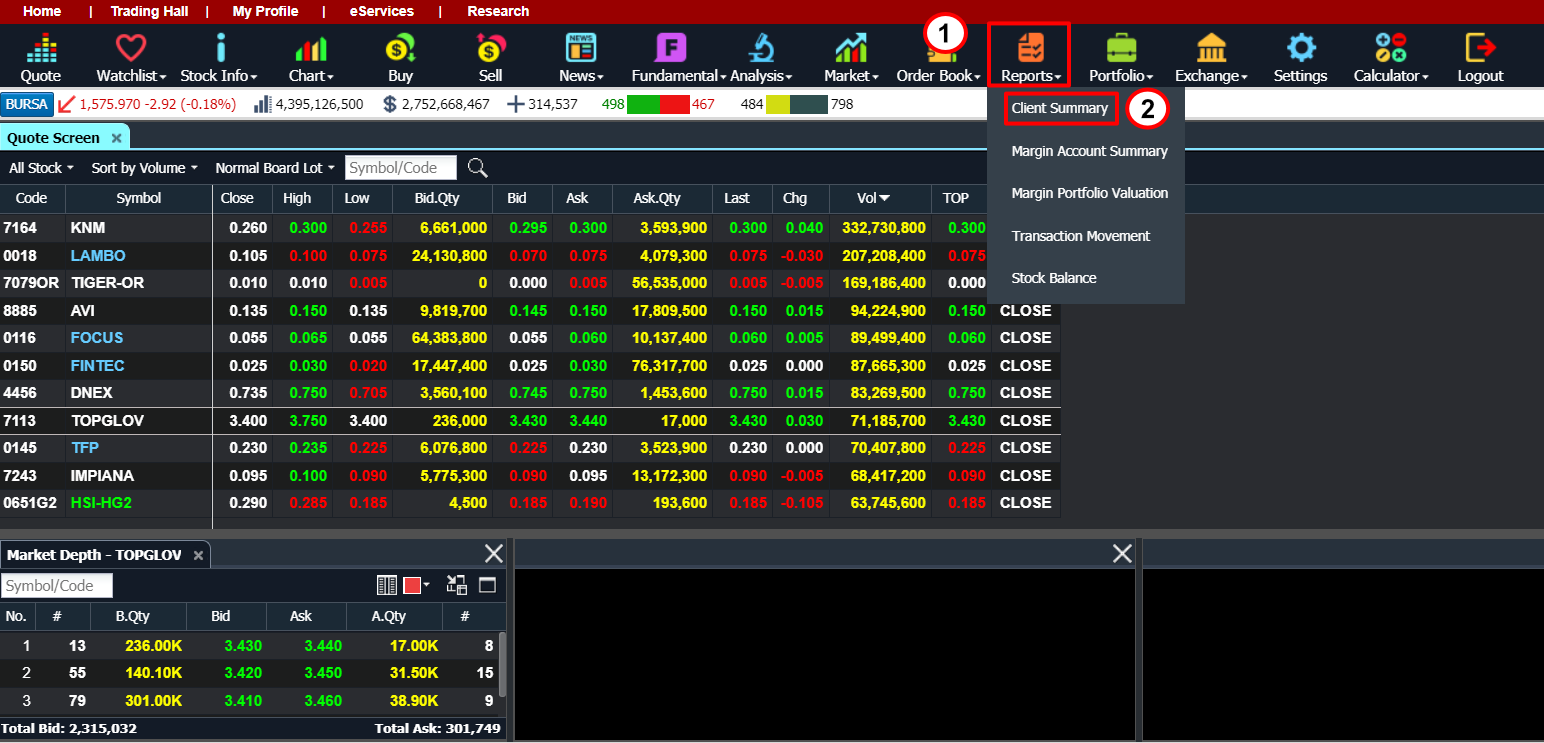

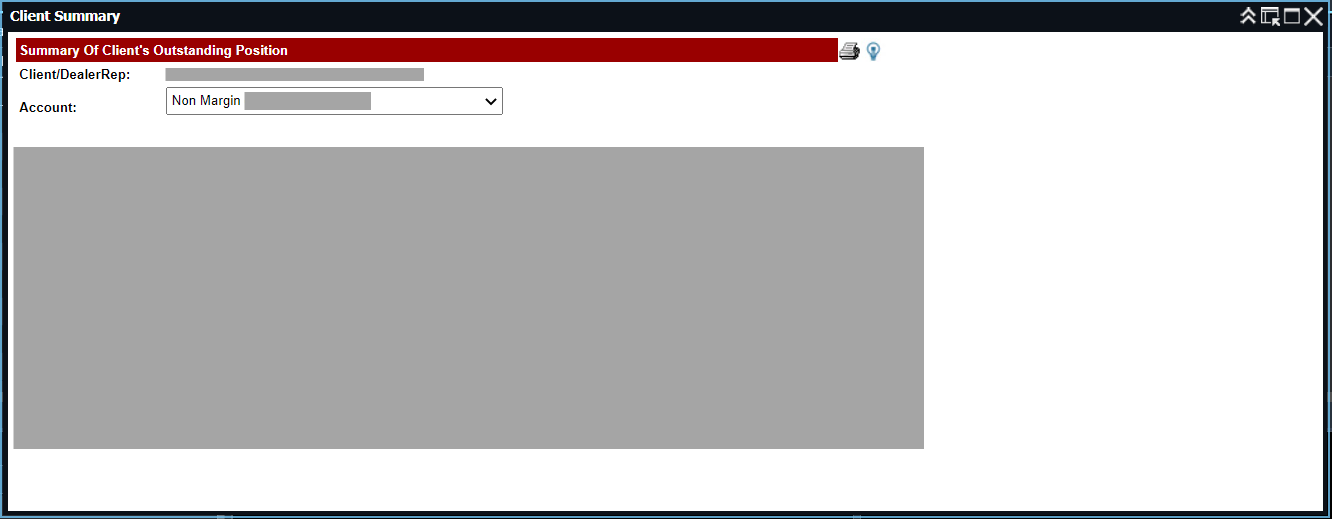

Where can I view my account summary?

Attributes in account summary.

Is there a mobile app that I can use on my phone?

Where can I view my Contract Note?

How can I calculate my portfolio profit and loss?

