Mplus Market Pulse - 14 Nov 2024

MalaccaSecurities

Publish date: Thu, 14 Nov 2024, 09:50 AM

Exporters May Benefit From Strong Dollar

Market Review

Malaysia: The FBMKLCI (+0.19%) rebounded, as the index was lifted by buying pressure in selected Banking stocks, namely PBBANK (+3.0 sen) and HLBANK (+7.0 sen), despite weaker overnight performance on Wall Street prior to the release of CPI and PPI data.

Global markets: While Wall Street ended mixed, Treasury yields rebounded from session lows as CPI data came in higher, albeit within expectation, which may lower down the probability of a December rate cut. Meanwhile, both the European and Asian markets closed on a negative note after Wall Street rally losses steam.

The Day Ahead

The FBMKLCI rebounded, buoyed by renewed interest in Utilities and Industrial stocks, the latter surged due as SOLARVEST received approval to operate as a merchant generator in Kedah, which spurred buying support in the sector. Meanwhile, US inflation data came in within expectations, with CPI and Core CPI rising to 2.6%-3.3% YoY, respectively. As a result, Wall Street closed on a mixed note; the Dow advanced, while both the S&P 500 and Nasdaq ended flat. This week, traders will be closely watching (i) PPI, (ii) Retail Sales, and (iii) Q3 2024 Malaysia GDP data. In the commodities market, Brent crude oil traded flat following OPEC+'s reduced demand forecast. Gold prices retreated further to USD 2,573 as the dollar gained momentum, while the CPO price fell significantly below RM 4,800 as a slowdown in exports weighed on vegetable oil prices.

Sector Focus: We remain positive view on Technology and Gloves given the strong dollar environment. We also favour stocks within the Industrial Engineering industry and AI-driven sectors, as KGB experienced a breakout yesterday due to its strong earnings and its positive prospects. Also, selected Construction, Property, and Building Materials stocks are expected to post stronger earnings, supported by ongoing data center investments.

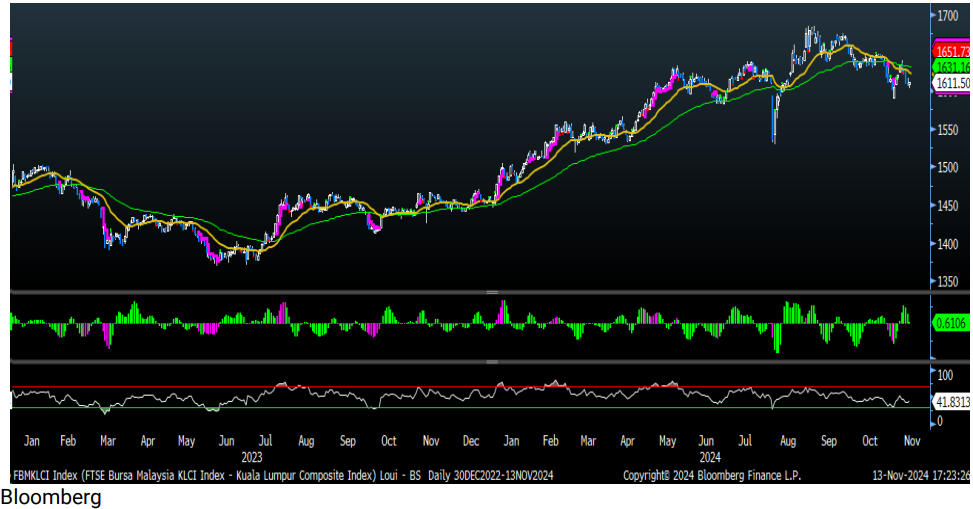

FBMKLCI Technical Outlook

The FBM KLCI index closed higher towards the 1,611 level. However, the technical readings on the key index were mixed, with the MACD histogram formed another positive bar, while the RSI trended below 50. The resistance is envisaged around 1,626-1,631, and the support is set at 1,591-1,596.

Company Briefs

Palm oil producer Johor Plantations Group Bhd (JPG) is optimistic in the final quarter of the year, thanks to strong crude palm oil (CPO) prices. Its quarterly net profit for the three months ended Sept 31, 2024 (3QFY2024) grew 13% in the third quarter to RM77.1m, boosted by higher sales volume and CPO prices from a year earlier, an exchange filing showed. It declared a second interim dividend of 1.25 sen per share, payable on Dec 17, 2024. Quarterly revenue increased 18% to RM404.13m. For 9MFY2024, Johor Plantations reported a 69% surge in net profit to RM176.81m while revenue climbed 23% to RM1.05bn. (The Edge)

United Plantations Bhd (UTDPLT), whose share price hit a record high on Tuesday, announced a 60 sen per share dividend payout — comprising a special dividend of 20 sen and an interim dividend of 40 sen — plus a one-for-two bonus issue. However, the dividend declared, which will be paid on Dec 10, was lower compared with 80 sen per share a year ago. The oil palm planter’s net profit for its third quarter ended Sept 30, 2024 (3QFY2024) dropped 8.8% to RM215.03m from RM235.68m in 3QFY2023. Its net profit was dragged by a sharp rise in operating expenses to over RM80m. Quarterly revenue was 1.4% higher at RM547.67m in 3QFY2024 from RM540.16m in 3QFY2023. For the nine-month period ended Sept 30, United Plantations' net profit grew 5.3% to RM533.84m from RM506.79m, as revenue increased 6.8% to RM1.57bn from RM1.47bn. (The Edge)

