Stock on The Move - Kein Hing International

AmInvest

Publish date: Wed, 08 Feb 2023, 09:06 AM

Company Background. Kein Hing International’s core business segment comprises sheet metal forming, precision machining, component assembly and manufacture as well as sale of gas appliances. Its parts/metal components are mainly used for assembly of products which consist of components and devices, home appliances, automotive, eletrical and audio visual. The group’s manufacturing bases are principally located in Malaysia and Vietnam.

Prospects. (i) Overseas expansion particularly in Vietnam as the main overseas manufacturing base in the long term - focusing on sheet metal forming, precision machining and component assembly. (ii) Expanding its manufacturing capability and engineering services, especially in the manufacturing of parts for the automotive industry. (iii) Vertical diversification into end-consumer market with its own brand “Zenne”.

Financial Performance. In 1HFY23, Kein Hing reported revenue of RM181.7mil (+50% YoY) with a PAT of RM17.6mil (+2.8x YoY). This was mainly attributed to the revenue growth achieved by its Vietnam operation (growth in strong demand for parts and metal components), coupled with economies of scale and net forex exchange gain.

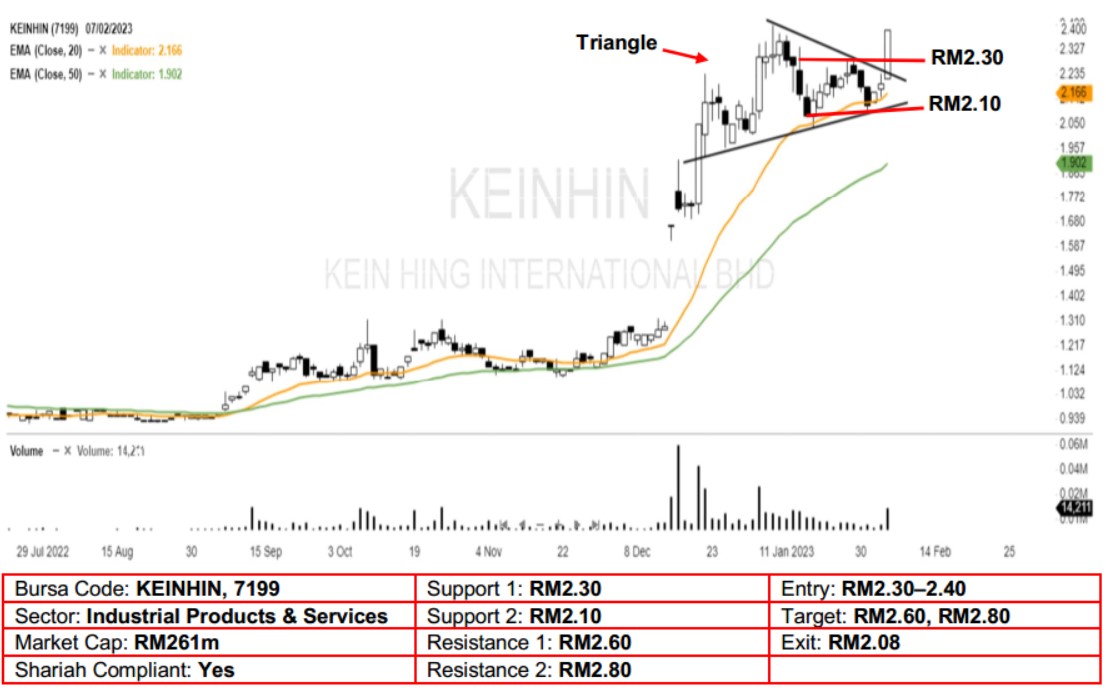

Technical Analysis. We expect further upside for Kein Hing after it broke out from the 7-week bullish triangle pattern yesterday. With the stock posting a long white candle and pushing near its all-time high, a bullish momentum may be present now. A bullish bias may emerge above the RM2.30 level, with a stop-loss set at RM2.08, below the 20-day EMA. Towards the upside, near-term resistance level is seen at RM2.60, followed by RM2.80.

Source: AmInvest Research - 8 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024

Created by AmInvest | Nov 14, 2024