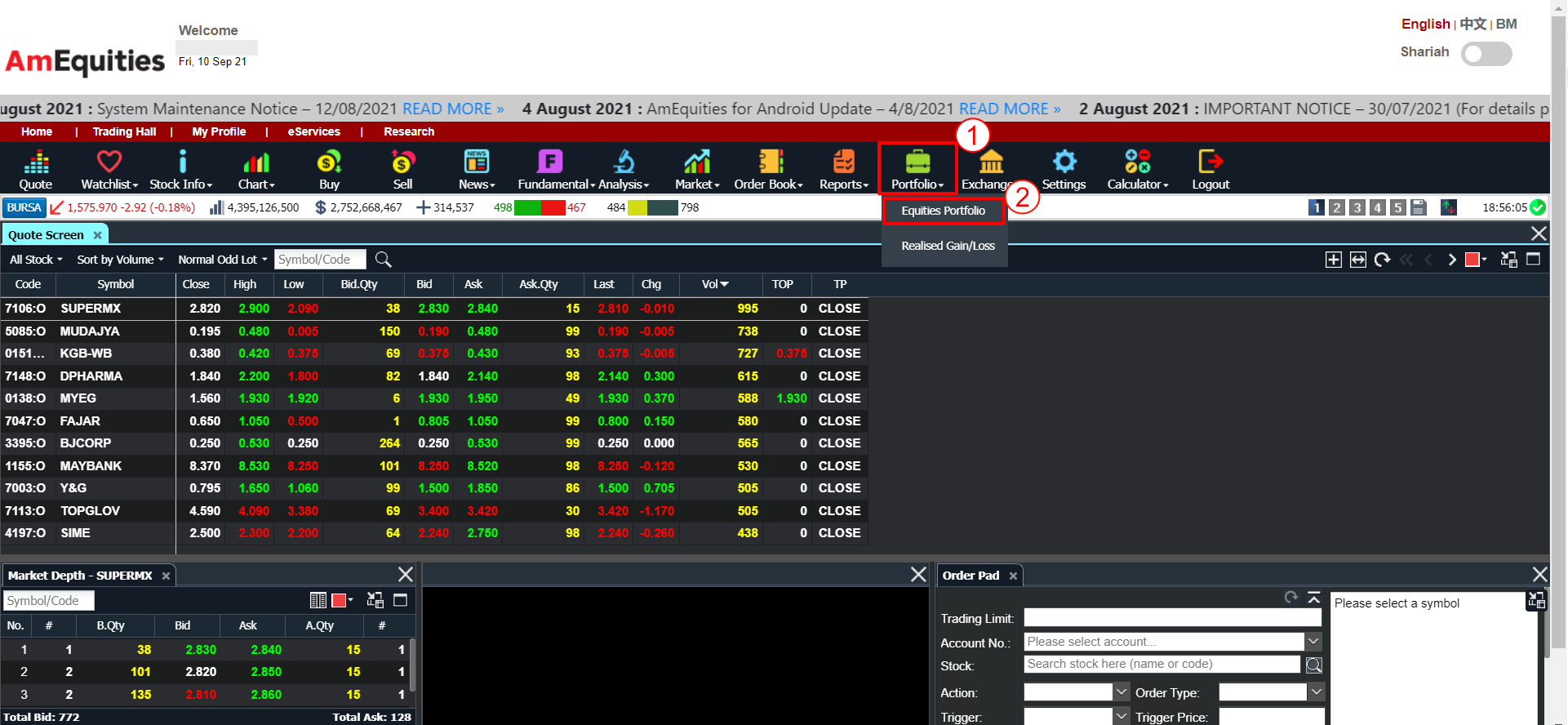

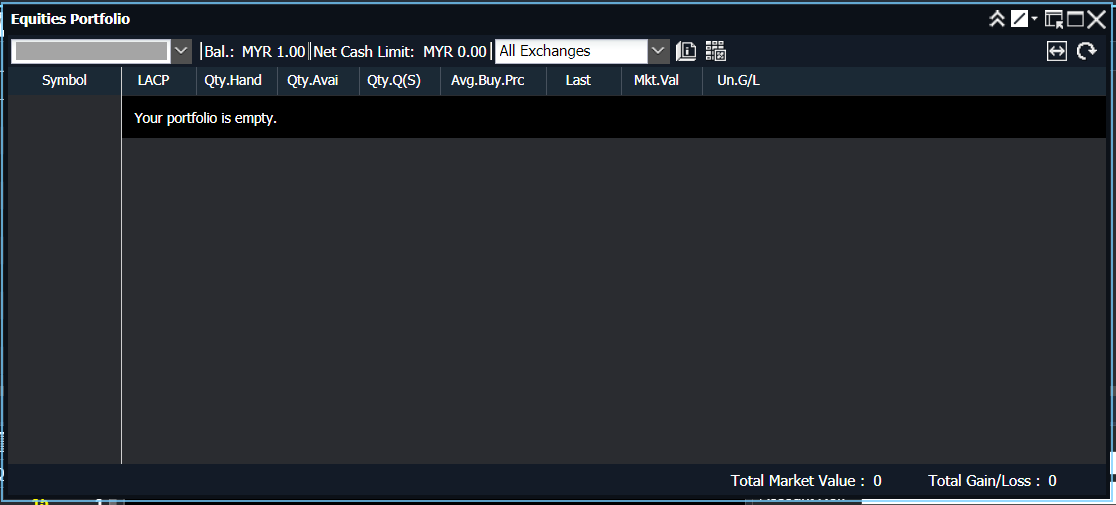

Where can I view my portfolio?

Why is my brokerage rate in the profit and loss calculation in the trading platform so high?

What are the brokerage charges for my account?

Are there any other charges other than brokerage fees?

What is the stamp duty rate?

Are there any Service Tax Charges?

What is the DF fee?

How can I deposit funds into my trading account?

How long will my deposit be processed?

Is there a minimum deposit?

How can I withdraw funds from my trading account?

