Warning!

FAQ - M+ Online

TOPICS

What is the brokerage rate?

Click here to view the comparison of brokerage rate

What is the stamp duty rate?

Stamp duty is standard across Malaysia, RM1.00 per RM1,000.00 (max RM200).

Are there any Service Tax Charges?

There is a 6% Service Tax on brokerage fees and clearing fees.

What is the DF fee?

DF = Discretionary Financing

Discretionary Financing is a trading facility that allows clients to settle their outstanding purchases at any time up to T+7. With Discretionary Financing, clients have the flexibility in portfolio management where a stock can be sold at a later date to cover the cost of a stock purchase.

Fees incurred on discretionary financing are lower than brokerage fees that need to be paid to roll over a purchase contract. Collateral is in the form of shares or cash deposits.

How can I start my trading journey?

You may start your trading journey by depositing funds into your trading account.

Visit our trading education platforms to empower yourself with unparalleled knowledge in trading!

Click here to go to MQ Academy, the new education platform for traders

Click here to visit our MQ Trader Education Series blog

How to buy an IPO?

You can buy IPO shares using your bank account (e.g. Maybank, Public Bank, etc).

You just need to enter the Mplus CDS account number when you buy. Then, if your IPO shares purchase is successful, the shares will be available for you to trade in the Mplus platform.

Click here to watch the step-by-step guidelines.

How long will it take for my trade orders to be matched

Bursa trading hours:

The morning session, 9.00 a.m. to 12.30 p.m. (local time)

The afternoon session, 2.30 p.m. to 5.00 p.m. (local time)

All orders (including orders to buy and sell) will be transmitted to Bursa Malaysia during Bursa Malaysia trading hours.

The matching of orders depends on the supply and demand of the market, it can only be matched within Bursa Malaysia trading hours.

How to buy or sell odd lots?

You can request the feature through the MQ Trader support team and this feature will be granted upon request.

Are the stock prices on Mplus Online platform real-time?

Yes, the stock prices on the Mplus Online platform is real-time for the Bursa market.

How to make changes to my orders?

You can make changes to your unmatched order at Order Status > Click your Stock > Modify Order. Now you may change the quantity and price from there.

How to short sell via Mplus?

This feature will be activated upon request. You may seek help from the MQ Supporting group on WhatsApp. Here is an example of the name of the MQ Supporting group in WhatsApp, e.g., MQ@Mplus: ABC123C. (ABC123C is referring to your client code)

After activation, you may perform a short sell at Sell > IDSS. Now you may fill in the order details for your IDSS order.

How to check whether my order status is matched?

Under the order status section, it will be shown under the “Status” column.

How to access e-statement from Bursa?

To access your eStatement, key in the Default Password in capital letters, which comprises the first two characters of your name as reflected in our Central Depository System (CDS) based on your Application for Opening of Account form and the last six digits/alphanumeric of your NRIC/passport number.

For Example:

Name of the account holder in CDS: Chan Mei Ling

NRIC number: xxxxxx-10-1234

Default Password is CH101234

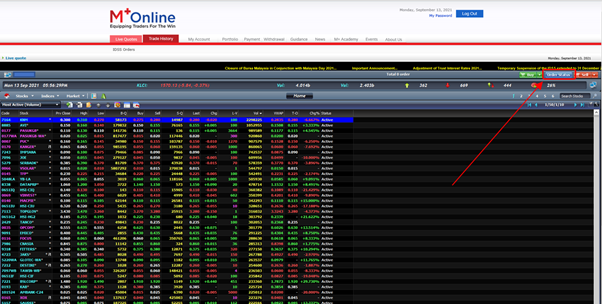

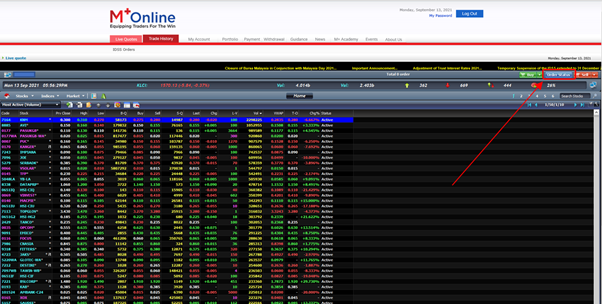

Where to find my trading history?

Login to https://www.mplusonline.com.my/

You can view your trading history under the menu “Trade History”

What is the maximum or minimum quantity of shares I can place per order?

The minimum number of shares that you can place is 1 share (for Odd lot) and a minimum of 100 shares (for board lot), whereas the maximum number of shares that you can place in a normal board lot order is 5,000 (500,000 shares).

Can I place orders during non-trading hours?

You can place orders during non-trading hours. But matching of orders will only be done during trading hours.

What are the trading hours in Bursa?

The Bursa Market will only be open during weekdays (Monday to Friday except for Public Holidays). Trading hours in Bursa Market are as below:

9:00am to 12:30pm

2:30pm to 4:45pm

How to trade foreign markets?

Currently, you can only trade local stocks via the Mplus Online platform.

However, we have partners from AmEquities that offer foreign trading accounts.

Click here to learn more about AmEquities!

Where is my Client Code?

You may refer to the MQ Supporting group in WhatsApp. Here is an example of the name of the MQ Supporting group in WhatsApp, e.g., MQ@Mplus: ABC123C. (ABC123C is referring to your client code)

You may also obtain it from your Mplus trading platform, it is located under My Account > My Profile

Where is my CDS number?

