Stock On The Move - Hume Cement Industries

AmInvest

Publish date: Mon, 19 Jun 2023, 09:04 AM

Company Background. Hume Cement Industries (HCIB) is principally engaged in the manufacturing/sale of cement/cement-related products and concrete/concrete-related products. HCIB’s main subsidiaries are Hume Cement and Hume Concrete. The group currently operates an integrated cement plant located in Perak and 3 factories strategically located throughout Malaysia.

Prospects. (i) Expected to benefit from the continued recovery of construction activities on the back of 2023F economic growth of 4%-5% in Malaysia. (ii) Focus on improving the overall sales of all its products, especially the newly launched Panda Yellow (Portland Limestone Cement) which has received positive feedback from the market. (iii) Optimise its operations while intensifying research and development into new innovative products to cater to the construction market’s emerging needs.

Financial Performance. In 3QFY23, HCIB posted a higher revenue of RM289mil (+51% YoY) with a PAT of RM27mil (+14x YoY). This was mainly due to the revision in the cement retail selling price, coupled with lower cement rebate and higher cement sales volume which has mitigated the increase in input costs, particularly from coal and electricity.

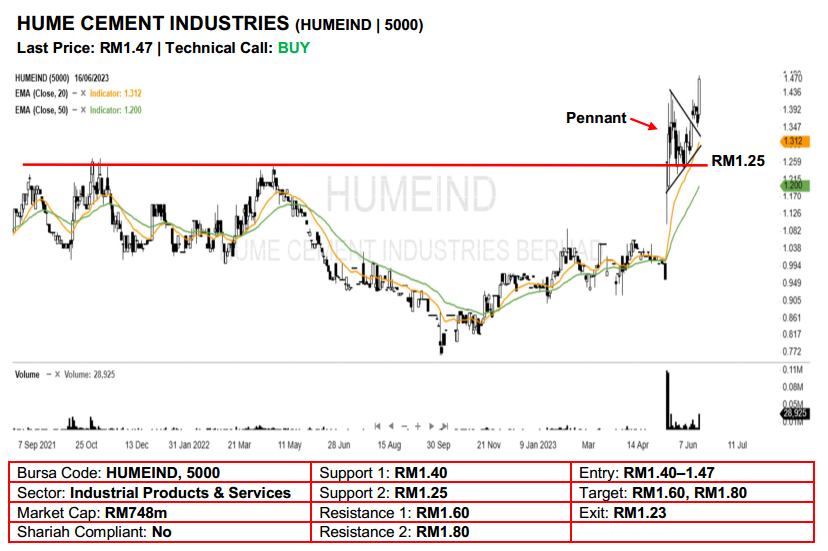

Technical Analysis. We expect further upside for HCIB after it surged to a new multi-year high with a long white candle on Friday. Given that the stock has broken out from the 1-month bullish pennant pattern and supported by rising EMAs, the near-term bullish trend may still have legs. A bullish bias may emerge above the RM1.40 level, with stop-loss set at RM1.23, below the 20-day EMA. Towards the upside, near-term resistance level is seen at RM1.60, followed by RM1.80.

Source: AmInvest Research - 19 Jun 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024