Are there any withdrawal charges?

What is LO?

LO refers to a Letter of Offer

by AmEquities on their approval of your Margin account details. You will need

to sign the LO before your trading account can be opened.

What is Facility Limit?

Facility limit is the approved

loan amount provided by an investment bank or a broker against the value of

assets in your portfolio.

What is Financing Ratio?

Please note that the financing ratio is different from the facility limit. The financing ratio would be based as follows:

(a) If the client would pledge 30k cash, then he will be able to buy up to 60k. (Means for cash is 2x financing)

(b) If the client would pledge 30k shares, then he can buy up to 30k. (Means for shares is 1x financing)

If clients were to transfer/pledge more shares/ cash into the margin account (more than the existing Facility limit amount), then they need to apply for a higher limit in their margin account.

What is interest rate?

The interest rate is chargeable when you are using your facility, 5% p.a. daily rest basis. It shall be triggered when you utilize your loan - based on the amount that you have utilized, not the facility limit.

What is rollover fee?

Rollover fee is charged for outstanding share purchase contracts that are carried over to the next period (normally brought forward every quarter).

0% rollover fee applies for the first 6 months after your account is opened. The terms vary from an individual as it is subject to approval by the bank. Based on our past experience on bank approval on LO with our various clients, the clause stated that if the client could not generate brokerage more than RM6,000 within the first 6 months upon bank approval, the rollover fee shall update to 0.25% per quarter (should you have any outstanding).

Please note that all margin accounts will be subjected to annual review on both facility limit and rollover fee policy. If there are any changes, the bank will inform the client directly through letter and email.

What is MoF?

The maximum amount of financing available is based on the underlying collateral. For AmInvestment Bank, MoF is 50%, and Margin Call at 60%.

What is share capped value?

Share capped value is the value of the share that an investment bank or a broker agrees to accept as collateral for the facility limit. It is computed by the multiplier of share capped percentage and market value of the shares. Share capped percentage will be adjusted from time to time based on the stock valuation which is affected by various factors such as political changes. Should you want to know the specific share capped value for any stock, you can provide us with the list. We can get the share capped value individually from the ops team.

What is the Loan to Security Ratio (LSR)?

Loan to Security Ratio (LSR) refers to the total outstanding loans over the share capped value in your portfolio. The formula can be written as below:

LSR (%) = (Total Outstanding loan)/(Final Capped Value of shares in the portfolio)

What is the example of LSR calculation?

Shares Market value = RM200,000

Shares Capped Value = RM200,000 x 70% = RM140,000

Outstanding loan = RM70,000

LSR % = (RM70,000 / RM140,000) X 100% = 50.00%

What is the importance of LSR?

LSR is important to determine your portfolio risks. A higher LSR percentage (e.g., 80%) indicates that your outstanding loan is higher than your portfolio shares value and the portfolio holds a higher risk of not being able to recover from possible losses. Conversely, a lower LSR means your outstanding loan is lower than your portfolio shares value, hence your portfolio has a lower risk.

Share capped value in a portfolio affects the LSR. A higher capped value percentage will contribute to a lower LSR. Conversely, a lower capped value percentage will contribute to a higher LSR. The share capped value formula is as below:

Share capped value = Share market value×Capped value percentage

The formula of LSR (equation 1.1) is:

LSR (%) = (Total Outstanding loan)/(Final Capped Value of share in the portfolio)

By combining both formulas,

LSR (%) = (Total Outstanding loan)/Total(Share capped value)

LSR (%) = (Total Outstanding loan)/[Total(Share market value×Capped value percentage)]

LSR is inversely proportional to share capped value and share market value. Hence, when the market value of a share increases, the share capped value will also increase, leading to a lower LSR.

It is important to maintain a healthy LSR percentage as it indicates your portfolio risks exposure. A lower LSR percentage indicates that your portfolio has a healthier Loan to Securities exposure. It is advisable to hold shares with higher capped value and with lesser market volatility in your portfolio to maintain a lower and stable LSR percentage.

In AmEquities, the LSR to be maintained in each margin account is 50%. Our MQ support team will send notifications to clients whose LSR is 50% and above. Once your LSR exceeds 60%, a margin call will be made.

