Stock on The Move - Dayang Enterprise Holdings

AmInvest

Publish date: Mon, 21 Nov 2022, 10:00 AM

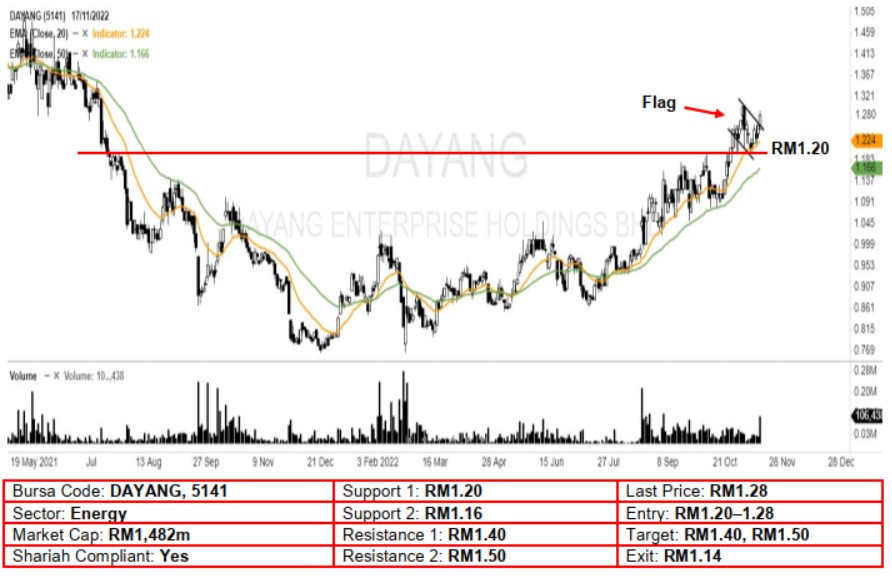

Technical Analysis. We believe buying interest for Dayang Enterprise is back after pushing out from the 3-week bullish flag pattern on Thursday. With the stock posting 2 white candles in a row and pushing near its 52-week high, the bullish momentum appears to be picking up. A bullish bias may emerge above the RM1.20 level, with a stop-loss set at RM1.14, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM1.40, followed by RM1.50.

Company Background. Dayang Enterprise Holdings provides offshore maintenance services. The group also offers minor fabrication operations, offshore hook-ups, commissioning and chartering of marine vessels to the oil and gas industry. It owns about 16 vessels through Perdana Petroleum.

Prospects. (i) Benefit from increased demand for offshore maintenance, construction and modification (MCM), and hook-up and commissioning (HUC) works as the group’s order book remains strong at RM1.8bil. (ii) Continuously participating in new contract bids by oil majors given its outstanding track record and financial position. (iii) Moving forward, the group is expecting clients to initiate extensive capital expenditures to increase their productivity with an emphasis on maintenance activities.

Financial Performance. In 9MFY22, the group recorded a total revenue of RM761.9m (+63% YoY), mainly attributable to the revival of work orders/contracts being awarded from oil majors and the improvement of vessel utilisation rate. The group also recorded a PAT of RM105.4m (+2.9x YoY) after taking into account an insurance claim of RM11mil received for Dayang Topaz in 2020, a reversal of impairment loss of RM1.4mil on trade receivables as well as a lower depreciation charge by RM16.1m.

Source: AmInvest Research - 21 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024