Stock Idea - OSK Holdings

AmInvest

Publish date: Tue, 22 Aug 2023, 09:38 AM

Company Background. OSK Holdings (OSK) is a conglomerate with diversified business interests in 5 segments: property, construction, financial services, industries and hospitality. Property segment serves as the core business of the group and comprises a host of real estate across Malaysia and Australia. OSK’s main subsidiaries include PJ Development and OSK Property.

Prospects. (i) Property segment is expected to provide a sustainable revenue stream with total unbilled property sales at RM1bil due to high take up rates for new and ongoing projects. Its land bank totalled 2,002 acres as of 1QFY23, with an estimated effective GDV of RM16.2bil, (ii) Construction segment is committed to deliver its current outstanding order book of RM415.1mil, (iii) Demand for financing is expected to remain strong as evidenced by higher loan disbursement in 1QFY23, and (iv) OSK’s increased stake of 10.2% in RHB Bank could deliver consistent and steady returns for the coming quarters.

Financial Performance. In 1QFY23, OSK posted a higher revenue of RM333.2mil (+9% YoY) with a PAT of RM115.7mil (+36.5% YoY). This was mainly due to overall operating performance across all business segments showing improvement, underpinned by stronger consumer sentiments, recovering labour market conditions and the revival of tourism activities.

Valuation. OSK is trading at an attractive FY24F P/E of 5.3x, versus Bursa Property Index’s 5-year forward average of 12x. As a comparison, Malaysian Resources Corporation, involved in property development/management and construction/engineering services-related activities, trades at a much higher FY24F P/E of 22.7x.

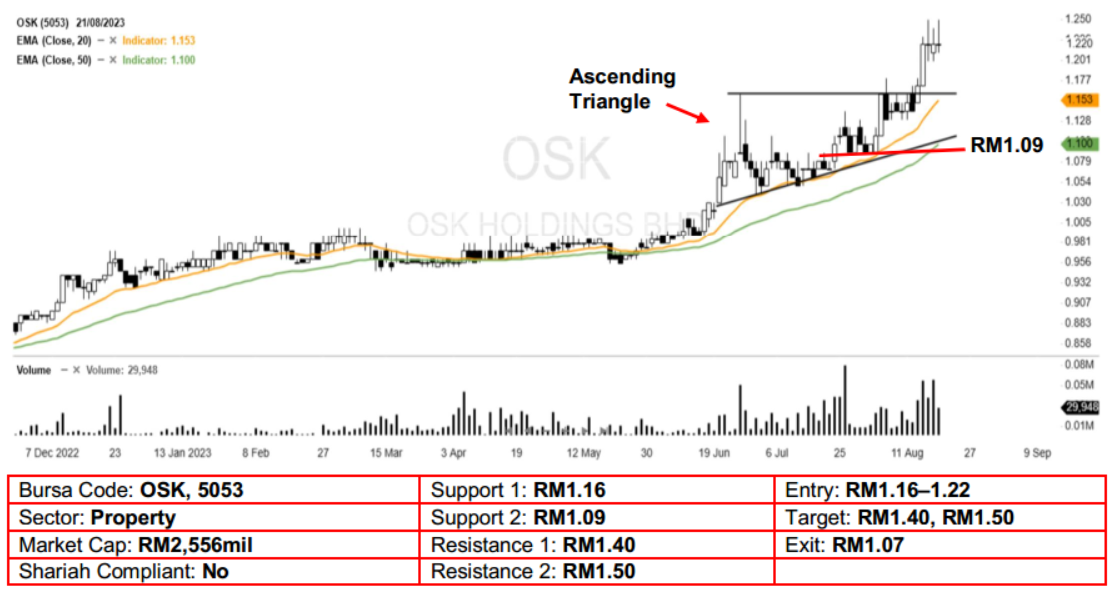

Technical Analysis. OSK may rise higher after reaching a new multi-year high with a long white candle a few sessions ago. Given that the stock has broken out from the 2-month bullish ascending triangle formation as well, the resumption of its previous uptrend may be taking place now. A bullish bias may emerge above the RM1.16 level, with stop-loss set at RM1.07, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM1.40, followed by RM1.50.

Source: AmInvest Research - 22 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 21, 2024