How to maintain high share capped value?

The share capped value generally depends on its current market price and share capped percentage which is being reviewed and updated every quarter based on the performance of stocks. Shares with good fundamentals and with a higher market price will normally have a higher capped value.

(a) If you hold 20,000 units of share A, with a market price of RM 2.00, which are listed on the Main market (with maximum 100% capped value), the share capped value will be calculated as below:

Total Market value = RM 2.00 X 20,000 unit = RM 40,000.00

Share capped value = RM 40,000.00 x 100% = RM 40,000.00

(b) If you hold 20,000 units of share B, with a market price of RM 2.00, which are listed on the ACE market (with maximum 80% capped value), the share capped value will be calculated as below:

Total Market value = RM 2.00 X 20,000 unit = RM 40,000.00

Share capped value = RM 40,000.00 x 80% = RM 32,000.00

(c) If you hold 20,000 units of Warrant C, with a market price of RM 2.00 (with a maximum 50% capped value), the share capped value will be calculated as below:

Total Market value = RM 2.00 X 20,000 unit = RM 40,000.00

Share capped value = RM 40,000.00 x 50% = RM 20,000.00

As the LSR is affected by share capped value, it is advisable to hold fundamentally good stocks with less volatility in your margin account portfolio to prevent fluctuation on your share capped value and to maintain a lower LSR percentage.

**Disclaimer: the above examples are just for illustration purposes on how share capped value can be calculated. The share capped value and shares market value may be updated by the broker/bank from time to time, you can check the share capped value for specific counters with our support team in the dedicated WhatsApp group.

What is Margin Call?

A margin call is made by the lender when the value of the collateral falls below a certain percentage of the financed amount.

When a margin call is made, the borrower is required to top-up the value of the assets (i.e., pledge more assets that can be in the form of shares, fixed deposits, and unit trusts) or reduce the outstanding loan to meet the required MoF within three trading days.

What are the causes of Margin Call?

Let’s look at a simplified scenario so that you can have a clearer comprehension. Mr. ABC deposited RM100,000 into his account and it contributed RM 200,000 facility limit as a result of 2x cash multiplier. He proceeds to purchase a basket of stocks with a market value of RM 200,000.00 and a share capped percentage of 100 %. Therefore, the share capped value is RM200,000.00 as shown below:

Share capped value= Share market value x shares capped percentage

Share capped value= RM 200,000.00 x 100 %

Share capped value= RM 200,000.00

This brings his LSR squarely to his MoF of 50%. Here's some sample scenario:

LSR

= (Total Outstanding loan – Cash) / Total Share Equity

= RM 200,000 - RM 100,000 / RM200,000

= 50 %

When the value of the stocks appreciates to RM250,000, Mr. ABC’s LSR becomes 40%.

LSR

= Total Outstanding loan / Total Share Equity

= RM100,000 / RM250,000

= 40%

As a result, Mr. ABC has more facility limits to purchase additional stocks. He decides to purchase additional stocks for a market value of RM 50,000 and a share capped value of 100%. The total share capped value is RM50,000.

LSR

= Total Outstanding loan / Total Share Equity

= (RM100,000 + RM 50,000) / (RM250,000 + RM 50,000)

= RM150,000 / RM300,000

= 50%

After a few days, the value of the stocks decreases from RM 250,000 to RM 200,000. The bank makes a margin call as his LSR exceeds 60%, which triggers a margin call.

LSR

= Total Outstanding loan / Total Share Equity

= RM 150,000 / RM200,000

= 75 %

At this point, Mr. ABC will have to top up cash or sell off some shares to bring his LSR back down to below 50%.

What are the actions to rectify the margin call?

You’ll need to either transfer funds or sell some shares to cover the Margin Call position. You can refer to our support team (in the dedicated WhatsApp group) for funds or shares to be transferred or sold respectively.

What is force selling?

When the LSR exceeds the approved force sell ratio (e.g., 70%) or the borrower fails to rectify a margin call within the given grace period, the lender would then have the right to sell or dispose of the security pledged or any part thereof.