Stock on The Move - PT Resources Holdings

AmInvest

Publish date: Mon, 19 Dec 2022, 08:58 AM

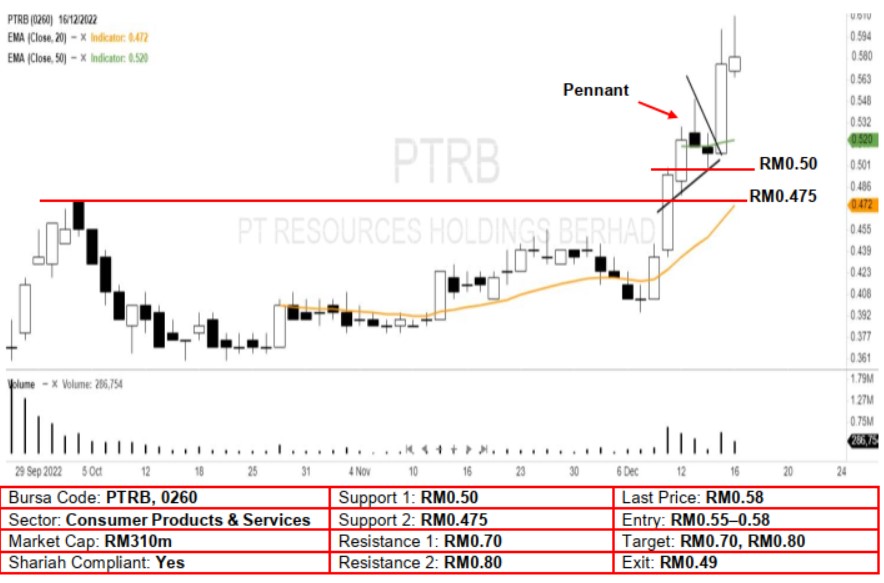

Technical Analysis. PT Resources’ buying momentum is back after it broke out of the bullish pennant pattern with a long white candle on Thursday. In view that the 20-day EMA is starting to turn upwards, the uptrend may continue in the near term. A bullish bias may emerge above the RM0.55 level, with a stop-loss set at RM0.49, below the 14 Dec low. Towards the upside, the near-term resistance level is seen at RM0.70, followed by RM0.80.

Company Background. PT Resources is principally involved in the processing and trading of frozen seafood products as well as the trading of meat and non-meat products. Its products are sold to wholesalers, food manufacturers and retailers. In addition, PT Resources also sells frozen seafood and other products through its own outlets and online marketplace - MO Signature. The group owns and operates 6 MO Foodmart outlets and 1 MO Wholesale Centre outlet in East Coast region of Peninsular Malaysia.

Prospects. (i) Setting up a new cold storage warehouse to cater for the increasing demand from international customers and expansion of outlets. (ii) Continue to grow its exports of frozen seafood products to the international market, particularly Asia Pacific and Middle East. (iii) Expand its network of MO Foodmart outlets through a licensing business model.

Financial Performance. In 1QFY23, the group reported revenue of RM115.3m with a PAT of RM7.5m. No comparative figures for the preceding year’s quarter are available as PT Resources is a newly listed company on 27 Sep 2022. Prior to the listing, the group’s revenue recorded a CAGR growth of 47.1% while the group’s PAT registered a CAGR growth of 31.5% in FY20-FY22.

Source: AmInvest Research - 19 Dec 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024