You may obtain it from your Mplus trading platform, it is located under My Account > My Profile

Where is my realised profit/loss?

The Mplus trading platform does not show profit/loss for any contracts.

It just shows the list of past contracts, and the current holdings, and the last market prices of the client's holdings.

You can check under My Acc > Contract Note for your contracts from there, you can see the gain/loss of each holding based on the average purchase price vs market price of each stock.

However, one of the benefits of opening a trading account with MQ Trader includes FREE i3investor portfolio integration. This allows you to synchronize your trade data to the i3investor advanced Portfolio Management System. You can use this Portfolio Management to easily view and calculate your profit and loss. You can send your integration request to the dedicated MQ Support group we have for you on Whatsapp.

Where to view my dividend payouts?

Dividend payouts will be paid directly to your registered bank account.

What should I do if I forgotten my username and password

You may seek help from the MQ Supporting group on WhatsApp. Here is an example of the name of the MQ Supporting group in WhatsApp, e.g., MQ@Mplus: ABC123C. (ABC123C is referring to your client code)

What is my trading pin?

The trading pin is the same as your login password.

How do I contact the MQ Trader support team?

Our FAQ pages are the quickest and easiest way to find answers for most of your inquiries. If you can’t find the answer you’re looking for, you may seek help from the MQ Supporting group on WhatsApp. Here is an example of the name of the MQ Supporting group in WhatsApp, e.g., MQ@Mplus: ABC123C. (ABC123C is referring to your client code)

How to activate your M+ trading account.

Activate your M+ trading account.

Step 1

Open email and search for support@mplusonline.com.my

Step 2

Click the blue activation link and get the username from the email with title: Welcome to Malacca Securities.

Step 3

Get the first time password from the email with the title New/ Lost Password.

Step 4

Login M+ trading platform with the provided username and password.

**Kindly check your spam/junk mail if you cannot find the stated emails.

How to deposit funds to my account?

FPX Transfer

You may deposit your funds to your account via FPX fund transfer.

Click here to follow the step-by-step guidelines.

OR

Manual Transfer

You can deposit funds to your trading account via Online Banking or Cash Deposit to our bank accounts as stated below:

Malacca Securities Sdn Bhd

Bank Name Account Number

Maybank 0-04021-40918-1

UOB 198-302-039-4

CIMB 8004758259

Public Bank 3171666534

After transfer, you can fill in your deposit details at the Trading Platform from the menu: Payment -> Deposit.

Alternatively, you can just snap the deposit details and send them to us for updating and tracking purposes. You may reach us at the MQ Supporting group on WhatsApp. Here is an example of the name of the MQ Supporting group in WhatsApp, e.g., MQ@Mplus: ABC123C. (ABC123C is referring to your client code)

Can I deposit money via app using another person's account?

Please note that fund transfer from third parties (other than direct family members and personal bank account) is not allowed.

How long does it take to update my deposit / trading limit?

FPX around 15 min

Manual Transfer (i.e. Direct Transfer, cash deposit) 1- 2 hours

Please take note that all deposits can only be processed during working hours.

I have done the deposit, but it didn't show in my trust account balance

Normally the cash balance in your trust account will only be updated the next working day.

How to calculate the trading limit for a Mplus Silver account?

The trading limit computation will be 99.5% – RM40. However, the trust amount will be updated by the end of the day which will reflect the actual amount that you have deposited with Malacca Securities Sdn Bhd.

For example, a client deposited RM10,000 into their trust account

Their trading limit will be calculated as below:

Trading limit = RM10,000 x 99.5% - RM40

= RM9,910

How to withdraw from my account?

You may withdraw via https://www.mplusonline.com.my/

It is located under Menu > Withdrawal > Cash Withdrawal > Fill up details > Submit

Or let us know the amount, bank name & bank account number, and we will help you to submit. You may reach us at the MQ Supporting group on WhatsApp. Here is an example of the name of the MQ Supporting group in WhatsApp, e.g., MQ@Mplus: ABC123C. (ABC123C is referring to your client code)

What is the minimum deposit amount for FPX fund transfer?

The minimum amount will be RM1000 for the FPX fund transfer.

Will my deposit earn interest from my trust account?

Yes, interest will be given on your trust deposit.

It will be calculated on a daily basis (daily trust balance) and credited back to your trust on a monthly basis (end of the month).

For more info on the interest rate, click here and hover your mouse over the “Question Mark Icon” that is located beside the word “Interest” to view the interest for the trust account.

What are the charges of FPX fund transfer?

There are no charges for FPX fund transfer.

Where to access Mplus Online Platform and Mobile App?

There are 3 methods of login M+ Trading Platform:

(a) Internet Explorer/ Google Chrome

(b) Android App

(c) IOS App

Where to view the stock information

To view the stock information, simply: Right-click your stock > under “General Info”

What is my ID and Password for Mobile App?

It has the same ID and Password as per the web platform.

Where to view your account balance?

To view your account balance, simply click: Menu > My Account > Account Summary

How to use the Good-Till Date order?

Click here to follow the step-by-step guidelines.

What browser is compatible with Mplus Platform?

M+ Online Platform can be opened with all major browsers. Chrome, Internet Explorer, Edge, Mozilla Firefox.

*Note: The M+ Online trading platform only works well with the recent versions of the Internet Explorer browser. It does not work well with Firefox, Chrome, and Edge browsers.

What is the Good-Till-Date order?

Good Till Date (GTD) Order is a type of order that is active until its specified date unless it has already been fulfilled or canceled.