Stock On The Move - Genetec Technology

AmInvest

Publish date: Mon, 13 Mar 2023, 08:42 AM

Company Background. Genetec Technology (Genetec) is principally involved in design and build of smart automation systems, customised factory automated equipment & integrated systems from conceptual design and development of prototype to mass replication of equipment. Genetec’s core business segments are electric vehicle (EV) & energy storage, automotive and hard disk drive. The group serves customers across United States, Europe, Mexico and Asia.

Prospects. (i) Actively participates in new bids to expand the customer base to capitalise on the electrification megatrend in EV & energy storage segments with in-house sophiscated R&D team. (ii) Unique automation solutions and technology driven capabilities in the EV & energy storage segments further strengthen its competitive advantage. (iii) Potential a new growth driver in renewable energy segment as the group develops its in-house battery energy storage management system to store/manage excess power.

Financial Performance. In 9MFY23, Genetec reported higher revenue of RM229m (+39% YoY) with a PAT of RM56.8m (+28.8% YoY). This was mainly due to a robust order book, higher sales volume, stronger orders from existing customers, operational efficiency and margin improvement in product mix.

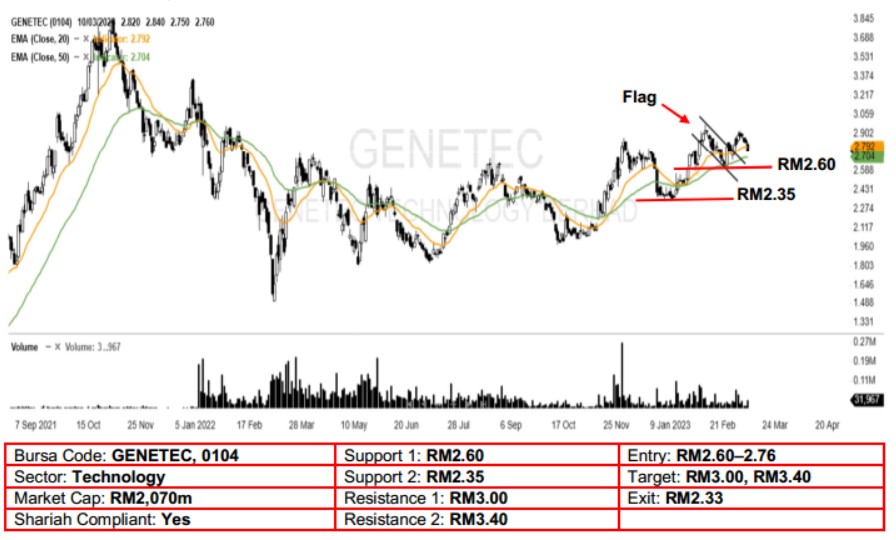

Technical Analysis. Genetec broke out from its 3-week bullish flag pattern two weeks ago, implying that its previous uptrend may have resumed. With the 20-day EMA remaining above the 50-day EMA since the bullish crossover in late Nov22, the uptrend may continue in the near term. A bullish bias may emerge above the RM2.60 level, with a stop-loss set at RM2.33, below the 4 Jan low. Towards the upside, the near-term resistance level is seen at RM3.00, followed by RM3.40.

Source: AmInvest Research - 13 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024