Stock on the Move - Edelteq Holdings

AmInvest

Publish date: Mon, 03 Jul 2023, 09:54 AM

Company Background. Edelteq is principally involved in the provision of engineering support for integrated circuit (IC) assembly and test processes in the semiconductor industry. It operates under 4 main segments: (i) Design and assembly of IC burn-in boards and supply of printed circuit board, (ii) Supply and refurbishment of IC assembly & test consumables, (iii) Design, development, and assembly of automated test equipment (ATE) and factory automation, (iv) Trading of general and technical operating supplies.

Prospects. (i) Expand product and services portfolio for ATE and IC assembly & test consumables such as strip level automated optical inspection machine, wafer level automated optical inspection machine, cantilever probe card, smart burn-in board sorter & loader and intelligent burn-in system. (ii) Enhance factory automation solutions involving R&D activities to design, develop and integrate hardware and software, as well as prototyping, testing, and commissioning of factory automation solutions.

Financial Performance. In 1QFY23, Edelteq reported revenue of RM9.8mil with a PAT of RM3mil. No comparative QoQ figures are available as Edelteq was listed on 7 Jun 2023. Prior to the listing, the group’s revenue recorded a CAGR growth of 21% while PAT registered a CAGR growth of 16% in FY20-FY22.

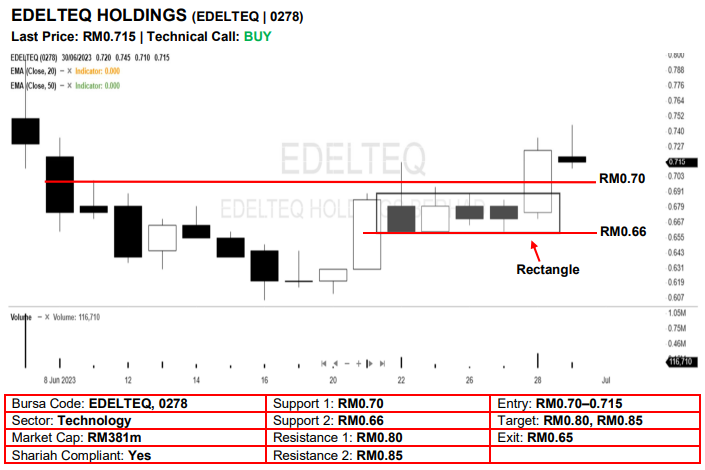

Technical Analysis. Edelteq may trend higher after it surged above the RM0.70 psychological mark and posted a long white candle 2 sessions ago. The stock also broke out from the bullish rectangle pattern, likely indicating that the near-term uptrend may persist. A bullish bias may emerge above the RM0.70 level, with stop-loss set at RM0.65, below the 22 June low. Towards the upside, the near-term resistance level is seen at RM0.80, followed by RM0.85.

Source: AmInvest Research - 3 Jul 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024