Stock Idea - EG Industries

AmInvest

Publish date: Tue, 15 Aug 2023, 09:57 AM

Company Background. EG Industries is a leading electronics manufacturing services (EMS) and vertical integration provider for electrical & electronics products in several industries including consumer electronics, ICT, medical, automotive and telecommunications. The group provides services in original equipment manufacturing and original design manufacturing with full turnkey solutions for assembly of completed final products, printed circuit board and modular components.

Prospects. (i) Demand for 5G wireless and photonic modular-related products remain robust as the group aims to produce advanced high-speed optical signal transmitter and receiver (optical modules) for 5G wireless network, (ii) With the group’s state-of-the-art 5G high-speed modules, it has entered into partnership with a MNC for setting up a smart 4.0 light-out factory, and (iii) New factory expansion is anticipated to raise total built-up area across its production, warehousing, and office spaces by 45%.

Financial Performance. In 9MFY23, EG Industries posted a higher revenue of RM1.1bil (+28.3% YoY) with a PAT of RM28.8mil (+86% YoY). This was mainly attributed to favourable product sales mix, increase in sales of consumer electronic, 5G wireless access and photonics modular-related products.

Valuation. EG Industries is trading at an attractive FY24F P/E of 7.7x, versus Bursa Technology Index’s 5-year forward average of 22.8x. As a comparison, NationGate and Aurelius Technologies, both also involved in electronic manufacturing services (EMS) provider, trades at much higher FY24F P/Es of 22x and FY24F P/E of 21x respectively.

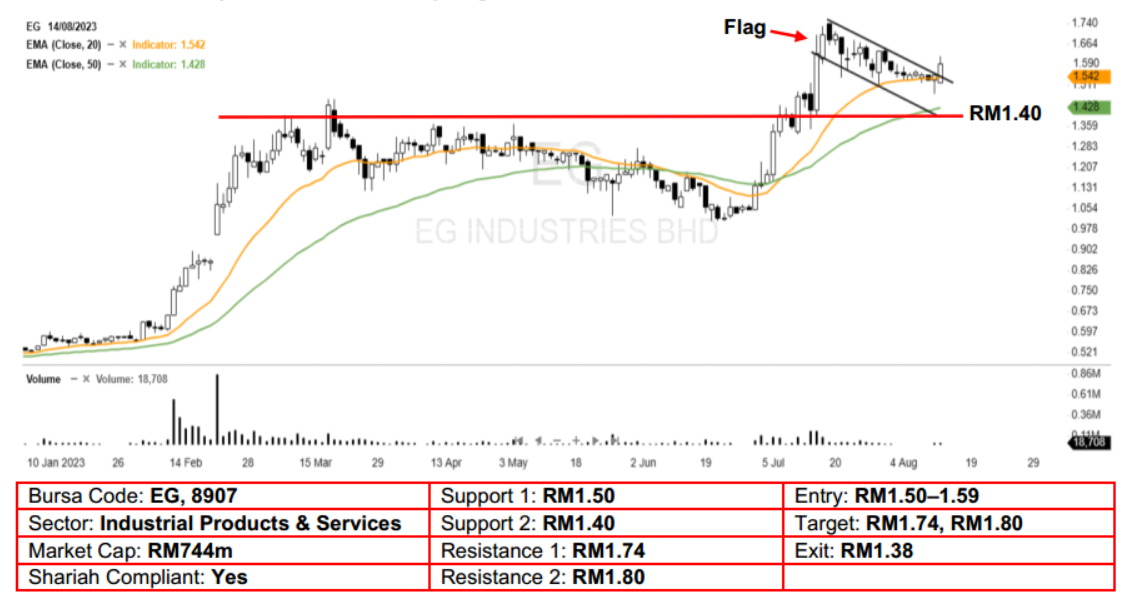

Technical Analysis. EG Industries broke out from its 1-month bullish flag pattern yesterday, implying that its previous uptrend may have resumed. With the 20-day EMA remaining above the 50-day EMA since the bullish crossover in mid-July, upward momentum may persist in the near term. A bullish bias may emerge above the RM1.50 level, with stop-loss set at RM1.38, below the 50-day EMA. Towards the upside, the near-term resistance level is seen at RM1.74, followed by RM1.80.

Source: AmInvest Research - 15 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 21, 2024