Stock On The Move - Malayan Cement

AmInvest

Publish date: Mon, 12 Jun 2023, 09:07 AM

Company Background. Malayan Cement Berhad (MCB) is the leading cement and building materials group in Malaysia. The group is involved in the production, manufacturing and trading of cement, clinker, ready-mixed concrete, other building materials and related products. The core business segments: (i) Cement - encompassing its cement business and other building materials. (ii) Aggregates & Concrete - comprising its aggregates and ready-mixed concrete business.

Prospects. (i) Cement demand from property-related construction is expected to improve, supported by the development of residential and industrial properties. (ii) Non-residential construction activities are expected to benefit from higher investments in manufacturing facilities, with potential new developments for logistics hubs, data centres and semiconductor plants, given the shift in global supply chains. (iii) The Langkawi Plant is well positioned to capitalise on the continuing healthy demand from the export market.

Financial Performance. In 3QFY23, MCB posted a higher revenue of RM990.7m (+24.6% YoY) with a PAT of RM63.3m (+3.5x YoY). This was mainly attributable to the improvement in both the volume and selling price of domestic cement as well as the better selling price of ready-mixed concrete.

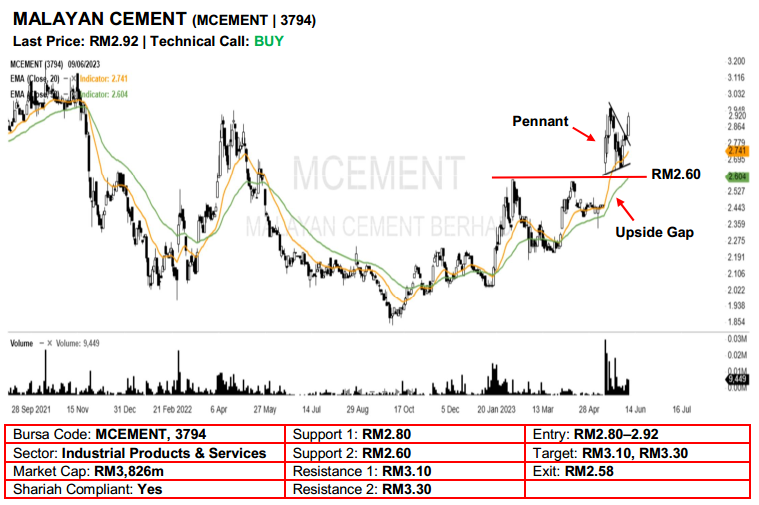

Technical Analysis. MCB broke out from its 3-week bullish pennant pattern on Friday, implying that its previous uptrend may have resumed. With the stock posting a long white candle and closing near its 52-week high, bullish momentum may be present now. A bullish bias may emerge above the RM2.80 level, with a stop-loss set at RM2.58, below the 50-day EMA. Towards the upside, the near-term resistance level is seen at RM3.10, followed by RM3.30.

Source: AmInvest Research - 12 Jun 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024