FBM KLCI Outlook

AmInvest

Publish date: Mon, 08 Oct 2018, 09:38 AM

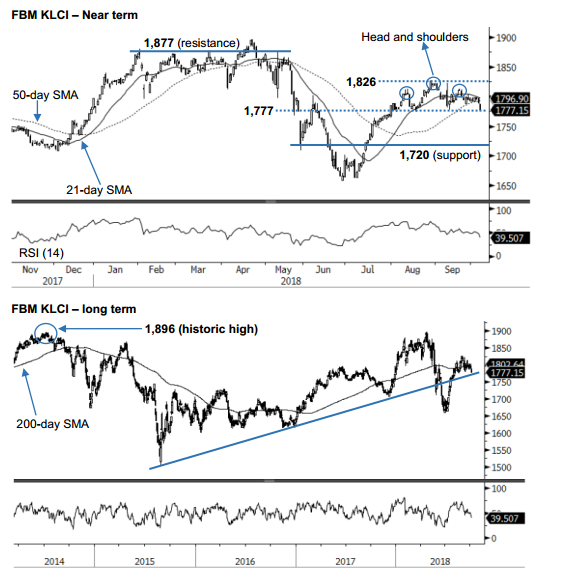

Consolidation or waning momentum? Following the post-GE recovery, the FBM KLCI rebounded 167pts or 10% from a low of 1,659 in June 2018 to reach a high of 1,826 in August 2018. Since then, the index has been hovering around the 1,800 mark for the past month as it moves back and forth the 200-day SMA line, which is a closely watched indicator for determining the long-term overall trend. Momentum indicator like the RSI has also remained in the neutral territory over the past few weeks, showing no directional bias. Until the index moves out from the range of 1,826–1,777, it is expected to continue trending sideways in the immediate term.

Foreigners snapped 4-month selling streak. While foreigners’ exposure is still in the negative territory of RM8.39bil YTD, selling pressure has gradually eased. For the month of Sep, foreigners snapped the 4-month selling streak to emerge as net buyer, amounting to RM109.2mil while net selling from local institution and retailers was at RM89.5mil and RM19.7mil respectively. With the long-term uptrend line still intact, there is possibility for the index to cross above the 1,826 level and advance towards the next resistance at 1,877.

Uncertainty remains. On the other hand, the recent movement shows the index forming a reversal chart pattern that resembles a head-and-shoulders formation. A breach below the 1,777 support level will confirm the reversal chart pattern. In this case, the index may experience further downside where the next support level is estimated at 1,720.

Source: AmInvest Research - 8 Oct 2018

More articles on AmInvest Research Reports

Created by AmInvest | Nov 27, 2024

Created by AmInvest | Nov 27, 2024