Stock Idea - RGB International

AmInvest

Publish date: Mon, 31 Jul 2023, 08:40 AM

Company Background. RGB International (RGB) is a leading supplier of electronic gaming machines (EGM) and casino equipment as well as a major machine concession provider. The group operates under 3 main divisions: (i) sales/marketing, and manufacturing of EGM/equipment (SSM), (ii) machine concession, technical support and management (TSM), and (iii) engineering services. RGB has marked its presence in Malaysia, Cambodia, Laos, Vietnam, Singapore, Philippines, Macau, Timor-Leste and Nepal.

Prospects. (i) Expect to perform better due to the recovery of tourism and hospitality industries, supported by the increase in international travels especially in the ASEAN regions where RGB operates, (ii) Continues to expand its TSM division as RGB has partnered with licensed operators throughout Asia with 5k machines stationed across 46 outlets, and (iii) With a sustainable growth path, the group aims to explore and establish a formal dividend policy over the longer term.

Financial Performance. In 1QFY23, RGB posted a higher revenue of RM95mil (+3x YoY) with a PAT of RM10.5mil (+5x YoY). This was mainly due to the increase in the number of products sold, better performance and an increase in operating capacity in most of the outlets as well as realised foreign exchange gains.

Valuation. Based on its 1QFY23 annualised net profit, the stock is trading at an attractive 2023E P/E of 12.9x, below its 5-year historical average of 17.7x, and FBMKLCI’s 14x currently. As a comparison, China-based Guangzhou Wahlap Technolgy Corp, which produces interactive somatosensory gaming products, trades at a much higher FY23F P/E of 40.5x.

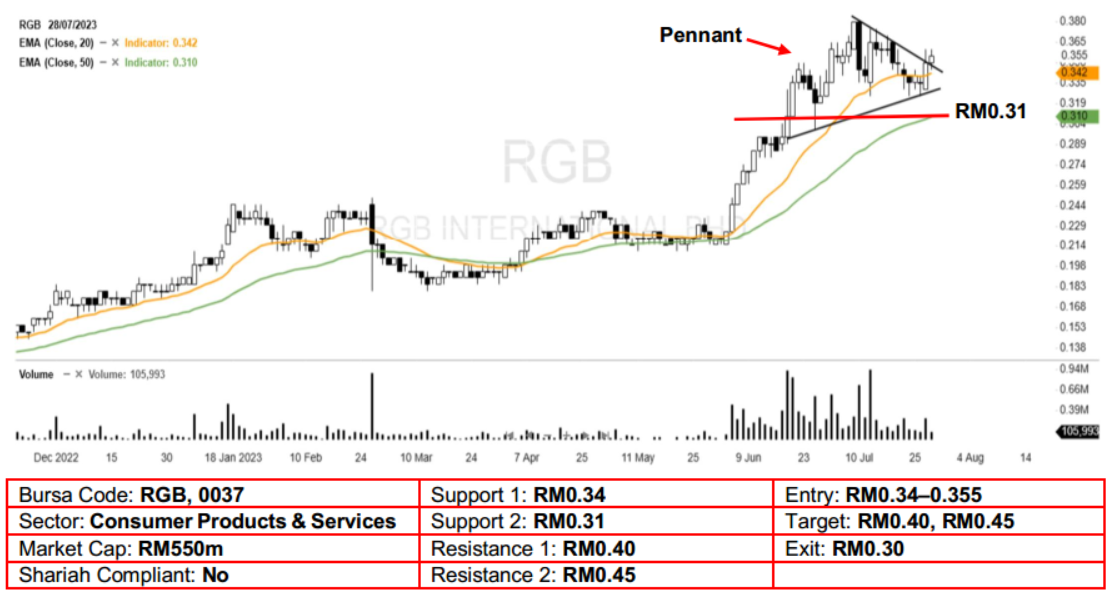

Technical Analysis. RGB’s buying interest is back after it broke out of the 1-month bullish pennant pattern on Friday. With the stock posting another white candle and pushing near its 52-week high, the upward momentum appears to be picking up. A bullish bias may emerge above the RM0.34 level, with stop-loss set at RM0.30, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM0.40, followed by RM0.45.

Source: AmInvest Research - 31 Jul 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024