Packaging solution provider Scientex Bhd (SCIENTX) said it has established a perpetual multi-currency Islamic medium-term notes programme of RM1.5bn in nominal value. The group, which lodged the Sukuk Wakalah Programme with the Securities Commission Malaysia on Wednesday, said proceeds from the issuance of the sukuk will be used to finance and reimburse capital expenditure. It will also be used to refinance existing and future financing, investment, and working capital requirements. (The Edge)

Logistics firm Swift Haulage Bhd (SWIFT)’s net profit came in lower at RM5.77m for the third quarter ended Sept 30 (3QFY2024), down nearly 80% against RM28.3m a year ago when it booked in RM25.47m gain from bargain purchase. Higher finance costs also weighed its quarterly earnings. The company did not declare any dividend. Quarterly revenue grew 8.9% year-on-year to RM183.06m. For 9MFY2024,its net profit fell 27% to RM35.25m though revenue grew 7.5% to RM535.28m. (The Edge)

Property developer Pasdec Bhd (PASDEC) is expected to realise an estimated net gain of RM68.38m from the proposed sale of industrial land in Kuantan, Pahang to Petroluxe Refinery (M) Sdn Bhd (PRSB) for RM73.5m. Proceeds received from the proposed disposal will be utilised for working capital purposes for its ongoing and newly launched projects and paring down debts. The net book value of the property is about RM3.97m as at end-Dec 2023. (The Edge)

Bumi Armada Bhd (ARMADA) said its floating production storage and offloading (FPSO) vessel, Armada TGT1, has secured a two-year charter extension worth US$74.4m (RM330.93m). The bareboat charter contract was extended by Vietnam's petroleum producer Hoang Long Joint Operating Co for the Te Giac Trang field located offshore Vietnam. (The Edge)

Dayang Enterprise Bhd (DAYANG) has secured two more contracts to provide pan- Malaysia services to Petronas and its production sharing contractors. The contracts involve offshore maintenance, construction, and modification (MCM) as well as hook-up and commissioning (HUC) services for Package A3 for the Sarawak asset (SKA Oil) and Package A5 for the Sabah asset (SBA Southern). The values of the contracts were not specified. Dayang said the tenures of both contracts are five years effective from Sept 27, 2024. The contracts come with options to extend for three years and subsequently another two years. (The Edge)

Malaysia Marine and Heavy Engineering Holdings Bhd (MHB) turned profitable in the third quarter ended Sept 30, 2024 (3QFY2024). Quarterly revenue jumped 42% year-on-year to RM906.46m, thanks to improved performance of both its heavy engineering and marine segments. It posted a quarterly net profit of RM15.27m, against a net loss of RM105.21m in 3QFY2023. No dividend was declared. For 9MFY2024, the group made a net profit of RM99.61m, as opposed to a net loss of RM490.37m a year ago, as revenue rose to RM2.79bn from RM2.19bn. (The Edge)

Information and communications technology (ICT) products distributor VSTECS Bhd (VSTECS)’s revenue climbed to record high of RM841.76m for the three months ended Sept 30, 2024 (3QFY2024). This lifted its quarterly net profit to RM19.58m, up 54% from RM12.73m a year ago. The improved earnings were supported by a recovery in both consumer and enterprise products as well as new product launches. It declared a first interim dividend of 2.8 sen per share, payable on Jan 9. For the 9MFY2024, its net profit grew 13.7% to RM49.13m from RM43.23m in the previous corresponding period, as revenue expanded 8.5% to RM2.08bn from RM1.92bn. (The Edge)

Source: Mplus Research - 14 Nov 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-23

JPG2025-01-23

SWIFT2025-01-23

UTDPLT2025-01-23

VSTECS2025-01-22

JPG2025-01-22

SWIFT2025-01-22

UTDPLT2025-01-22

UTDPLT2025-01-22

UTDPLT2025-01-21

DAYANG2025-01-21

DAYANG2025-01-21

JPG2025-01-21

UTDPLT2025-01-21

UTDPLT2025-01-20

SCIENTX2025-01-20

SCIENTX2025-01-20

SCIENTX2025-01-20

SCIENTX2025-01-20

SCIENTX2025-01-20

SWIFT2025-01-20

SWIFT2025-01-20

UTDPLT2025-01-17

ARMADA2025-01-17

ARMADA2025-01-17

DAYANG2025-01-17

JPG2025-01-17

JPG2025-01-17

MHB2025-01-17

SWIFT2025-01-17

UTDPLT2025-01-17

VSTECS2025-01-16

DAYANG2025-01-16

JPG2025-01-16

JPG2025-01-16

JPG2025-01-16

JPG2025-01-16

JPG2025-01-16

JPG2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

SCIENTX2025-01-16

UTDPLT