GETTING TO THE FRONT WITH FRONTKEN

100percentprofits

Publish date: Thu, 29 Jun 2017, 12:25 PM

FrontKen Corporation is a very misunderstood company on Bursa Malaysia. Today I am writing a short piece on how you can make 100% profit from the misperception of this company.

First of all, technically Frontken has completed the rounding bottom and have broke the neckline resistance between 29c and 30c. It retraced to test the neckline support after breaking it late May and it is still above the support.

Next, it is possible for it to double the space of the rounding bottom to form a technical TP of 48c.

Okay so it's not a 100% profit. Sorry, not easy to find 100% everyday.

The reason Frontken is making this move is because the market is starting to realize that Frontken should be priced as a semiconductor stock and not a heavy industry or O&G counter.

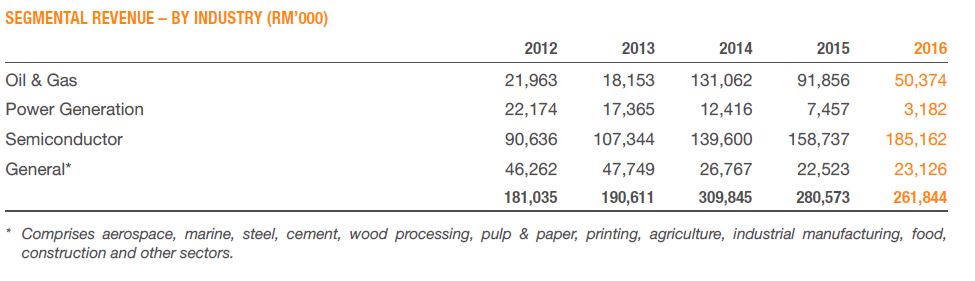

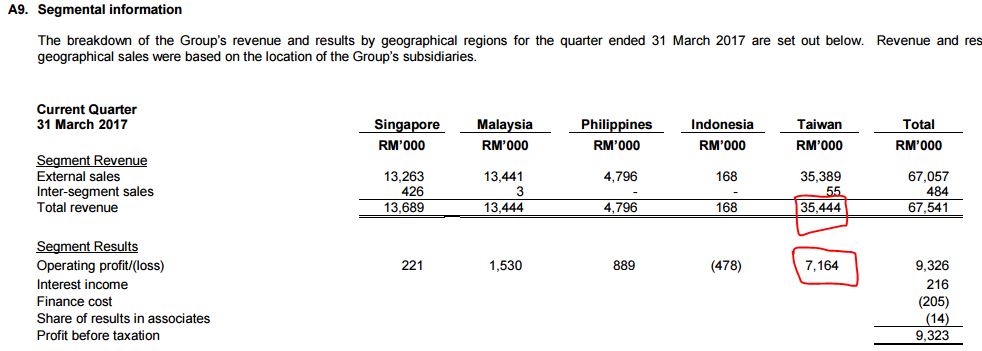

The problem is that when you look at the Q report, the segmental reporting only discloses Rev & PBT by geographic region and not by business segment. You can only find that in the Annual report.

Notice how in 2016, 71% of revenue is derived from Semiconductor? This is a predominantly semiconductor stock with a few other businesses. The Annual report does not disclose PBT by industry, but since we all know that their Taiwan Subsidiary, Ares Green Technology is a 100% semicon stock, we can see from the latest Q report that their taiwanese division has a PBT margin of 20.2% (ref pic below). That is a pretty thick margin if you ask me. In fact, Inari's PBT margin for the last 4Q was 19.3%.

If you ask me a PE of 12.2 (at 30.5c) is pretty low, given most semiconductors are priced from 15-25 (let's not even talk about gtronic's 60 PE).

So why the misinformation? I think that it is because if you visit their website, http://www.frontken.com/ and look at their products, everything tells you that they are a heavy industry company. Nothing there tells you that they are a semiconductor company.

In fact, if you visit their taiwanese website, http://www.aresgreen.com.tw/index.asp?lang=1 you will also be confused because you don't see the typical semiconductor words. Most people when you say semicon, they will think wafers, sensors, chips or EMS.

On their taiwanese website, they will mention anodizaiton, electrolytic polishing cleaning etc. As an example, if you look at the picture below, to a layman, they might be thinking that Frontken is a cleaning company that cleans shower heads and random parts.

The thing most people fail to realize is that just as in any industry, there is the popular main business and other periferal busineses. Example: to a layman, oil & gas refers to drilling platform, exploration, and maybe refinery. However when you learn more about O&G you will learn business such as FPSO (Yinson & Bumi Armada) or support vessles (Dayang/ Coastal). Just because they are not the drilling platform, does not mean that they are not O&G.

The same applies for Frontken. They are in the support industry for semiconductor, which requires very specific standards. For example, the ultral cleaning as per the picture above is aimed to remove ions such as Lithium/ Natrium etc because any impurities on the surface will damage the semicon wafers when being produced.

If they weren't so specialized, there is no way they would be able to generate a PBT margin of 20%.

But what else? Have you noticed how clean their balance sheet is? They have net cash of RM74mil or 6c per share. Their latest CF statement shows that their Op cash flow is also clean.

In summary

- Semicon stock at 12PE

- Growing semicon division at 19.5% CAGR for the last 5 years

- Semi-con PBT margin of 20%

- Recently increased stake of Taiwanese semicon company from 73.2% to 84.6%

- Clean balance sheet, net cash of RM74mil or 6c/share

- Completed rounding bottom technically and retested long term support with technical TP of 48c

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on 100% PROFITS

Discussions

would have bought it if this article was in February when price around 0.18. Now it has hit a high of 0.33 and on its way DOWN. Better be careful.

2017-06-29 16:30

stockmanmy

I like your writing style but will not trust you with my money.

2017-06-29 13:48